Two weeks in the past, shortly after she marketed an condo for hire within the Bay Space, Barbara Lamb discovered 5 envelopes from the state’s unem

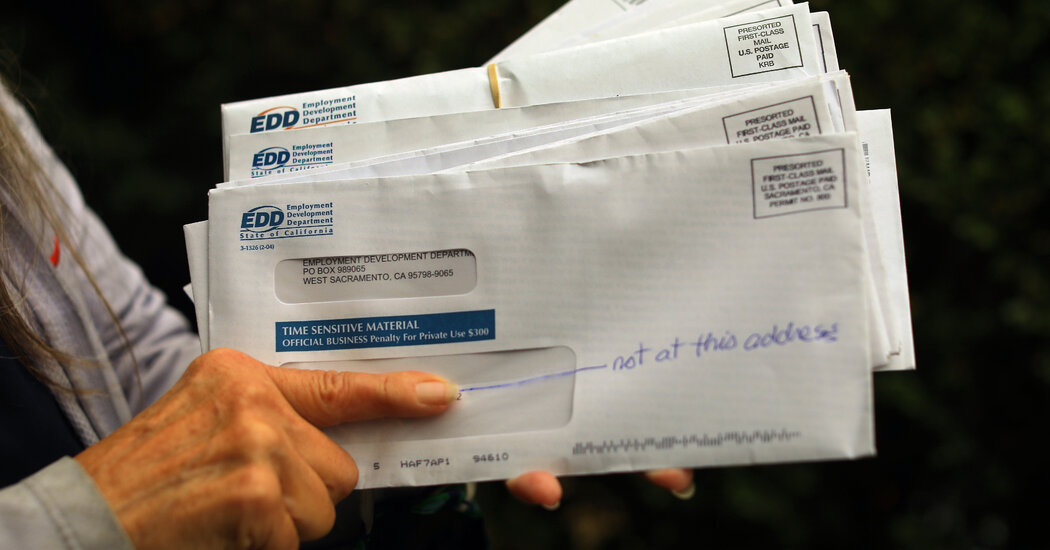

Two weeks in the past, shortly after she marketed an condo for hire within the Bay Space, Barbara Lamb discovered 5 envelopes from the state’s unemployment workplace within the constructing’s communal mail slot. They saved coming, day after day, till a stack of greater than 30 piled up, bulging with notices of profit approvals, questionnaires about job standing — and debit playing cards with cash.

“They might barely get them by the mail slot, they have been so thick,” she mentioned.

However Ms. Lamb had not utilized for advantages, and had by no means heard of the individuals to whom the envelopes have been despatched. Fearing the tackle of the vacant unit was getting used as a part of a fraud scheme to gather the cash, she contacted the F.B.I.

California is on the middle of accelerating considerations about in depth fraud in a federal program to push unemployment advantages to freelancers, part-timers and others missing a security internet within the coronavirus pandemic.

On the similar time, there may be rising proof of issues maintaining observe of how many individuals are being paid by this system. The Labor Division stories about 15 million claims for advantages nationwide. A comparability of state and federal data by The New York Occasions means that complete might overstate the variety of recipients by 5 million or extra.

If the variety of individuals getting unemployment advantages is decrease than formally reported, it might have an effect on fascinated by the dimensions of the pandemic’s financial affect. As well as, the taint of fraud might undermine help for this system, and efforts to fight abuses might make it more durable for legit candidates to gather advantages, that are distributed by the states.

This system, Pandemic Unemployment Help, is a part of a $2.2 trillion aid package deal hurriedly enacted in March. Within the newest Labor Division tally, this system accounted for practically half the whole recipients amassing jobless advantages of any type.

These figures indicate that just about seven million individuals are amassing Pandemic Unemployment Help advantages in California alone, way over its inhabitants would counsel. The state’s personal information suggests the quantity could also be lower than two million. Consultants on the unemployment system say such discrepancies appear to replicate a number of counting as states rushed out funds.

However a surge in new claims in California — the place they’ve risen to greater than 400,000 every week, twice the extent in August — is attributed to not accounting, however to fraud.

“We do suspect {that a} large a part of the bizarre latest rise in P.U.A. claims is linked to fraud,” mentioned Loree Levy, a spokeswoman for the California Employment Improvement Division. She mentioned the state was investigating “unscrupulous assaults” exploiting id theft and vulnerabilities within the system.

Pandemic Unemployment Help is supposed to offer advantages to the self-employed, impartial contractors, gig employees, part-timers and others ordinarily ineligible for state unemployment insurance coverage. Set as much as final by the top of the 12 months, it was a significant component of the CARES Act, which economists extensively agree has saved the nation from a far better financial calamity. In response to the Labor Division, $47 billion in pandemic unemployment advantages have been paid thus far.

Fraud shouldn’t be unusual in swiftly assembled catastrophe applications, together with the Paycheck Safety Program, the element of the CARES Act that offered forgivable loans to small companies to assist climate the pandemic with out layoffs.

However indicators of bother with the Pandemic Unemployment Help program have surfaced for months as individuals who didn’t file claims — together with the governor of Arkansas — discovered advantages issued of their names. A rising variety of states have signaled that the issues with this system transcend the routine.

California has warned that it’s slicing off recipients when it detects irregularities, like mailings stacking up at a given tackle. “These conditions are believed to be fraud, and scammers will usually attempt to intercept, redirect, or collect mail related to these claims,” the state’s employment company wrote.

Colorado mentioned Thursday that in a six-week stretch this summer season, 77 % of recent claims below this system weren’t legit.

“Nationally, it’s simply introduced a chance for criminals to make the most of a program that doesn’t have numerous security measures in place,” mentioned Cher Haavind, deputy govt director of the Colorado Division of Labor.

Citing a big enhance in fraud, the Labor Division put aside $100 million lately to assist states forestall, detect and examine misuse of Pandemic Unemployment Help and a smaller federal jobless advantages program. However fraud shouldn’t be the one difficulty elevating questions in regards to the surge in recipients mirrored in official information.

Questions About Counting

Consultants on the unemployment system discovered months in the past that the tallies being reported to the Labor Division have been overstated in lots of states, almost certainly due to processing backlogs that led to a number of counting of particular person recipients. They anticipated the problem to fade as backlogs cleared and job losses slowed. As an alternative, the overcounting difficulty might even have grow to be extra severe in some states.

“It’s an ideal storm,” mentioned Stephen A. Wandner, a former prime Labor Division official who’s now a senior fellow on the Nationwide Academy of Social Insurance coverage. “You’ve bought insane numbers of functions in comparison with what the states are used to and insufficient numbers of employees to course of and adjudicate claims.”

Figuring out the dimensions of the issue on a nationwide degree has proved tough, nonetheless. Overwhelmed state employment workplaces have struggled to offer well timed information to the federal authorities, and there have been a number of examples of outright errors making their means into the official information.

Not less than a few of the overcounting seems to replicate the way in which the Labor Division collects statistics on unemployment advantages. The federal government doesn’t observe the variety of particular person individuals receiving advantages, however quite the whole variety of weeks of advantages claimed. Throughout regular instances, when claims are processed on a weekly foundation, the variety of recipients and the variety of weeks are basically the identical — every individual information for one week of advantages every week. (Additional complicating issues, the division tracks claims for advantages, not all of that are permitted.)

In the course of the pandemic, nonetheless, the flood of claims overwhelmed state employment workplaces. As a result of advantages are paid retroactively, processing delays meant that by the point many individuals have been permitted for advantages, they have been owed a number of weeks without delay — in order that they counted as a number of “persevering with claims” in a single week.

Within the absence of a dependable depend from the Labor Division, economists have tried to estimate the variety of recipients utilizing information from surveys, federal spending information from the Treasury Division and different sources. These approaches yield a variety of estimates, however most counsel that the official complete overstates the true variety of recipients by thousands and thousands.

“It’s nearly actually decrease than is being reported,” mentioned Daniel Zhao, senior economist for the profession website Glassdoor. He mentioned it was laborious to provide you with a exact estimate, however that the true quantity was almost certainly under 10 million, not the practically 15 million counted by the Labor Division.

The Labor Division didn’t instantly reply Friday to a question in regards to the reporting discrepancies.

Mr. Zhao mentioned that the counting points didn’t essentially alter the larger image: Hundreds of thousands of Individuals are nonetheless counting on unemployment advantages to pay hire and purchase meals, and that quantity has fallen solely slowly over time.

The Draw back of Streamlining

Pandemic Unemployment Help goals to seize these missing a path into conventional state advantages and accounts for the pandemic’s specific disruptions. A university pupil might qualify if she interviewed for a job in February and was set to start out working in March however by no means did. So might individuals with restricted earnings histories, and a few of these unable to work due to child-care wants arising from faculty shutdowns.

The minimal fee is often half the typical weekly profit paid below a state’s common unemployment program. The utmost for a person ranges from $235 every week in Mississippi to $823 in Massachusetts, in accordance with the job website ZipRecruiter.

And the claims course of is streamlined in contrast with typical unemployment insurance coverage, making it extra susceptible to fraud, mentioned Michele Evermore, senior researcher and coverage analyst on the Nationwide Employment Legislation Venture.

Earlier than amassing state unemployment insurance coverage, candidates often should present proof of previous work or have state businesses contact employers. With Pandemic Unemployment Help, many individuals can begin amassing the minimal with far much less documentation. Then they often have 21 days to offer proof of misplaced work, like a pay stub or a 1099 kind from the Inner Income Service.

In an emergency program like Pandemic Unemployment Help, Ms. Evermore mentioned, there’s a pure stress between the necessity to get funds flowing and the danger that some individuals will take benefit and fraudulently apply for advantages.

“There’s a selection between denying advantages or by accident overpaying individuals,” she mentioned. “With Pandemic Unemployment Help, scammers could also be getting cash that’s meant for the unemployed.”

Erica Quealy, communications director of the Michigan Division of Labor and Financial Alternative, mentioned this system had grow to be the prey of “massive fraud rings.” Michigan’s legal professional normal has performed tons of of investigations, and the state has appointed a particular fraud adviser and introduced within the consulting agency Deloitte to assist.

Some schemes contain utilizing false Social Safety playing cards and faux driver’s licenses to use. One man was charged with submitting functions in Pennsylvania below false names, after which having advantages price $150,000 in debit playing cards mailed to addresses in Michigan, in accordance with the state legal professional normal. Prosecutors mentioned he used the cash to purchase a $45,000 Rolex watch.

The speed of fraudulent claims in Colorado has been hanging. After including extra screening measures to catch fraud, Colorado discovered that greater than three out of 4 claims filed over a six-week interval for jobless advantages below the federal Pandemic Unemployment Help program have been bogus.

On Thursday, the state mentioned it had diminished its depend of recent claims filed from July 12 to Aug. 22 by 48,000 due to new fraud-detection efforts. Earlier than being found, although, these answerable for the fraud have been in a position to acquire $40 million throughout that interval, mentioned Jeff Fitzgerald, head of the state’s unemployment insurance coverage program.

Officers estimated that the state’s screening instruments had saved the federal authorities $750 million to $1 billion over eight weeks by halting wrongful funds or by flagging them earlier than they have been made.

“What we’re taking a look at is kind of subtle,” Mr. Fitzgerald mentioned. “It’s one thing {that a} widespread particular person wouldn’t be capable of do, and actually it factors to orchestrated, very subtle, massive fraud schemes. These aren’t onesies and twosies.”

The fraud detection efforts are placing an unlimited burden on the states. Mr. Fitzgerald mentioned that Colorado had assigned 60 individuals to analyze unemployment fraud, in contrast with 5 in regular instances.

Within the meantime, the mail retains coming. Ms. Lamb, whose East Bay rental unit had been inundated with envelopes, rubber-banded them into neat stacks Thursday to ship again to the state unemployment workplace. She had given the 5 addressees’ names to the F.B.I.

On Friday, two extra envelopes arrived from the state, bearing a brand new identify.

Tara Siegel Bernard contributed reporting, and Sheelagh McNeill contributed analysis.