By Karen Braun FORT COLLINS, Colo., Jan 21 (Reuters) - U.S.

By Karen Braun

FORT COLLINS, Colo., Jan 21 (Reuters) – U.S. grain and oilseed producers cheered when america signed the Section 1 commerce take care of China a 12 months in the past, because it instructed one in every of their most vital prospects can be again within the American market in an even bigger means than ever earlier than.

However whereas the deal delights U.S. farmers and exporters, its short-sighted nature may find yourself being dangerous to home customers of grain and different commodities, and people results may finally harm shoppers.

Cracking down on China’s commerce practices was among the many high targets of the Trump administration, which set forth the Section 1 commerce deal in January 2020. That deal instructed China’s 2020 U.S. farm imports would rise at the least 50% above 2017 ranges, and the 2021 goal was much more aggressive.

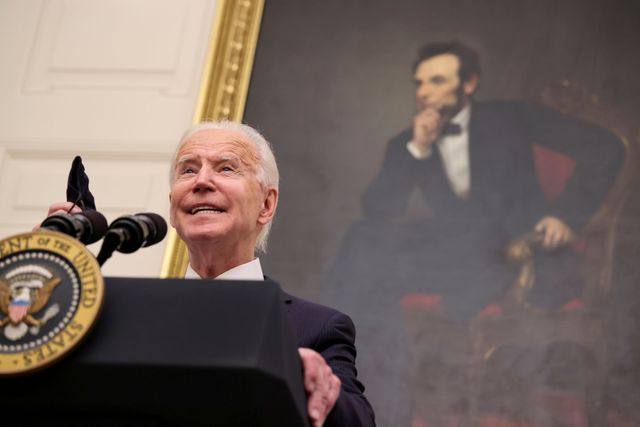

President Joe Biden, sworn in on Wednesday, stated late final 12 months he wouldn’t instantly cancel Section 1 or the prevailing commerce tariffs, since a deeper evaluation was vital first. However he has acknowledged China’s “abusive practices,” together with stealing mental property and dumping merchandise.

Chinese language media reported shortly after the U.S. election that Beijing would search to renegotiate the commerce take care of the brand new president, claiming the settlement favored america.

China has actually used the commerce warfare and commerce deal to its benefit, nonetheless, as evidenced by the document volumes of U.S. corn and soybeans it started securing final 12 months at considerably decrease costs than present ones. The state of affairs has even drawn comparisons with the “Nice Grain Theft” of 1972, when the Soviet Union cleaned out U.S. wheat provides.

Though China possible fell wanting the 2020 Section 1 goal, most analysts imagine the nation’s demand for agricultural commodities, particularly uncooked supplies, will stay elevated in 2021 and proceed to drive robust U.S. exports.

However among the premises and motivation behind Section 1 seem defective, and Biden would do nicely to re-examine the settlement to make sure it doesn’t foster disadvantages for both agriculture business contributors or U.S. shoppers.

FLAWED CONCEPTION

Probably the most puzzling features of Section 1 is that the commerce targets are in greenback values as a substitute of tonnage. Meaning commodity costs largely drive China’s progress, and on the time of the negotiation, these costs had been considerably decrease than within the document commerce years.

Even with the current rise in costs, the 2021 goal of $43.5 billion, some 19% above the 2020 objective, appears extremely formidable. The present document for U.S. farm exports to China is $29 billion in 2013.

These lofty numbers would require extra document participation from feed components and different bulk commodities like soybeans, corn and cotton. Bulk commodities accounted for almost two-thirds of U.S. agricultural and associated exports to China between January and November 2020.

Due to this fact, in concept, U.S. commerce officers ought to have been conscious that they had been probably organising a provide battle between home finish customers and exporters. Former President Donald Trump hinted at this in an October 2019 rally, when he appeared to recommend his advisers had advisable a 2020 commerce goal of at the least half his requested $40 billion to $50 billion primarily based on the concept that U.S. manufacturing will not be sufficiently massive.

Within the speech, Trump was upbeat on the concept of China utterly emptying U.S. grain bins, implying that the commerce deal utterly ignores how a lot provide is required at dwelling.

Exports often account for less than about 15% of annual U.S. corn use, whereas feeding and ethanol manufacturing occupy a bit lower than 40% apiece. U.S. soybean use is break up half-and-half between exports and crushing, however greater than 70% of the ensuing soybean meal is used domestically.

Feed prices for U.S. finish customers have risen drastically in current months, and this might finally imply larger meals costs for American shoppers. Soybean and soymeal costs are about 50% above year-ago ranges and corn costs are round 35% larger. In the meantime, costs for lean hogs, reside cattle and feeder cattle are close to or beneath a 12 months in the past.

One other problematic side of a contractual settlement for a hard and fast quantity of exports is that U.S. manufacturing volumes are unknown prematurely annually. The 2020 corn and soybean crops fell nicely wanting unique expectations, although document exports are nonetheless forecast, contributing to elevated costs.

Fortunately for U.S. finish customers, Beijing has acknowledged its intentions to buy solely what it wants from america as a substitute of merely shopping for stuff to satisfy the deal. However within the case of corn, sky-high home costs in China, at the least 50% above year-ago, recommend that the nation certainly wants the yellow grain.

MORE MEAT?

An identical controversy arose almost a 12 months in the past when the pandemic quickly shuttered many U.S. slaughterhouses, lowering meat provide on the home market. However on the similar time, American exporters had been transport document quantities of pork to China, drawing some criticism.

China’s pork spree sought to fill the protein hole that arose after African swine fever ripped by means of its hog herd beginning in 2018, sharply lowering pork output. That deficit nonetheless exists, although China’s pig inhabitants has made vital restoration.

On paper, the commerce deal and ASF mixture seems to be like an enormous alternative for U.S. livestock producers and meatpackers, however the outcomes are possible not dwelling as much as expectations. U.S. pork exports to China haven’t but returned to the document ranges noticed final spring.

China’s U.S. beef purchases accelerated late final 12 months and stay robust, however that phase of whole American agricultural commerce with China is comparatively small. China accounted for 7% of whole abroad gross sales of recent, frozen or chilled U.S. beef cuts in 2020.

Between January and November 2020, the worth of U.S. exports to China of pork, beef and poultry merchandise topped $three billion, nicely above the complete 2019 determine of $1.four billion, which was a document. Even with this enormous surge in enterprise, it represents a small portion of the full-year Section 1 objective.

By comparability, america exported $13.four billion value of soybeans, corn, sorghum and wheat to China within the first 11 months of final 12 months, with soybeans reaching $11.1 billion.

(Enhancing by Matthew Lewis)

(([email protected]; Reuters Messaging: [email protected]; Twitter: @kannbwx))

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.