By David Shepardson and Tracy Rucinski WASHINGTON/CHICAGO,

By David Shepardson and Tracy Rucinski

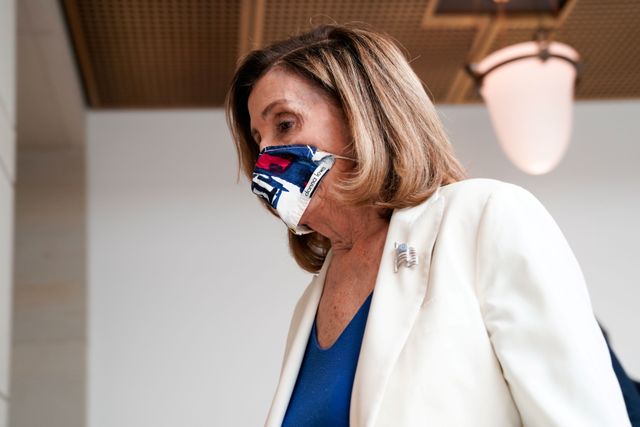

WASHINGTON/CHICAGO, Oct 2 (Reuters) – Home Speaker Nancy Pelosi stated Friday that settlement was “imminent” on a deal to offer one other $25 billion in authorities help to maintain tens of 1000’s of airline employees on the job for an additional six months.

Pelosi stated the Home will both move “bipartisan stand-alone laws or obtain this as a part of a complete negotiated reduction invoice.” She referred to as on airways to carry off on furloughs and firings “as an settlement for reduction for airline employees is being reached.”

Airline shares jumped on the information.

Congressional aides anticipated the Home to move a standalone measure to help airways in a while Friday that the Senate might take up subsequent week if a broader coronavirus deal isn’t reached.

Senate aides stated Thursday that solely a single Republican senator had been holding up the brand new bailout from being accredited within the U.S. Senate.

Congress in March accredited a $50 billion bailout for the passenger airline business, with $25 billion in principally money grants to fund payroll prices with the situation that they not eradicate jobs earlier than Oct. 1. It additionally included $25 billion in authorities loans.

American Airways AAL.O and United Airways UAL.O started shedding 32,000 employees on Wednesday after a deadline handed with no new assist from Washington, however advised employees they’d reverse this if lawmakers attain a deal on COVID-19 reduction.

U.S. airways are collectively burning about $5 billion of money a month as passenger site visitors has stalled at round 30% of 2019 ranges. After tapping capital markets, they are saying they’ve sufficient liquidity to final them at the very least 12 months at that price.

They’ve argued for an additional $25 billion in federal payroll assist to keep up their workforce and meet demand because the economic system rebounds. With out the cash, flight networks might additional shrink, hampering their income energy and shortening their liquidity runway.

(Reporting by David Shepardson and Tracy Rucinski; Modifying by David Gregorio)

(([email protected]; 2028988324;))

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.