By Pratima Desai

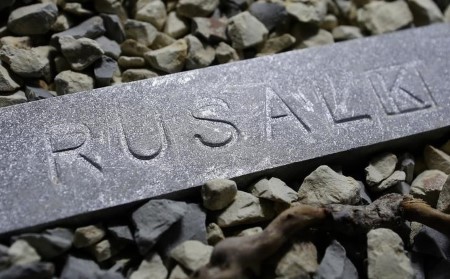

LONDON, June 21 (Reuters) – Russia’s Rusal 0486.HK is incomes a small premium for its low-carbon aluminium, Gregory Barker, the chairman of its main shareholder EN+, stated, regardless of present trade resistance to paying increased costs for much less polluting steel.

Aluminium customers within the transport, packaging and development industries trying to lower their carbon footprint need to supply low-carbon materials, however most are reluctant to pay a premium, aluminium trade sources say.

Barker declined to quantify the premium Rusal, the world’s high producer of aluminium, is getting above market costs for the steel.

“There are premiums, however they’re small,” Barker stated in an interview for this week’s Reuters Occasions: World Vitality Transition convention.

He stated higher-carbon aluminium would ultimately change palms at important reductions “as a result of the price of the carbon goes to be implicit within the promoting value of the steel”.

Barker stated manufacturing of Rusal’s low-carbon aluminium emitted lower than 2.5 tonnes of carbon per tonne in contrast with some Chinese language aluminium with a carbon footprint “north of 16.50 tonnes per tonne”.

Vitality produced utilizing coal can account for 40% of aluminium manufacturing prices in China.

China is the world’s largest producer of aluminium, accounting for about 57% of the worldwide complete of 65.three million tonnes final 12 months, Worldwide Aluminium Institute information confirmed.

Hong Kong-listed Rusal, during which EN+ ENPLq.L holds an almost 57% stake, is planning to spin off its increased carbon property right into a separate firm early subsequent 12 months.

“We’ll instantly go again the 57% of the brand new firm that EN+ receives within the de-merged firm to our shareholders,” Barker stated in response to a query on what EN+ plans to do with its stake.

“The brand new firm shall be listed in Moscow. Our shareholders can promote their shares there.”

Main EN+ shareholders are Russian tycoon Oleg Deripaska, with round a 45% stake, and commodity dealer and miner Glencore GLEN.L, which holds greater than 10%.

Rusal will change its identify to AL+ as a part of the demerger course of, which it hopes will assist it obtain carbon neutrality by 2050.

Barker declined to share particulars of negotiations EN+ is having about the way forward for its coal-fired energy vegetation and mines.

On the European Union’s plans for a carbon tax on imports from international locations with simpler carbon emissions requirements, Barker stated he was frightened about unintended penalties.

“A less complicated manner could be to zero-rate low-carbon aluminium on the level of entry,” Barker stated.

For extra on the Reuters World Vitality Transition convention, please click on right here – https://reutersevents.com/occasions/energy-transition-global/

(Reporting by Pratima Desai; further reporting by Anastasia Lyrchikova; enhancing by Veronica Brown and xxx)

(([email protected]; +44 207 513 5681;))

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.