By Tom Arnold LONDON, Nov 23 (Reuters) - Buyers are shoppin

By Tom Arnold

LONDON, Nov 23 (Reuters) – Buyers are shopping for up debt of the whole lot from Brazilian airways to Indian ports, hastened by a hunt for yield and default ranges amongst rising market corporations beneath that of U.S. friends.

In an indication of the sector’s rising enchantment, year-to-date flows into rising bonds have turned optimistic for the primary time in eight months, with $3.5 billion flowing in throughout the week to Nov. 18, the fourth largest inflows ever, in accordance with BofA, citing EPFR International information.

A breakdown of the push into rising market company debt just isn’t obtainable, however fund managers see indicators of rising curiosity because the passing of the U.S. election and progress on COVID-19 vaccines reawakens traders’ urge for food for danger.

“The Fed has indicated it is not going to hike charges for a very long time and on this atmosphere the seek for yield will proceed and intensify,” stated Rodica Glavan, head of rising market company fastened revenue at Perception Funding.

“Folks must put cash to work and as inflows are available they may should be invested and EM corporates stand to profit.”

EM company fastened revenue affords a year-to-date return of 5.6%, lower than 30-year Treasury bonds, however greater than different fastened revenue friends like U.S. company high-yield and rising market sovereign, in accordance with BofA.

And traders see extra upside potential as rising market company bond spreads are buying and selling at round 320 foundation factors, in need of the 255 foundation factors stage of mid-February, indicating there’s room for extra tightening and, due to this fact, extra returns.

Their bullishness is constructed on a perception {that a} COVID-19 vaccine ought to assist tip the stability again in favour of sectors akin to commerce, tourism and commodities, the engines motoring rising markets which were sputtering because the pandemic.

Brazilian airline bonds are being eyed by Glavan, who’s already invested in Pemex, the state-owned Mexican power behemoth.

Iron ore, copper and zinc producers in South America, in addition to Center East and Indian ports and Egyptian corporations within the tourism sector are within the cross-hairs of Alejandro Arevalo, rising market debt supervisor at Jupiter Asset Administration.

“As soon as the vaccine begins to play via we’ll see some rotation into Latin America because it has been a kind of areas the place folks have been very cautious due to the continued excessive unfold of the virus and with a vaccine we may even see these economies outperform,” stated Arevalo.

RISKS

However dangers lurk beneath the floor. A number of Chinese language state corporations have defaulted or confronted credit score stress in latest weeks, sparking a selloff in China’s company debt market.

The event alarmed some traders who usually assume state-owned companies might be supported by the federal government in instances of stress.

“Extra defaults are coming as Chinese language authorities refocus on deleveraging of SOEs (state-owned enterprises) now that the worst of the pandemic has handed,” stated Chang Li, China nation specialist at S&P International Rankings. “Default charges are nonetheless low general, nevertheless, and can unlikely result in systemic danger.”

Regardless of the ravages of the pandemic, default charges amongst rising market high-yield corporates year-to-date stand at about 3%, roughly half that of U.S. high-yield companies, stated Glavan. It is also lower than throughout the world monetary disaster when it touched 10.5% for rising market corporations.

Contemporary flare-ups in COVID-19 infections that hinder the worldwide financial restoration and sanctions or different opposed coverage motion by the incoming U.S. administration towards the likes of Russia, Turkey and China are different potential pitfalls for traders.

However most traders are betting on a extra supportive backdrop, with a Joe Biden presidency seen providing a extra predictable policymaking on commerce and U.S.-China relations. The outlook for a decrease U.S. greenback can even be useful for growing currencies.

“Wanting forward into 2021, the outlook for EM company fastened revenue stays constructive,” stated Michael Bolliger, chief funding officer, world rising markets at UBS. “EM corporations stand to profit from a gradual normalization in world financial exercise, the ultra-accommodative financial insurance policies of main world central banks, and our expectation of a weaker U.S. greenback.”

Flows to rising market debt flip positivehttps://tmsnrt.rs/36RouE9

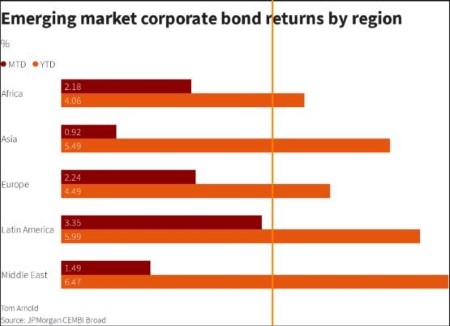

Rising market company bond returns by regionhttps://tmsnrt.rs/3kQltZy

(Modifying by Toby Chopra)

(([email protected]; +442075428510; Reuters Messaging: [email protected]))

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.