Gold, XAU/USD, Crude Oil, US Greenback, Treasury Yields, PPI, Commodities Briefing - Speaking Factors:Gold costs acquire as US Gr

Gold, XAU/USD, Crude Oil, US Greenback, Treasury Yields, PPI, Commodities Briefing – Speaking Factors:

- Gold costs acquire as US Greenback sinks with Treasury yields

- Crude oil gained with shares however struggled to maintain up tempo

- All eyes on US PPI information as Chinese language equal overshoots

Really useful by Daniel Dubrovsky

How you can Commerce Gold

Gold costs climbed over the previous 24 hours because the anti-fiat valuable steel capitalized on weak spot within the US Greenback and longer-term Treasury charges. Dovish commentary from Fed officers as of late has possible been fueling this pattern, with St. Louis Fed President James Bullard being welcome to inflation being modestly above 2% for a while.

This was underscored on Thursday when Fed Chair Jerome Powell famous that the central financial institution “will present assist to the economic system till it not wants it”. Having a look at Fed Funds Futures, the chances of 1 charge hike by December 2022 have dramatically shifted decrease. They now stand at round 68% most likely, in comparison with about 90% in the beginning of this month.

In the meantime, crude oil costs aimed barely larger. The sentiment-linked commodity discovered some momentum as equities in Europe and North America rallied. Nonetheless, a softer-than-expected US jobless claims report and file Covid infections in India possible sapped upside potential from power costs. The latter is among the world’s largest importers of oil.

Markets are off to a barely ‘risk-off’ throughout Friday’s Asia-Pacific buying and selling session. A mixture of stronger-than-expected Chinese language wholesale costs and dangers that the RBA highlighted to Australia’s economic system could be taking part in a task right here. The previous is of explicit curiosity given rising world inflation woes, particularly forward of equal information from the US.

PPI closing demand is predicted to clock in at 3.8% y/y in March versus 2.8% prior. A faster-than-expected enhance might deliver again rising value fears into the markets. If that pushes Treasury yields again larger, then gold could weaken because the US Greenback sees demand. If this additionally interprets into additional danger aversion because the week wraps up, then crude oil costs may see some cautious promoting strain.

Uncover what sort of foreign exchange dealer you might be

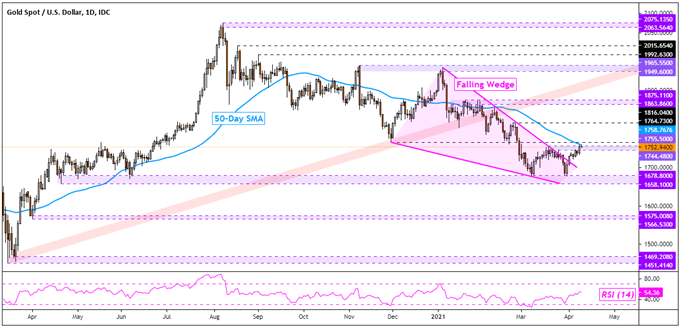

Gold Technical Evaluation

Gold costs have confirmed a push above a bullish Falling Wedge chart sample. Nonetheless, costs are caught round the important thing 1744 – 1755 resistance zone in addition to the 50-day Easy Transferring Common. As such, we might see XAU/USD flip decrease right here again in direction of the March low. Pushing above speedy resistance alternatively could open the door to extending final month’s bounce.

Gold Each day Chart

Chart Created Utilizing TradingView

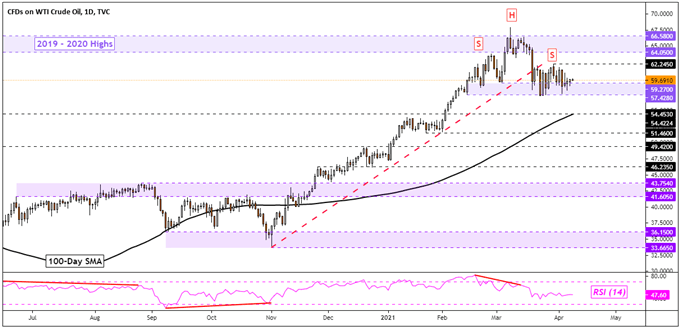

Crude Oil Technical Evaluation

Crude oil costs have been struggling to substantiate a breakout underneath rising help from November. WTI has since been buying and selling above the essential 57.42 – 59.27 help zone. It seems that a bearish Head and Shoulders chart sample has been brewing. A breakout underneath speedy help might open the door to extending losses, in direction of the 100-day SMA.

Really useful by Daniel Dubrovsky

How you can Commerce Oil

WTI Crude Oil Each day Chart

Chart Created Utilizing TradingView

–— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the feedback part beneath or @ddubrovskyFX on Twitter

ingredient contained in the

ingredient. That is most likely not what you meant to do!nn Load your software’s JavaScript bundle contained in the ingredient as a substitute.www.dailyfx.com