RBNZ assembly unlikely to rattle the kiwi – Foreign exchange Information Preview Posted on April 9, 2021 a

RBNZ assembly unlikely to rattle the kiwi – Foreign exchange Information Preview

Posted on April 9, 2021 at 11:57 am GMTMarios Hadjikyriacos, XM Funding Analysis Desk

The Reserve Financial institution of New Zealand (RBNZ) will wrap up its upcoming assembly at 02:00 GMT Wednesday. Financial information have misplaced some momentum these days and in consequence, markets have priced out expectations for fee hikes. That stated, the financial system stays in fine condition total. As for the kiwi, the outlook nonetheless appears optimistic, simply not towards the US greenback.

Housing market on fireplace

Quite a bit has occurred because the RBNZ final met in February, however since developments have been each optimistic and adverse, they’ll probably cancel one another out within the central financial institution’s eyes.

On the brilliant facet, the island stays nearly virus-free. Due to this, Australia and New Zealand agreed to determine a ‘journey bubble’ between them, so there’s some reduction coming for the struggling tourism sector. Moreover, the federal government will increase the minimal wage by roughly one kiwi greenback to $20 per hour, which can hopefully increase spending within the financial system.

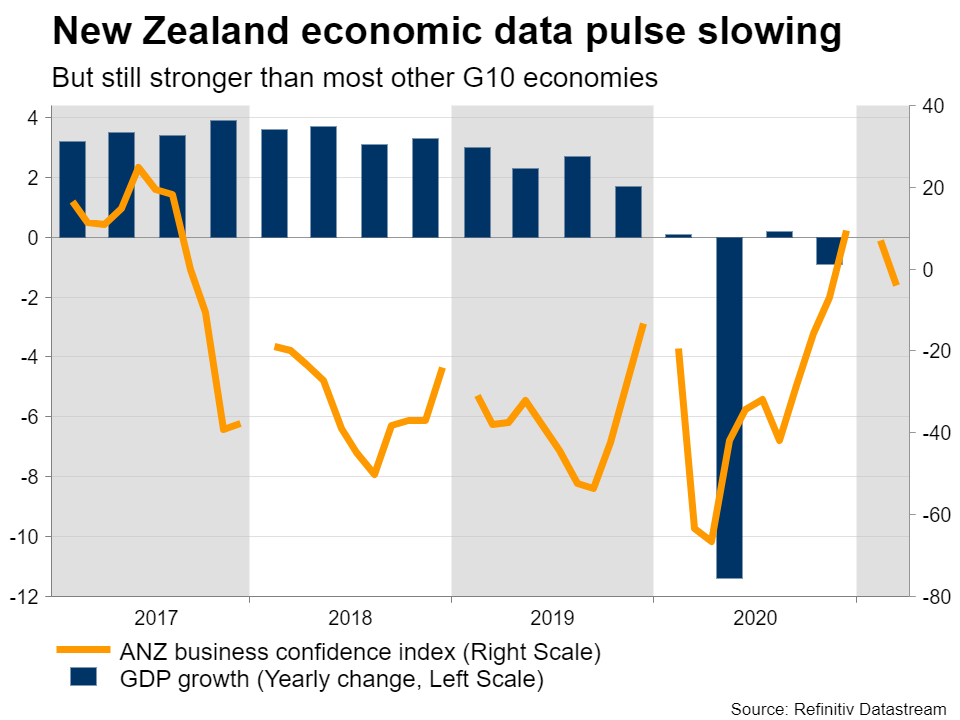

Nonetheless, the information pulse has began to sluggish. Retail gross sales and enterprise confidence each declined these days, whereas financial development dissatisfied in This fall. That stated, the RBNZ already anticipated a gradual slowdown in its newest financial forecasts, so this gained’t be any enormous shock.

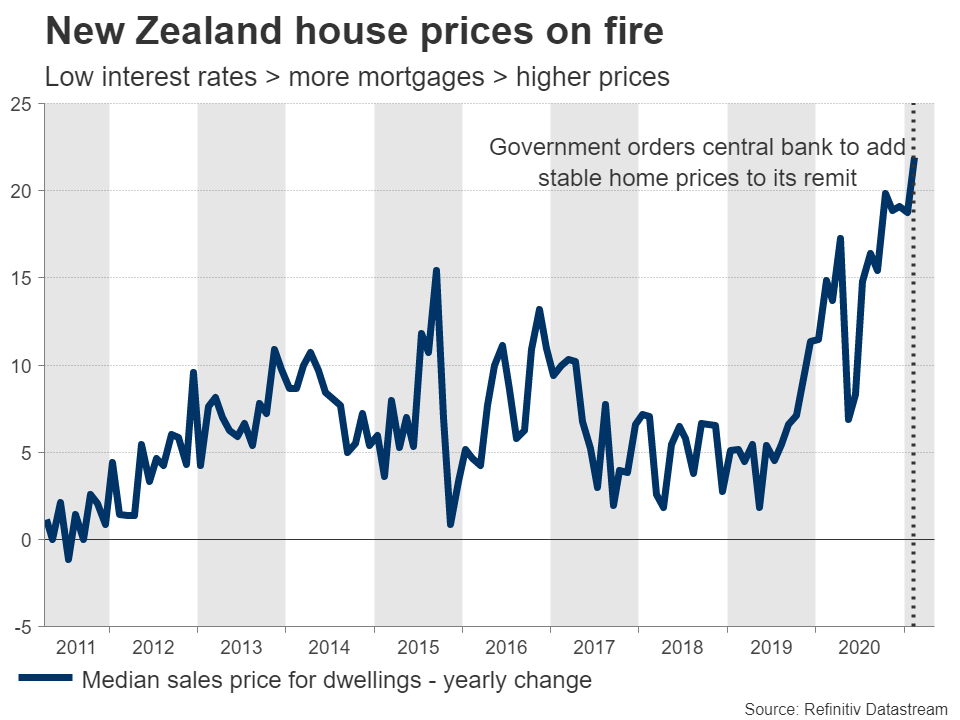

The opposite piece of stories is that the RBNZ’s mandate has been modified to additionally take into account the affect on house costs when formulating selections, along with maintaining inflation secure and selling full employment. Home costs in New Zealand have been on fireplace these days as low rates of interest inspired extra borrowing for mortgages. This modification basically makes it more durable for the RBNZ to chop charges once more.

RBNZ to ‘maintain the road’

Turning to the upcoming assembly, no coverage adjustments are on the playing cards. Given the combined developments these days, it’s also tough to examine the RBNZ altering its language both. Policymakers will probably repeat that they’re ‘on maintain’ for the foreseeable future.

There isn’t any actual must push again towards market pricing for future fee hikes. Markets are presently pricing in round a 30% likelihood for a fee enhance by this time subsequent 12 months, which appears truthful given the strong form of the general financial system. Plus, this likelihood declined considerably these days, so the market itself is having doubts.

If the RBNZ merely reaffirms its wait-and-see stance, any response within the kiwi is prone to be minor.

Larger image optimistic, however thoughts the US greenback

General, the kiwi’s fortunes will rely totally on how the financial system performs, the velocity of vaccinations globally, commodity costs, and danger sentiment within the markets. All of those components appear to be enhancing, so it’s tough to be pessimistic on the foreign money.

New Zealand is sort of virus-free and the financial system is stronger than most different areas due to fewer lockdowns, international vaccinations are shifting ahead, dairy costs are elevated, and America is about to unleash a landslide of stimulus that would hold market completely satisfied for some time.

The ‘catch’ is that the outlook for the US greenback appears promising too with the American vaccination program firing on all cylinders, so any future features within the kiwi won’t be mirrored in greenback/kiwi.

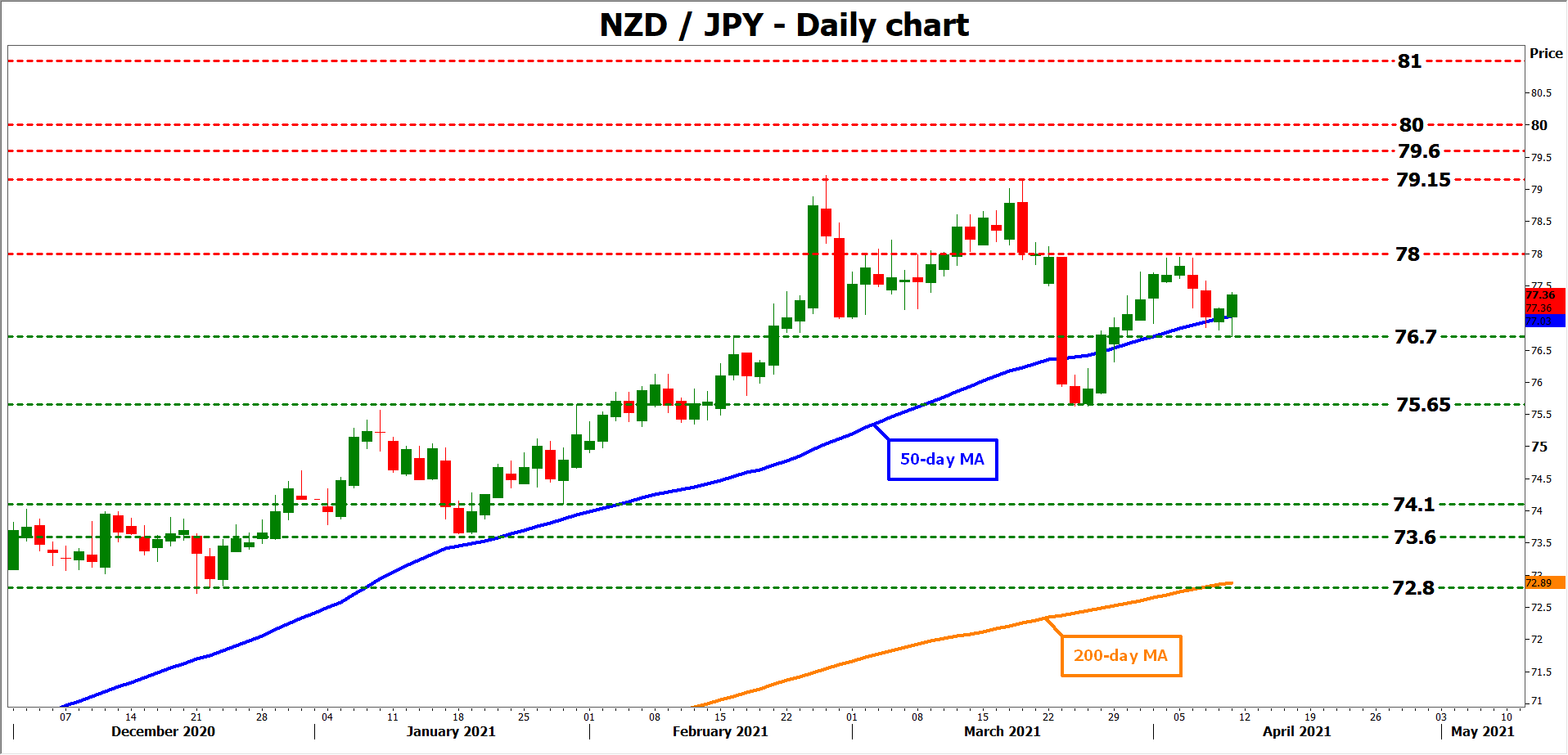

As an alternative, euro/kiwi or kiwi/yen could be higher candidates. Regardless of the most recent rebound, the prospects for the euro stay bleak, with the area nonetheless partially locked down, behind in stimulus, and unlikely to catch up in vaccinations. It’s an analogous story for the yen, which is prone to endure as the worldwide financial system heals its wounds, due to the BoJ maintaining a ceiling on Japanese bond yields.

Taking a technical take a look at kiwi/yen, speedy resistance to advances might come from the 78.00 area, earlier than the current high of 79.15 comes into play.

On the draw back, preliminary help could also be discovered close to the 76.70 zone, a break of which might flip the main focus to the most recent low of 75.65.

EURNZDNZDJPYRBNZ