Ulta Magnificence (ULTA) is anticipated to ship a year-over-year improve in earnings on greater revenues when it stories outcomes for the quarter ended July 2021. This widely-known consensus outlook offers a very good sense of the corporate’s earnings image, however how the precise outcomes examine to those estimates is a robust issue that would affect its near-term inventory worth.

The inventory would possibly transfer greater if these key numbers high expectations within the upcoming earnings report, which is anticipated to be launched on August 25. Then again, in the event that they miss, the inventory could transfer decrease.

Whereas the sustainability of the fast worth change and future earnings expectations will principally rely on administration’s dialogue of enterprise circumstances on the earnings name, it is value handicapping the chance of a optimistic EPS shock.

Zacks Consensus Estimate

This magnificence merchandise retailer is anticipated to put up quarterly earnings of $2.32 per share in its upcoming report, which represents a year-over-year change of +217.8%.

Revenues are anticipated to be $1.75 billion, up 42.5% from the year-ago quarter.

Estimate Revisions Pattern

The consensus EPS estimate for the quarter has been revised 1.91% decrease over the past 30 days to the present degree. That is basically a mirrored image of how the protecting analysts have collectively reassessed their preliminary estimates over this era.

Traders ought to needless to say the course of estimate revisions by every of the protecting analysts could not all the time get mirrored within the mixture change.

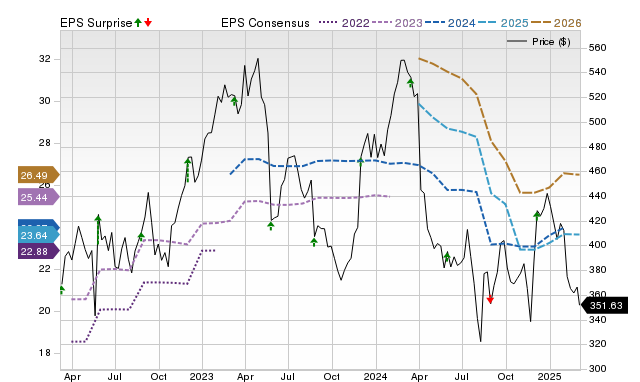

Worth, Consensus and EPS Shock

Earnings Whisper

Estimate revisions forward of an organization’s earnings launch supply clues to the enterprise circumstances for the interval whose outcomes are popping out. This perception is on the core of our proprietary shock prediction mannequin — the Zacks Earnings ESP (Anticipated Shock Prediction).

The Zacks Earnings ESP compares the Most Correct Estimate to the Zacks Consensus Estimate for the quarter; the Most Correct Estimate is a newer model of the Zacks Consensus EPS estimate. The thought right here is that analysts revising their estimates proper earlier than an earnings launch have the newest data, which might probably be extra correct than what they and others contributing to the consensus had predicted earlier.

Thus, a optimistic or unfavorable Earnings ESP studying theoretically signifies the doubtless deviation of the particular earnings from the consensus estimate. Nevertheless, the mannequin’s predictive energy is important for optimistic ESP readings solely.

A optimistic Earnings ESP is a powerful predictor of an earnings beat, notably when mixed with a Zacks Rank #1 (Robust Purchase), 2 (Purchase) or 3 (Maintain). Our analysis reveals that shares with this mix produce a optimistic shock almost 70% of the time, and a strong Zacks Rank truly will increase the predictive energy of Earnings ESP.

Please word {that a} unfavorable Earnings ESP studying will not be indicative of an earnings miss. Our analysis reveals that it’s troublesome to foretell an earnings beat with any diploma of confidence for shares with unfavorable Earnings ESP readings and/or Zacks Rank of 4 (Promote) or 5 (Robust Promote).

How Have the Numbers Formed Up for Ulta?

For Ulta, the Most Correct Estimate is greater than the Zacks Consensus Estimate, suggesting that analysts have lately turn into bullish on the corporate’s earnings prospects. This has resulted in an Earnings ESP of +42.24%.

Then again, the inventory at present carries a Zacks Rank of #1.

So, this mix signifies that Ulta will most definitely beat the consensus EPS estimate.

Does Earnings Shock Historical past Maintain Any Clue?

Whereas calculating estimates for an organization’s future earnings, analysts usually take into account to what extent it has been in a position to match previous consensus estimates. So, it is value having a look on the shock historical past for gauging its affect on the upcoming quantity.

For the final reported quarter, it was anticipated that Ulta would put up earnings of $1.92 per share when it truly produced earnings of $4.10, delivering a shock of +113.54%.

Over the past 4 quarters, the corporate has overwhelmed consensus EPS estimates 4 instances.

Backside Line

An earnings beat or miss might not be the only foundation for a inventory shifting greater or decrease. Many shares find yourself shedding floor regardless of an earnings beat on account of different components that disappoint traders. Equally, unexpected catalysts assist a variety of shares achieve regardless of an earnings miss.

That stated, betting on shares which might be anticipated to beat earnings expectations does improve the percentages of success. Because of this it is value checking an organization’s Earnings ESP and Zacks Rank forward of its quarterly launch. Ensure that to make the most of our Earnings ESP Filter to uncover the very best shares to purchase or promote earlier than they’ve reported.

Ulta seems a compelling earnings-beat candidate. Nevertheless, traders ought to take note of different components too for betting on this inventory or staying away from it forward of its earnings launch.

Zacks’ High Picks to Money in on Synthetic Intelligence

This world-changing know-how is projected to generate $100s of billions by 2025. From self-driving automobiles to client information evaluation, individuals are counting on machines greater than we ever have earlier than. Now could be the time to capitalize on the 4th Industrial Revolution. Zacks’ pressing particular report reveals 6 AI picks traders have to find out about at this time.

See 6 Synthetic Intelligence Shares With Excessive Upside Potential>>

Click on to get this free report

Ulta Magnificence Inc. (ULTA): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.