A report authored by the analysis group of ByteTree purports to debunk one of the vital well-liked Bitcoin (BTC) valuation fashions — Inventory-to-

A report authored by the analysis group of ByteTree purports to debunk one of the vital well-liked Bitcoin (BTC) valuation fashions — Inventory-to-Stream. The mannequin offers a really optimistic forecast for Bitcoin, claiming {that a} yr from now we must always see value ranges above $100,000.

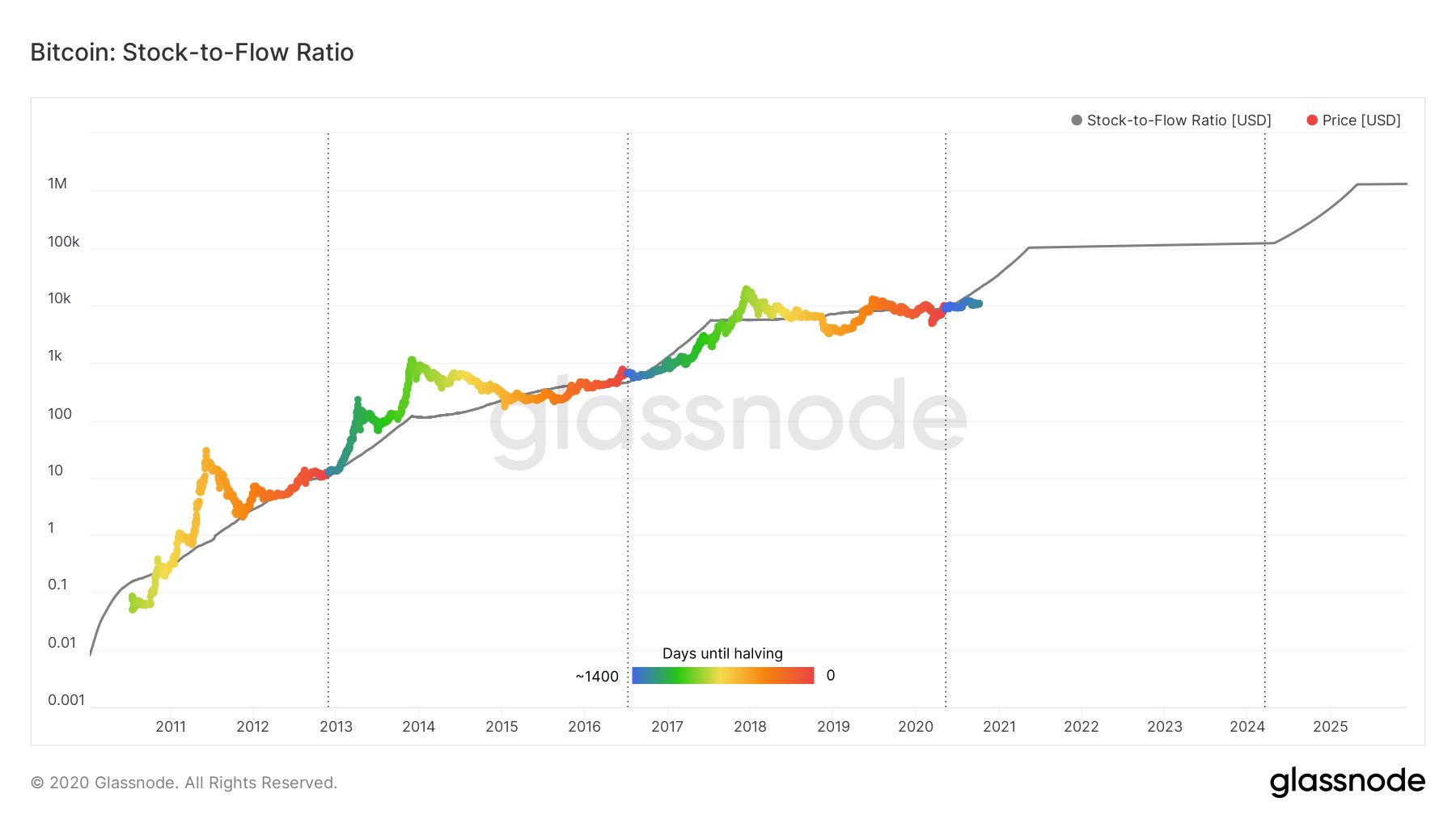

BytTree’s co-founder and chief funding officer, Charlie Morris, dedicates your entire fourth chapter of the report back to “debunking” it. The stock-to-flow fashions have been utilized for many years to forecast the value of commodities like gold and silver. Inventory is the prevailing provide of the asset and circulate is the extra new provide that’s being generated. Utilized to Bitcoin, it hinges on the truth that its inflation or circulate can be getting progressively smaller, whereas the stock-to-flow ratio can be getting progressively greater. Thus, producing “sky is the restrict” forecasts for the value.

Morris contends that the Bitcoin value shouldn’t be dictated by the supply-side economics in any respect. In an economic system, he argues, the market adjusts on each side: provide and demand till the brand new equilibrium is reached. Since Bitcoin’s provide is fastened, it’s left to the demand aspect of the equation to find out the value, he concludes.

Morris believes that one other drawback with the mannequin is that it overemphasizes newly-mined cash as in the event that they had been the one ones accessible on the market, “however anybody who owns Bitcoin is free to promote.” He additionally factors out that the community’s dynamics have modified:

“When the community has a big inventory and a comparatively small circulate, it’s the inventory that issues. Because the circulate diminishes, it turns into much less vital in influencing market costs.”

Additional, he suggests the position of the Bitcoin miners has diminished over time as indicated by the lower within the ratio of their revenues to market capitalization:

“Miners’ as soon as earned 50% of the market cap annually. At the moment, that they had an enormous affect on value, however at 1.7%, they don’t. Equally, they used to account for 68% of all the transaction worth, which has fallen to three.9%.”

He acknowledges that miners nonetheless play an vital position because the community’s maintainers “however their financial footprint is diminishing”.

Morris offers one other criticism of the mannequin — it doesn’t have in mind the precise utilization and adoption of Bitcoin, which he believes is the community’s intrinsic worth:

“I might argue that Bitcoin represents a strong digital community that’s thriving. It’s a form of expertise inventory with out earnings or a CEO, however with excessive safety, rising distribution and software. There are a lot of explanation why the value of Bitcoin can rise or fall, however S2F shouldn’t be considered one of them.”

It is price noting that the value has lagged behind the extent forecast by the mannequin within the months since Bitcoin’s third block halving.