In Africa, there's a long-running feud between white expatriates and ex-Ivy League founders on the one hand, and grassroots-bred Black native found

In Africa, there’s a long-running feud between white expatriates and ex-Ivy League founders on the one hand, and grassroots-bred Black native founders on the opposite. At stake is who has bragging rights to Africa’s sizzling, rising startup narrative.

Locals from East Africa and Nigeria accuse “wazungus,” or outsiders, of perpetuating racially biased enterprise capital funding cycles, muddying the funding panorama for the actual African founders.

Michael Kimani is a creator at Cryptobaraza, an skilled market builder of fintech, blockchain and crypto merchandise in Africa.

In Kenya, the divide includes native and white expatriates, whereas in Nigeria the stress is between native founders and Nigerians schooled overseas.

With near $5 billion invested since 2014, principally from Asian, European and U.S. funding banks, enterprise capital corporations, improvement companies and restricted partnerships, allocations in key African markets are inflicting disharmony.

It’s time for a radical resolution rooted within the expertise we wish to develop.

I suggest tokenizing African startup debt and fairness on a blockchain, beneath a transparent shopper framework, as a solution to break the white man’s curse.

The difficulty is structural

The query of whether or not or to not spend money on Africa has all the time been considered one of threat. In an surroundings the place property rights are questionable, international buyers’ issues boil all the way down to “can I get my cash out and in?”

Years of infringement of property rights, international foreign money controls and sudden shifts in governance have constructed a detrimental picture amongst worldwide corporations.

To counter this, African startups have mastered the craft of incorporating in international jurisdictions higher suited to the desires of buyers. Traders need someplace that’s protected and versatile, the place there’s authorized precedent for safeguarding shareholder rights and clear processes for acquisitions and exits.

See additionally: This Bitcoin Documentary From Africa Is Streaming on Amazon Prime

One such jurisdiction is the U.S. state of Delaware, dwelling to 70% of hundreds of African startups included outdoors the continent. Establishing within the U.S. and related jurisdictions, with years of goodwill, is a superb publicity to funding from U.S. angel and institutional buyers.

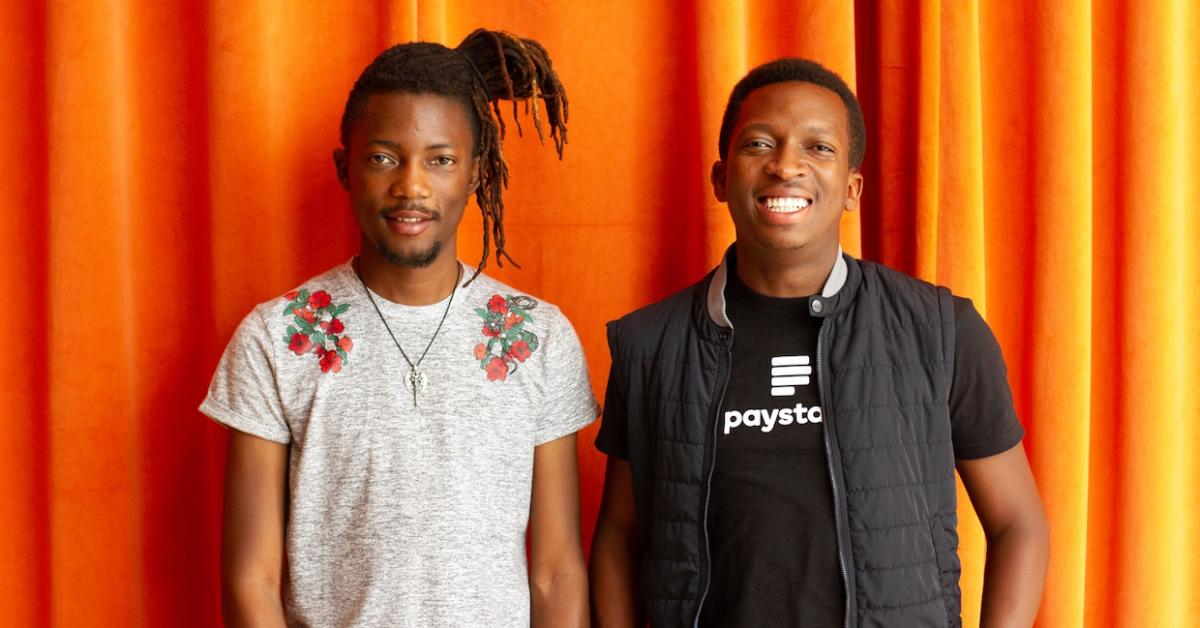

5 years in the past, Nigeria’s Shola Akinlade and Ezra Olubi had been enrolled at Y Combinator, one of many world’s most prestigious seed-stage accelerators. Once they got down to construct Paystack, a pan-African funds processor firm, their dream was to construct the Stripe of Africa. No Nigerian firm had ever made the minimize for the extremely coveted cohort slots.

Y Combinator, based mostly out of the U.S., had simply begun to maneuver into Africa as a part of its technique of unearthing ventures in rising markets together with India. For each startup that comes up via its ranks, Y combinator dolls out $125,000 in return for 7% of the startups utilizing a “post-money” Easy Settlement for Future Fairness (the “YC Secure”).

Jumia’s itemizing got here beneath fireplace for not being African sufficient.

However there was a catch. To safe $120,000 in seed, Paystack needed to be registered as a U.S. company in Delaware. Y Combinator’s mandate on the time expressly acknowledged it might solely spend money on American corporations. (It now accepts startups from the Cayman Islands, Singapore and Canada as effectively.)

Contemplating the benefit of organising a startup in Delaware ($500 down and a 24-hour wait), it was a no brainer to register a enterprise with satisfactory safety to appease buyers.

Paystack subsequently raised $1.three million in 2018, then $eight million from Stripe, Visa, Tencent and Y Combinator. In mid-October, it was acquired by Stripe for $200 million.

What it means

Paystack’s $200 million was a monster validation for Africa’s tech ecosystems, proof that the continent’s ventures might repay.

So, too, was Jumia, a extremely acclaimed pan-African e-commerce firm itemizing on the New York Inventory Trade. Jumia grew from pennies in 2012 to itemizing 17.6% of its shares for $1.1 billion in 2019.

However whereas Stripe’s acquisition sparked parades of pleasure throughout Africa’s tech ecosystems, Jumia’s itemizing got here beneath fireplace for not being African sufficient.

Jumia’s Sacha Poignonnec and Jeremy Hodara, two ex-McKinsey consultants specializing in retail, packaging and ecommerce, had noticed a chance in Africa. They registered an organization in Berlin, Germany, in 2012 after which, with the assistance of locals in Nigeria, grew e-commerce operations to six.eight million lively clients throughout 14 African markets in beneath seven years.

The distinction was, not like Paystack’s two Nigerian founders, Jumia’s founders are each French.

The backlash that adopted Jumia’s public itemizing resurfaced outdated wounds and pent-up emotions. Native founders felt discriminated in opposition to and this time they had been backed by the numbers.

An evaluation by The Guardian discovered that of the top-ten African-based startups that scored the very best quantity of enterprise capital in Africa in 2019, eight had been led by foreigners.

A report in 2019 by…