The primary quarter of 2020 will probably be remembered as a interval when the coronavirus-led uncertainty set off a liquidity disaster in monetary

The primary quarter of 2020 will probably be remembered as a interval when the coronavirus-led uncertainty set off a liquidity disaster in monetary markets, forcing traders to promote the whole lot, together with bitcoin (BTC).

The highest cryptocurrency, typically touted as a secure haven, fell by 10 % within the first three months of 2020.

Whereas the cryptocurrency eked out 30 % positive factors in January amid the U.S.-Iran tensions, it couldn’t face up to the bearish pressures emanating from the worldwide sprint for money in March.

The broader crypto market additionally suffered losses within the first quarter, as evidenced from the 5 % decline within the whole market capitalization, in line with TradingView.

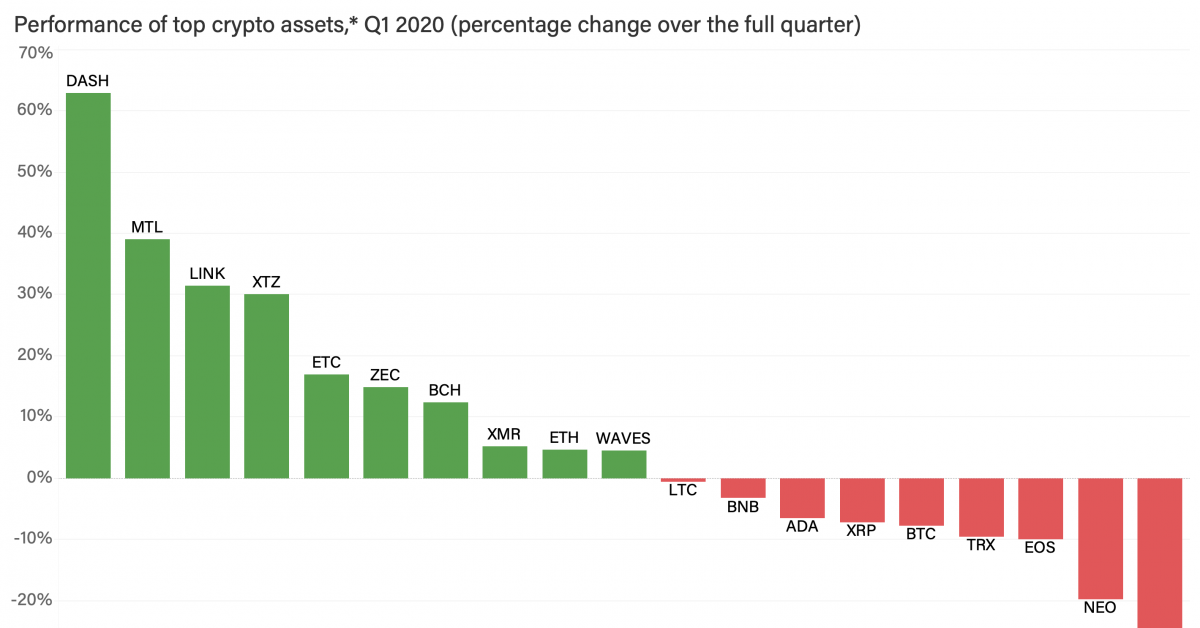

Nonetheless, a couple of cryptocurrencies together with the privateness coin sprint and hyperlink, the native token of decentralized oracle community Chainlink, managed to place in a constructive efficiency. Even probably the most actively traded cryptocurrencies have skinny volumes in comparison with conventional property like shares and bonds, so ascribing market actions to fundamentals stays a difficult train on this younger, speculative market. Nonetheless, developments reminiscent of proof of real-world adoption or new enterprise partnerships could have performed a task in these cash’ positive factors.

See additionally: How Monetary Fashions May Transfer Bitcoin’s Worth After the Halving

The next are notable winners and losers of the primary quarter amongst 19 main property featured within the forthcoming CoinDesk Quarterly Assessment. The record is curated to exclude cryptocurrencies with lower than 12 months of buying and selling historical past, and each day buying and selling quantity of lower than $5 billion. The record doesn’t embody stablecoins. CoinDesk Analysis will publish the Q1 version of the Assessment this month.

Winners

Quarterly efficiency: +63 %

Rank by market capitalization: 19

Market capitalization: $606 million

Sprint (sprint), the 19th largest cryptocurrency by market capitalization, jumped almost 63 % to register its finest quarterly efficiency because the last quarter of 2017, in line with knowledge supply Messari Professional.

Again then, the privacy-focused cryptocurrency had rallied by a staggering 217 % amid the bull market frenzy within the crypto markets.

The newest quarterly achieve is basically the results of January’s stellar 180 % value rise. Whereas the vast majority of distinguished cryptocurrencies outperformed bitcoin’s 30 % rise in January, sprint went a step additional by scoring triple-digit positive factors, probably attributable to elevated adoption in Venezuela’s hyperinflated economic system.

“Sprint established significant collaborations with worldwide manufacturers together with Burger King in Venezuela and Germany. These collaborations, coupled with decrease transaction prices and a sooner transaction expertise than bitcoin, additional promote sprint’s narrative of day-to-day usability,” mentioned Nemo Qin, an analyst at brokerage eToro.

The group behind sprint has definitely been pushing that narrative. “Venezuela is now the world’s main marketplace for crypto adoption,” Ernesto Contreras, the chief of the Sprint Core Group, declared in a weblog submit on Jan.11.

See additionally: Bitcoin All-Time Excessive in 2020? Possibilities Are Solely 4%, Choices Market Alerts

Some observers, nevertheless, challenged the sprint neighborhood’s declare of large adoption, accusing the cryptocurrency’s Venezuelan group of fabricating service provider utilization numbers. Peter McCormack, host of the What Bitcoin Did podcast, mentioned in February that Sprint was exploiting Venezuela with propaganda. Ryan Taylor, CEO of Sprint Core Group countered skeptics with an in depth submit outlining sprint’s growing utilization in Venezuela.

Taylor’s assurances, nevertheless, didn’t cease the cryptocurrency from taking a success in February and March alongside sharp losses in bitcoin. The cryptocurrency fell 23 % in March, however nonetheless ended the quarter with outsized positive factors.

Quarterly efficiency: +31.5 %

Rank by market capitalization: 14

Market capitalization: $2 billion

Hyperlink, the 14th largest cryptocurrency, closed the primary quarter with 31.5 % positive factors, having put in dismal performances within the previous two quarters.

At one level, in early March, the native cryptocurrency of the Chainlink community was buying and selling at document highs above $5.00, representing a staggering 200 % year-to-date achieve.

“Chainlink is benefitting from the shift in focus from base layer good contracts like Ethereum to oracles, which started in 2019,” Vance Spencer, co-founder of Framework Ventures, a blockchain expertise firm, mentioned in early March.

A decentralized oracle community constructed on high of Ethereum, Chainlink connects good contracts to real-world knowledge, occasions and funds. An oracle is a third-party data supply, whose sole goal is to produce knowledge to blockchains. So for instance, if two customers guess on the result of a soccer match, the oracle will inform the good contract which group received, so it may pay the successful bettor.

Chainlink has made encouraging noises during the last 12 months or so with a number of partnerships that seem like the product of relentless enterprise improvement and go-to-market technique, as noted by…