Cryptocurrency alternate Binance’s newest experiment to combine decentralized finance with its centralized platform, Binance Good Chain, is just no

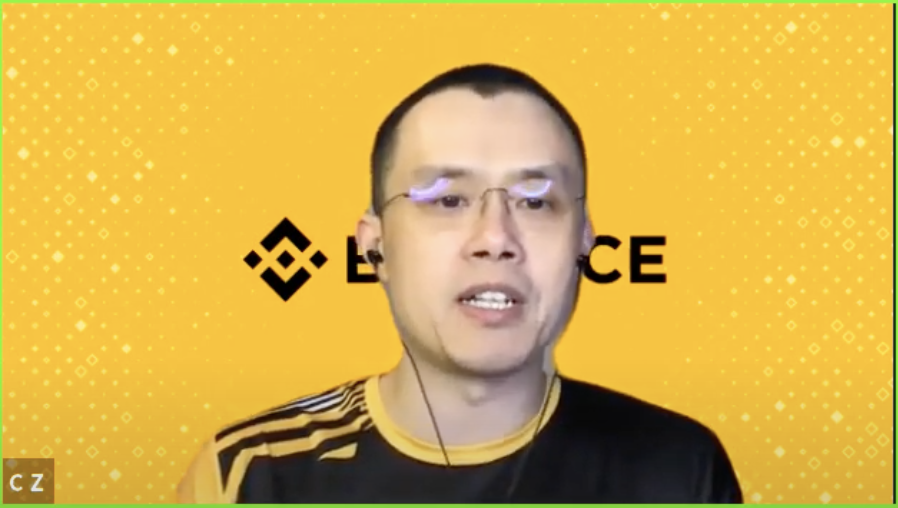

Cryptocurrency alternate Binance’s newest experiment to combine decentralized finance with its centralized platform, Binance Good Chain, is just not right here to beat DeFi, mentioned the corporate’s CEO, Changpeng “CZ” Zhao. As an alternative, it goals to speed up crypto and DeFi’s mass adoption.

“Right now, 99.9% of the cash continues to be in fiat,” mentioned Zhao in a one-on-one session with CoinDesk’s Leigh Cuen, throughout CoinDesk’s make investments: ethereum financial system digital convention Wednesday. “So with a purpose to get these cash in, we nonetheless want (fiat) gateways.”

Too early for ‘significant’ competitors

Binance introduced the launch of Binance Good Chain, its model of a decentralized public blockchain, in early September. Some argued the most important centralized alternate’s aggressive strikes into the quickly rising DeFi area was its try and turn into an Ethereum killer.

Zhao defended his firm, saying that crypto adoption is in its early levels and thus any competitors inside the area is meaningless.

“Competing inside the 0.1% is just not that significant,” Zhao mentioned. “So from a high-level perspective, we don’t actually view different tasks as competitors.”

Learn extra: Binance CEO Says He Totally Expects DeFi to Cannibalize His Crypto Trade

As of now, nearly all of so-called DeFi tasks – decentralized, blockchain-based buying and selling and lending purposes that theoretically may in the future take over the standard monetary market – have been constructed on the Ethereum blockchain, the second-largest blockchain by market capitalization. With the rise of the DeFi sector, many extra want to construct Ethereum alternate options as an effort to take at the very least a part of that market share.

Zhao claims Binance Good Chain, though a lot much less decentralized than Ethereum as a consequence of its Proof-Of-Staked-Authority (PoSA) consensus, mitigates the scalability downside of Ethereum, which has considerably slowed down the expansion of the DeFi sector.

“I believe Ethereum 1.Zero is just about absolutely congested,” Zhao mentioned. “Even when we don’t do something, even when there isn’t any competitors, there’s not going to be much more visitors on the blockchain. … So we view that Binance Good Chain is taking some load off Ethereum, the volumes that had been presupposed to get on that however couldn’t get on there.”

Zhao mentioned he and his firm are “very hopeful” about Ethereum 2.Zero however added that Ethereum 2.0’s reply to the scalability challenge might be “long-winded.”

‘Many levels of decentralization’

Zhao praised the innovation of DeFi tasks however mentioned they solely goal sure customers, making it nonetheless “a distinct segment factor,” whereas centralized exchanges like Binance enchantment to novice crypto customers who aren’t comfy with holding their very own crypto keys.

“If we take a look at the variety of customers, the preferred DeFi, Uniswap, is about 10,000 to 30,000 customers most,” Zhao mentioned, “whereas most others are 1,000 or a pair hundred customers per day.”

Learn extra: Decentralized Trade Quantity Rose 103% in September to Document $23.6B At the same time as Progress Consolidated

Zhao mentioned he hopes Binance Good Chain may appeal to extra individuals into the crypto area by making the most of options centralized and decentralized exchanges can supply. He had beforehand known as the concept “CeDeFi,” a portmanteau of centralized and decentralized finance.

In creating Binance Good Chain, Binance needed to sacrifice components of decentralization, which is without doubt one of the main criticisms of the general public blockchain, but Zhao argued that decentralization is just not all the time “black and white.”

Binance Good Chain is managed by 21 node operators, that are elected by Binance Coin (BNB) holders. And the corporate is without doubt one of the largest holders of the BNB Tokens, that means it nonetheless has vital management over the blockchain.

“I view that there are a lot of levels of decentralization,” he added.