Researchers on the Financial institution for Worldwide Settlements (BIS) suppose COVID-19 could speed up the adoption of digital funds and sharpen

Researchers on the Financial institution for Worldwide Settlements (BIS) suppose COVID-19 could speed up the adoption of digital funds and sharpen the talk over central financial institution digital currencies (CBDC).

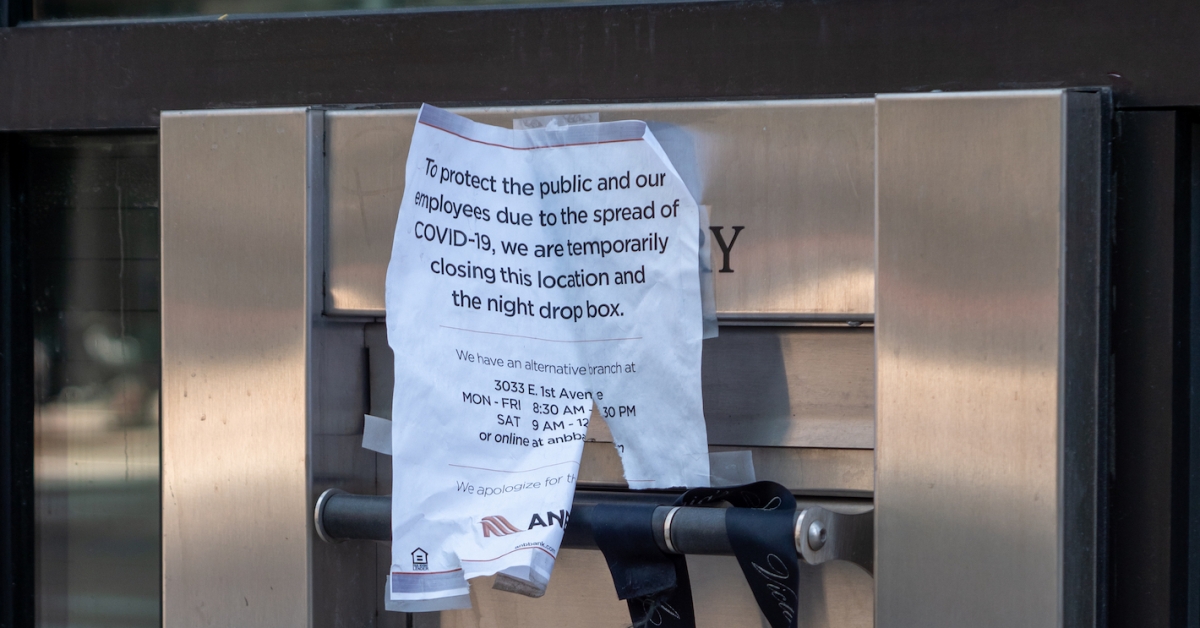

They issued their forecast in BIS’ April three Bulletin. COVID-19 is altering the general public’s relationship with money, they stated, regardless of the scientific neighborhood’s consensus that coronavirus transmission by way of banknote is comparatively unlikely.

“No matter whether or not issues are justified or not, perceptions that money might unfold pathogens could change cost behaviour by customers and companies,” the researchers stated.

For starters, nations could increase digital cost infrastructure with extra on-line, cell and contactless choices after COVID-19. Digital adoption actions might have an “particularly extreme influence” on hundreds of thousands of older and unbanked individuals, although.

“If money is just not typically accepted as a method of cost, this might open a ‘funds divide’ between these with entry to digital funds and people with out,” researchers stated. Money could due to this fact stage a comeback, the researchers admitted, however the pandemic “additionally requires CBDCs.”

CBDC might bridge society’s want for digital funds with its accountability to those that can’t simply entry them. There are a number of caveats: Central banks must tailor their CBDCs to “the context of the present disaster,” by making cost contactless and accessibility common, the researchers wrote.

“The pandemic could therefore put requires CBDCs into sharper focus, highlighting the worth of getting access to numerous technique of funds, and the necessity for any technique of funds to be resilient in opposition to a broad vary of threats,” they stated.

Certainly, some politicians are already proving the researchers’ prediction true. Jorge Capitanich, governor of Argentina’s Chaco province, advocated for “digital forex transaction programs” that section out money utilization in an April 1 coronavirus teleconference with President Alberto Fernández.

Capitanich didn’t reply to a request for remark.

Researchers additionally examined the query of whether or not the outbreak is having an influence on money utilization.

“The Covid-19 pandemic has led to unprecedented public issues about viral transmission by way of money,” researchers stated.

They discovered that completely different nations manifest their worry in usually contradictory methods. Money circulation surged within the U.S. whereas within the U.Ok ATM withdrawal quantity plummeted; some central banks sterilized reams of banknotes whereas others requested retailers to cease refusing money, or referred to as on the general public to put science over worry.

Concern, nonetheless, seems most rampant in economies with small denomination payments just like the U.S, U.Ok, Australia and others, the researchers discovered. Such nations spent the final 30 days Googling banknote transmission phrases with greater common search depth than their large-denomination invoice counterparts.

Disclosure Learn Extra

The chief in blockchain information, CoinDesk is a media outlet that strives for the very best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an impartial working subsidiary of Digital Foreign money Group, which invests in cryptocurrencies and blockchain startups.