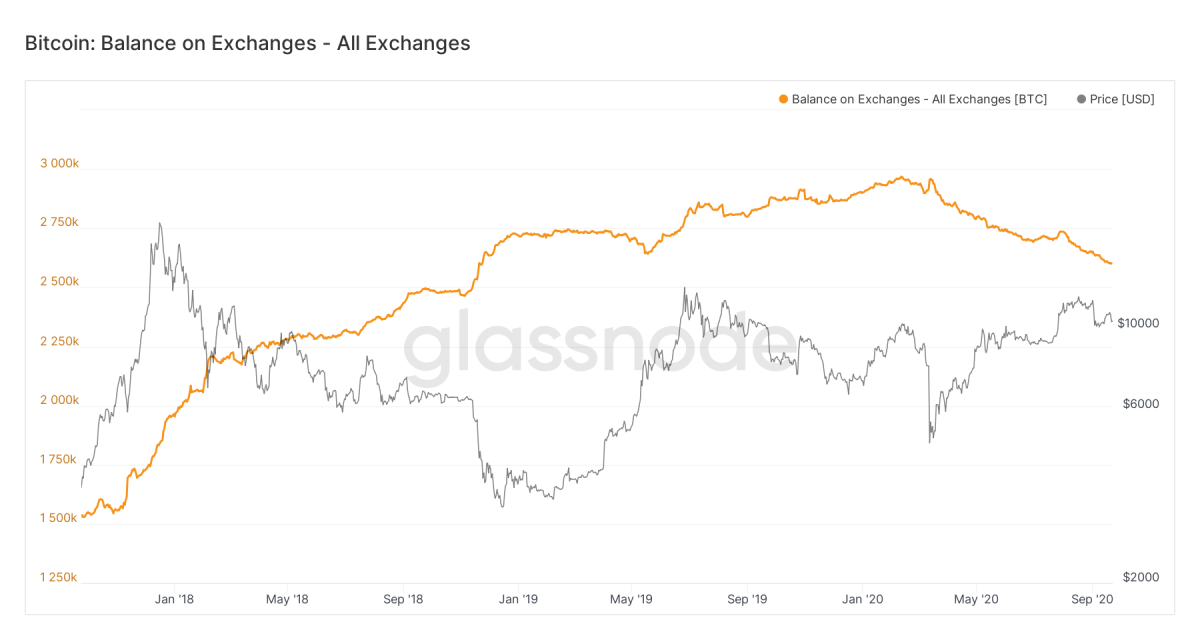

The steadiness of bitcoin on main exchanges has hit its lowest ranges since November 2018. But in contrast to that point, when bitcoin was within t

The steadiness of bitcoin on main exchanges has hit its lowest ranges since November 2018. But in contrast to that point, when bitcoin was within the depths of the crypto winter, some see this present spate of low bitcoin balances on exchanges as an indication {that a} new technology of traders is placing its cash in it for the long run.

The final time bitcoin balances on exchanges have been at this low a degree was in November 2018, in keeping with information from Glassnode. A tough fork on Bitcoin Money that month could have additionally brought about the declining bitcoin balances on exchanges since some homeowners have been transferring their bitcoins to non-public wallets with the intention to declare the brand new tokens from the fork. Bitcoin then continued its bearish development into the start of 2019, earlier than it recovered in April of that yr.

Lengthy-term holders as a attainable motive

Low bitcoin balances on centralized exchanges don’t essentially suggest a bearish market development. In reality, it may replicate a bullish view from bitcoin holders, as they transfer to longer-term holding methods, similar to chilly wallets, Glassnode tweeted again on April 14.

Which may be the case with this most up-to-date drop in balances, in keeping with Mike Alfred, CEO of Digital Property Knowledge.

“There’s no motive to promote now when you might have massive company treasuries like MicroStrategy shopping for the asset now,” Alfred advised CoinDesk in a telephone interview. “Why would you be promoting whenever you’re at first of a wave of potential company treasuries and institutional traders coming in?”

Learn extra: Bitcoin CEO: MicroStrategy’s Michael Saylor Explains His $425M Guess on BTC

South Korea-based information supplier CryptoQuant additionally captured the declining bitcoin balances on exchanges. In accordance with the corporate’s CEO, Ki Younger Ju, this implies there are fewer bitcoin holders who may promote their bitcoins on exchanges, avoiding a attainable main market correction.

Nonetheless, this decline hasn’t been a straight line down, in keeping with one other crypto information supply, Chainalysis. Their information present each day internet influx of bitcoin to exchanges logging its largest single-day enhance on Sept 21 because the market crash on March 12. Philip Gradwell, an economist on the firm, advised CoinDesk that the quantity indicated “a weakening market.”

“Whereas the general quantity of bitcoin held on exchanges is low, it has elevated over the previous couple of days, nonetheless small relative to the long run decline in bitcoin held on exchanges,” Gradwell wrote in an e mail response to CoinDesk.

The rise of bitcoin on DeFi

The newest bitcoin steadiness drop on exchanges began in mid-March when costs took a steep tumble to a 10-month low, in keeping with Norwegian crypto evaluation agency Arcane Analysis’s weekly report on Sept. 22.

Arcane Analysis attributed the decreased bitcoin steadiness on exchanges partly to the white-hot decentralized finance (DeFi) sector, the place bitcoin is being tokenized on Ethereum by these lending the cryptocurrency in change for yields.

“In the identical interval [since March 15, 2020], greater than 100,000 BTC have discovered their manner into Ethereum protocols, which may clarify a few of the outflow,” the analysis staff wrote.

As CoinDesk reported earlier this week, tokenized bitcoin has develop into one of many largest belongings on DeFi. Presently, greater than 108,000 BTC value some $1.1 billion minted from seven issuers, in keeping with Dune Analytics.

An inflow of less-experienced traders

Others, on the similar time, say {that a} new flux of crypto traders because the coronavirus pandemic began might be the rationale for the low bitcoin steadiness on exchanges. These traders, coming largely from conventional monetary markets, could want “white glove” providers similar to a crypto funding fund to handle their crypto portfolios for them, as an alternative of going to crypto exchanges themselves.

In consequence, the bitcoin steadiness on exchanges has been dropping this yr each constantly and considerably.

Digital Property Knowledge’s Alfred mentioned that crypto fund firms similar to Grayscale (a subsidiary of Digital Foreign money Group, which additionally owns CoinDesk) are shopping for a considerable amount of bitcoin, as each high-net-worth people and establishments are placing new capitals into the crypto market. For instance, at first of Q3, Grayscale had $4.1 billion in belongings below administration (AUM). As of Sept. 23, its AUM was $5.5 billion.

Conventional traders could also be involved with straightforward financial insurance policies of the Federal Reserve, different central banks and governments around the globe. However in contrast to the outdated technology of crypto traders, who have been typically technologically refined early adopters, new crypto traders are much less conversant in how crypto belongings work and subsequently much less snug with holding and managing bitcoins themselves, in keeping with Alfred. They thus flip over their funding capital to extra skilled corporations.

“These are those who don’t know a lot about bitcoin,” Alfred mentioned. “They only…