Bitcoin’s (BTC) derivatives proceed to develop regardless of gentle spot buying and selling over the previous two months. The cryptocurrency’s cho

Bitcoin’s (BTC) derivatives proceed to develop regardless of gentle spot buying and selling over the previous two months. The cryptocurrency’s choices market is on its technique to a file $1 billion month-to-month expiry this Friday.

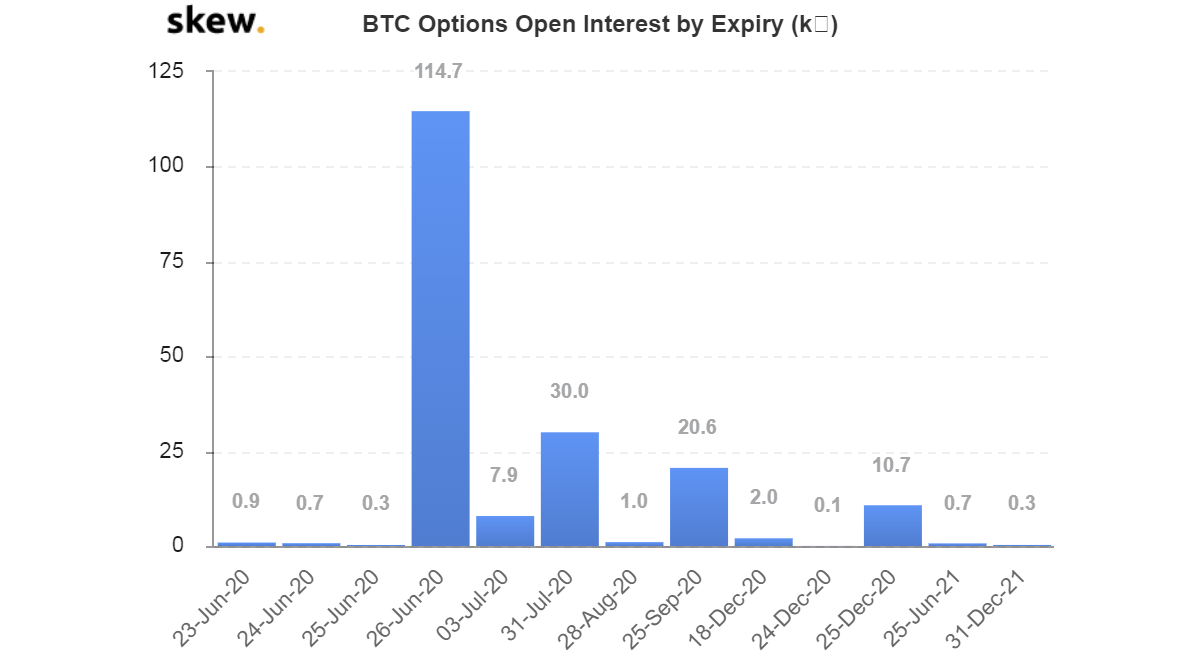

At press time, there are 114,700 possibility contracts (notional worth of over $1 billion) set to run out on June 26 throughout main exchanges – Deribit, CME, Bakkt, OKEx, LedgerX – in line with information offered by the crypto derivatives analysis agency Skew.

Choices are spinoff contracts that give patrons the appropriate however not obligation to purchase or promote the underlying asset at a predetermined value on or earlier than a selected date. A name possibility offers the appropriate to purchase and the put possibility represents the appropriate to promote. With choices, merchants could make bullish or bearish bets on contracts at varied value ranges referred to as strikes that expire in several months.

“That is undoubtedly the biggest BTC possibility expiry by a rustic mile,” mentioned Vishal Shah, an choices dealer and founding father of Polychain Capital-backed derivatives trade Alpha5.

In the meantime, Skew CEO Emmanuel Goh mentioned that “with massive quarterly expiry, you are inclined to see some pinning after which the market transferring post-expiry.”

Possibility expiries can affect market route by way of a course of generally known as “pinning” through which possibility merchants attempt to transfer the spot value to keep away from sharp losses.

See additionally: Miners Are Sending Bitcoins to Exchanges Once more – And That Might Be Bearish

Holders who profit from increased costs within the underlying asset – put sellers and name patrons – typically take lengthy positions within the spot market to lift costs earlier than the expiration date. However, put patrons and name sellers, who profit from a drop within the underlying asset, take quick positions within the spot market to maintain costs beneath strain forward of expiry.

The tug of battle typically results in costs being pinned at or close to the strike value the place numerous open positions are concentrated. “Relying on the place the open curiosity [open positions] is scattered, you would be within the sport to pin strikes,” Shah informed CoinDesk, and added additional that, “the majority of distribution of OI [open interest] on the whole is skewed barely increased.”

Certainly, open curiosity is concentrated at $10,000 and $11,000 strike costs. In the meantime, on the draw back, notable open curiosity buildup is seen at $9,000 strike.

In keeping with Pankaj Balani, CEO and founding father of Singapore-based Delta Trade, merchants have offered a superb quantity of calls round $10,000-$11,000 strikes for the June expiry.

Consequently, $10,000 could act as a stiff resistance heading into expiry. If costs start to rise, name sellers could take quick positions within the spot markets so as to maintain the cryptocurrency from scaling the $10,000 mark.

At press time, bitcoin was altering fingers close to $9,400, representing a 2.5% decline on the day. The cryptocurrency has traded largely within the vary of $9,000 to $10,000 ever since its third reward halving, which befell on Might 11.

Submit-expiry volatility?

Bitcoin could turn out to be susceptible to violent value strikes over the approaching months if merchants rollover quick positions in June contracts to July and September expiry.

A rollover refers to squaring off positions in contracts nearing expiry and replicating the identical place within the next-nearest expiry.

As famous earlier, there was important name writing (promoting) at $10,000 and $11,000 strike costs. Alpha5’s Vishal Shah says there’s danger in transporting quick positions to July or September expiry as bitcoin choices are at a really low degree of implied volatility traditionally.

That is undoubtedly the biggest BTC possibility expiry by a rustic mile.

The three-month implied volatility is hovering beneath its lifetime common of 96.6% on an annualized foundation, in line with information supply Skew. A protracted interval of low volatility consolidation, much like the one seen over the previous two months, typically paves the best way for a giant transfer in both route.

Thus, if merchants rollover quick positions, they face danger of an impending rise in volatility that might make choices costlier. That, in flip, would result in extra chaotic buying and selling and additional rise in volatility.

“If the present choices buildings [short position] are replicated into July and September expiries, merchants would run into a possible scenario of getting ‘offered too low’ by way of volatility. That may usher in all forms of issues, and result in some disorderly conduct if and when the spot picks up directionality,” mentioned Shah.

Volatility has a optimistic influence on possibility costs. The upper the volatility (uncertainty), the stronger is the hedging demand for choices. Seasoned merchants typically promote choices when volatility is nicely above its lifetime common and purchase choices when volatility is simply too low.

Choices expiry a non-event?

Some analysts say bitcoin’s choices market is simply too small to have any significant influence on the…