Bitcoin leaving macro belongings behind would be the “largest story in crypto” if it continues, however t

Bitcoin leaving macro belongings behind would be the “largest story in crypto” if it continues, however there’s extra to be bullish about, says Cole Garner.

Bitcoin (BTC) abandoning correlation with conventional markets will likely be its “largest story” if it continues, one well-liked analyst says.

In a sequence of tweets on Oct. 21, Cole Garner highlighted Bitcoin’s market decoupling amongst bullish value components.

Garner: Decoupling will likely be crypto’s “largest story”

Garner retweeted a chart of Bitcoin, gold, the S&P 500 and Ether (ETH), which reveals Bitcoin hanging out by itself, delivering optimistic returns whereas different belongings floundered.

The chart originated from Eric Wall, CIO of crypto hedge fund Arcane Property, who described the pattern as “uncommon.”

“BTC’s correlation to conventional markets seems to be unwinding. If this persists within the coming weeks, it’ll be the largest story in crypto,” Garner commented.

Bitcoin (orange) vs. gold, S&P 500 and Ethereum. Supply: Eric Wall/ Twitter

Bitcoin beforehand demonstrated long-term correlation to the S&P 500 specifically, additionally forming an in depth relationship to gold within the months after March’s coronavirus-induced value crash.

Others have beforehand famous the now-decaying pattern, amongst them statistician Willy Woo, who in September forecast that it might proceed.

“Clear skies” above $12,000 resistance

Additionally buoying the temper for Garner is the “amazingly impartial” funding fee throughout perpetual swaps on exchanges.

Regardless of Bitcoin’s newest beneficial properties which took it above $12,000, the funding fee suggests help for longs on the expense of shorts — an encouraging signal for additional upward momentum.

Coupled to that is institutional investor sentiment, which from final weekend’s dedication of merchants (COT) report is firmly lengthy, not quick.

As Cointelegraph reported, BTC/USD instantly retook $12,000 in a single day on Tuesday, having hung out tackling the pivotal resistance level of $11,900.

As Garner and others word, little or no stands in the way in which of additional optimistic value motion above $12,000 because of how Bitcoin spent the temporary intervals of time above that stage earlier than.

“Skies are largely clear above $12Ok throughout alternate orderbooks,” he summarized.

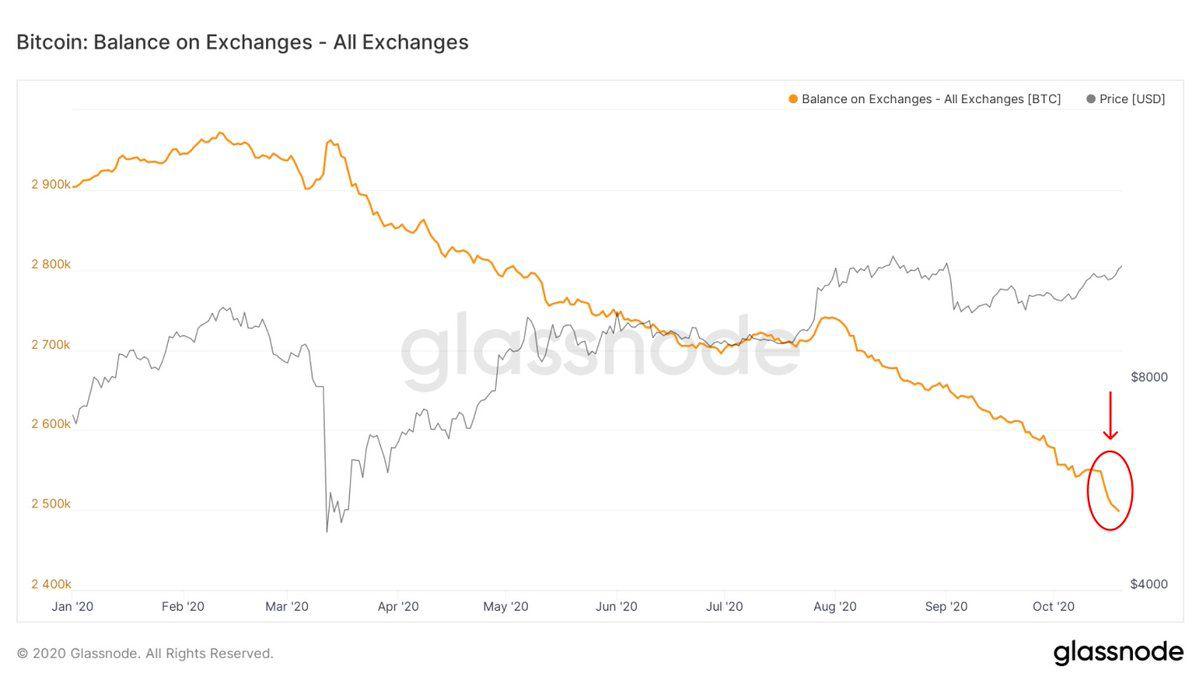

Different components stay from earlier weeks and months, notably the shortage of inflows from whales, suggesting that the will to promote massive quantities of BTC stays low. Change balances are in truth regularly dropping regardless of the value rises, information reveals.

Bitcoin alternate balances vs. value with newest drop highlighted. Supply: Cole Garner/ Glassnode

Concluding, Garner’s solely concern was that, if Twitter sentiment is a dependable measure, few hodlers anticipated the present situation.

“Too many individuals had been unprepared for this,” he wrote, linking to a latest survey during which 35% of respondents claimed that Bitcoin made up lower than 10% of their crypto portfolio.

“I’m no maximalist, bought loads of love for crypto throughout, however you gotta respect the king.”