Whereas bitcoin has gained 3% up to now this week, the general buying and selling atmosphere stays uninteresting with volatility hovering at multi-

Whereas bitcoin has gained 3% up to now this week, the general buying and selling atmosphere stays uninteresting with volatility hovering at multi-year lows.

Ten-day realized volatility, a historic metric, is now at simply 20%, the bottom stage for 2 years. That’s “a low that’s solely preceded in Sep & Oct 2018,” the Singapore-based quantitative buying and selling agency QCP Capital mentioned on its Telegram channel.

Again within the autumn of 2018, the low-volatility consolidation ended with a giant drop to beneath $6,000. This time, although, choices merchants are anticipating a breakout on the upper facet.

“With the rise in one-month implied volatility this previous week (on the again of extra name shopping for) leading to a notable divergence with realized volatility, the same bang to finish the lull is what choice merchants are betting on (this time with an upside break),” mentioned QCP Capital.

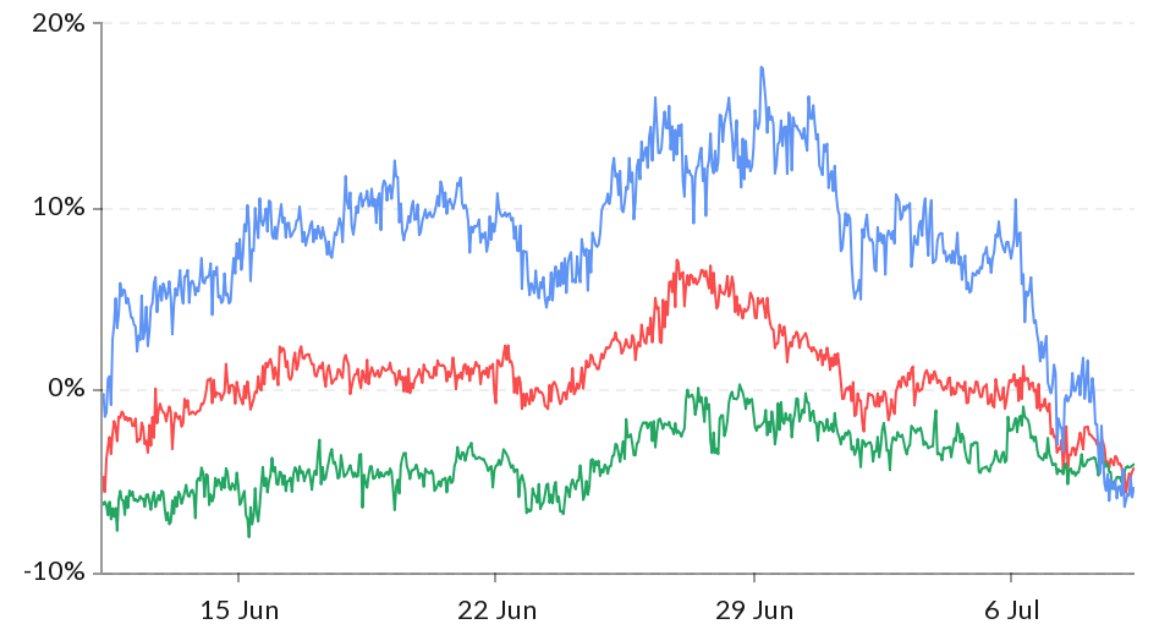

Bitcoin’s one-month implied volatility has risen from 46% to 55% over the previous six days, in accordance with information supplied by the crypto derivatives analysis agency Skew.

Implied volatility is the market’s expectation of how dangerous or risky an asset will likely be sooner or later and is calculated by taking an choice and the underlying asset’s value together with different inputs corresponding to time to expiration.

In the meantime, the one-month realized volatility has declined from 78% to 35%. Realized volatility represents the worth volatility that has actualized up to now.

The latest divergence between the 2 metrics is indicative of merchants pricing in a transition from a low-volatility to a high-volatility buying and selling atmosphere over the subsequent few 4 weeks.

Implied volatilities are primarily pushed by the online shopping for strain for choices (calls/places). The newest pick-up seems to have been fueled by elevated demand for name choices or bullish bets, as famous by QCP Capital.

That’s evident from the truth that the one-month, three-month and six-month put-call skews are reporting adverse values. Put-call skew measures the worth of places relative to that of calls.

The one-month skew has dropped sharply from 11% to -5.4% this week. Unfavourable values point out that decision choices (or bullish bets) are drawing greater costs than put choices (bearish bets). So, in impact, choices merchants are leaning bullish proper now, with calls in higher demand.

It stays to be seen if the multi-week-long buying and selling vary of $9,000 to $10,000 ends with a bullish breakout, as anticipated.

Additionally learn: London Inventory Change Father or mother Assigns Monetary ‘Bar Codes’ to 169 Cryptos

The technical charts are additionally backing that situation. For example, the cryptocurrency breached a month-long falling channel on the upper facet on Wednesday, signaling an finish of the pullback from highs above $10,400 seen July 1.

Additional, the MACD histogram, a momentum indicator, has crossed above zero in favor of the bulls.

The cryptocurrency is buying and selling close to $9,400 at press time, representing a 0.57% decline on the day.

Disclosure: The creator holds no cryptocurrency belongings on the time of writing.

The chief in blockchain information, CoinDesk is a media outlet that strives for the very best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an impartial working subsidiary of Digital Foreign money Group, which invests in cryptocurrencies and blockchain startups.