Rewards obtained by bitcoin miners kind a significant chunk of the salaries paid throughout main proof of labor (PoW) blockchains, according to Yas

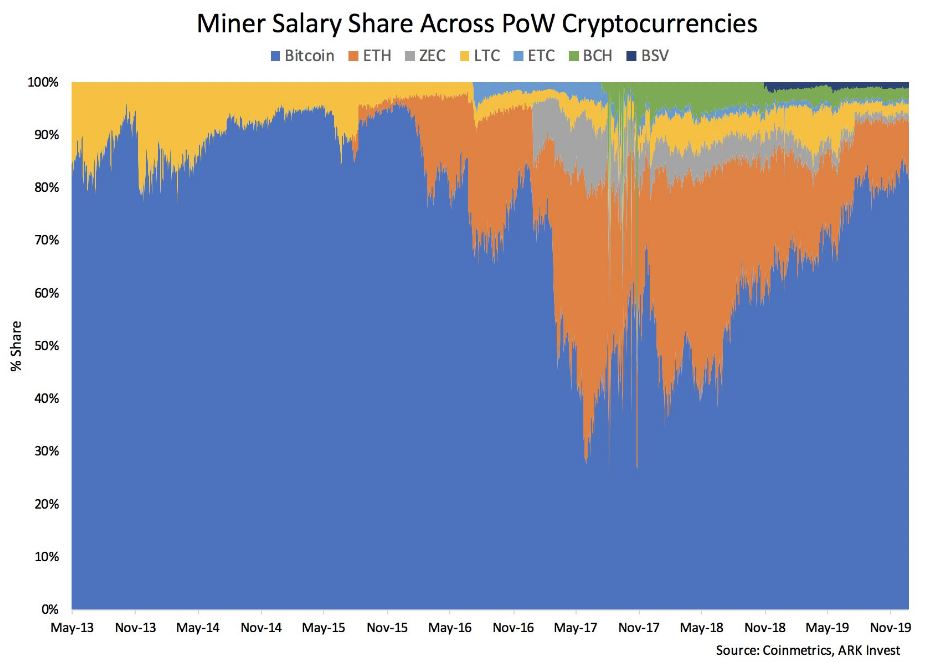

Rewards obtained by bitcoin miners kind a significant chunk of the salaries paid throughout main proof of labor (PoW) blockchains, according to Yassine Elmandjra, a cryptocurrency analyst from ARK Make investments.

For instance, bitcoin miners had been paid over $15 million price of the cryptocurrency as incentive to mine blocks and safe the community on Jan. 9. In the meantime, the entire rewards paid throughout bitcoin (BTC), ethereum (ETH) and different main PoW cryptocurrencies together with zcash (ZEC), litecoin (LTC), ethereum basic (ETC), bitcoin money (BCH) and bitcoin SV (BSV) had been only a bit greater than $18 million.

Basically, bitcoin miners had been answerable for practically 83 % of the entire mining rewards paid throughout main PoW blockchains.

Since mid-2017, bitcoin miners’ wage share has elevated by 250 %, whereas that of ether, the second-largest cryptocurrency, has dropped considerably.

Proof-of-work is a consensus algorithm for blockchain networks the place miners discover blocks by fixing cryptographically arduous puzzles. That is in distinction to the proof-of-stake (PoS), the place validators lock up the respective cryptocurrency to say their stake within the ecosystem.

Strongest coin

The truth that bitcoin miners are drawing considerably greater salaries than their counterparts isn’t a surprise, given bitcoin is the strongest PoW-powered coin with the biggest community impact and the longest observe report, in line with Muneeb Ali, CEO of Blockstack PBC.

A community impact is the concept that as adoption and integration right into a system grows, so does its worth – and at an exponential price fairly than at a linear price.

Again in 2016, bitcoin professional Hint Mayer mentioned the shop of worth attraction, safety and hypothesis that bitcoin’s community impact would develop quickly.

“The cryptocurrency has virtually completely captured the shop of worth narrative, permitting for consolidation across the strongest coin,” Blockstack’s Ali stated.

Additional, bitcoin’s community safety, as represented by its hash price, has elevated sharply over time, serving to construct confidence within the blockchain and establishing a constructive suggestions loop of safety and community impact. At press time, bitcoin’s hash price is roughly 100,000,000 Terahashes (or 100 exahashes).

Trying ahead

Bitcoin’s share of PoW mining may develop even bigger sooner or later as ethereum and different blockchains start shifting to proof-of-stake, which is much less energy-intensive consensus mechanism, stated Ali.

Ethereum is anticipated to finish the transition from PoW to PoS by 2022. “Its community will probably be higher as soon as ETH 2.0 (post-transition) exhibits its true worth within the international market,” Steve Tsou, World CEO of RRMine, instructed CoinDesk.

One other issue that would have an effect on miner’s earnings and affect bitcoin’s share of PoW mining is the reward halving due in 4 months. The rewards obtained for per block mined on bitcoin’s blockchain will probably be decreased from 12.5 BTC to six.25 BTC someday in Might. Mining prices will double put up halving and that would crowd out weak miners, inflicting modifications between provide and demand.

RRMine’s Tsou stated miners’ earnings will rise if halving creates a provide deficit, pushing costs above mining prices. That might additionally enhance bitcoin’s share of PoW mining – extra so, as elevated profitability could entice miners from different chains.

“An important factor is that the miners management the associated fee, which utterly determines if the miners can revenue from it,” Tsou stated.

Nonetheless, if costs drop sharply, controlling value will probably be a problem and miners could exit, probably resulting in a drop in bitcoin’s share of PoW mining.

Disclosure Learn Extra

The chief in blockchain information, CoinDesk is a media outlet that strives for the very best journalistic requirements and abides by a strict set of editorial policies. CoinDesk is an unbiased working subsidiary of Digital Forex Group, which invests in cryptocurrencies and blockchain startups.