Ever since its inception, bitcoin has been dubbed “digital gold,” given it's sturdy, fungible, divisible and scarce like the valuable steel. Nonet

Ever since its inception, bitcoin has been dubbed “digital gold,” given it’s sturdy, fungible, divisible and scarce like the valuable steel.

Nonetheless, whereas gold has a robust monitor report of rallying in instances of stress within the world fairness markets, bitcoin is but to construct the same repute as a safe-haven asset.

In reality, in current months, the cryptocurrency has been more and more correlated with the S&P 500, Wall Avenue’s fairness index and benchmark for world inventory markets. Now, knowledge means that relationship is stronger than ever, seemingly denting its enchantment as digital gold.

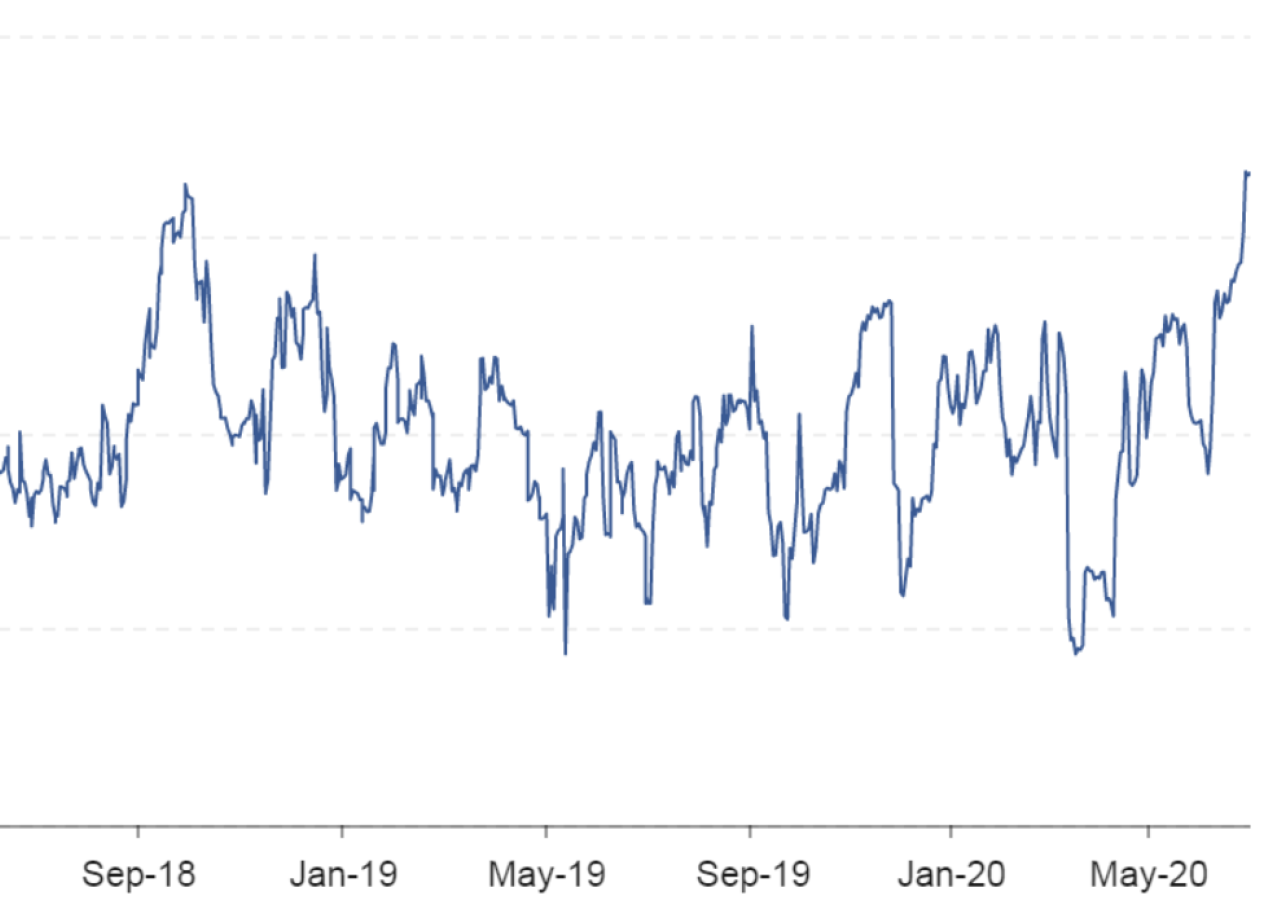

The one-month bitcoin-S&P 500 realized correlation rose to a report excessive of 66.2% on June 30 and stood at 65.8% on Thursday, in line with crypto derivatives analysis agency Skew, which started monitoring the information in April 2018.

“Whereas bitcoin and S&P 500 correlation is all the time an excellent indicator of market motion, it by no means actually maintains a constant place. Bitcoin behaves extra like a extremely leveraged place and follows the market traits in a extra risky, dramatic up and down swings,” stated Wayne Chen, CEO and director of Interlapse Applied sciences, a fintech agency.

The one-month metric oscillated largely within the vary of -30% to 50% for 12 months earlier than rising to report highs above 60% on June 30. The info certainly reveals that bitcoin’s correlation with the S&P 500 is considerably inconsistent.

The one-year correlation has additionally risen to lifetime highs above 37%, in line with Skew. One ought to be aware, although, that readings between 30% to 50% indicate a comparatively weak correlation between variables.

“Bitcoin, by all accounts, continues to be a threat asset. Regardless of those that might tout its basic similarities to gold, it has not but confirmed to be a adequate hedge or a flight to security in instances of risk-off sentiment,” stated Matthew Dibb, co-founder of Stack, a supplier of cryptocurrency trackers and index funds.

Danger property are the these with fortunes tied to the state of the worldwide economic system. As an example, costs of shares and industrial metals like copper are inclined to rise when the worldwide financial development price is predicted to choose up tempo and falter throughout an financial slowdown.

Bitcoin has roughly behaved like a threat asset this yr. The cryptocurrency’s worth fell from $10,000 to $3,867 within the first half of March, as world equities cratered on coronavirus fears. It then rose again towards $10,000 within the following two months because the S&P 500 noticed its quickest bear market restoration on report.

Nonetheless, being handled as a threat asset could also be a blessing in disguise for bitcoin.

“On condition that the correlation between BTC and equities continues to be so excessive, our expectation is that that is solely bullish for bitcoin worth within the quick time period, as world markets profit from an unprecedented quantity of financial stimulus,” stated Dibb.

Certainly, the U.S. Federal Reserve (Fed) and different main central banks are injecting huge quantities of fiat liquidity into their respective economies to counter the COVID-19 slowdown. As of final week, Fed’s steadiness sheet measurement was $7.01 trillion – up 67% from $4.24 trillion in early March, in line with knowledge offered by the St. Louis Federal Reserve.

HODLing retains rising

Whereas bitcoin is struggling to ascertain itself as a haven asset, some buyers stay undeterred.

“HODLers” or long-term holders of bitcoin, as gauged by the variety of addresses storing bitcoin for at the least 12 months, rose to a lifetime excessive of 20.Three million in June. That surpassed the earlier excessive of 19.52 million reached in Could, as per IntoTheBlock, a blockchain intelligence firm.

“With the halving only recently full, many holders imagine that Bitcoin’s median worth ought to be quite a bit increased than the present worth. This creates extra of a hodl kind of behaviour till the market begins constructing steam once more,” stated Chen.

The metric set a brand new report excessive for the 12th straight month in June. Notably, the variety of holders is up 22% year-on-year, regardless that bitcoin’s worth is down 25% over the identical interval.

At press time, the cryptocurrency is buying and selling at $9,110, having dipped to lows close to $8,930 throughout the U.S. buying and selling hours on Thursday.

Disclosure: The creator holds no cryptocurrency property on the time of writing.

The chief in blockchain information, CoinDesk is a media outlet that strives for the very best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an unbiased working subsidiary of Digital Forex Group, which invests in cryptocurrencies and blockchain startups.