Bitcoin is booming once more as crypto-bull Brian Brooks pushes via his “open entry” banking guidelines earlier than stepping down as the highest U

Bitcoin is booming once more as crypto-bull Brian Brooks pushes via his “open entry” banking guidelines earlier than stepping down as the highest U.S. banking regulator.

High shelf

Going public?

The Winklevoss twins are contemplating taking Gemini Belief, the cryptocurrency alternate and custodian based in 2014, public, in response to a Bloomberg interview. “We’re undoubtedly contemplating it and ensuring that we’ve got that possibility. We’re watching the market and we’re additionally having inner discussions on whether or not it is smart,” Cameron Winklevoss mentioned. The agency launched the Gemini Credit score Card providing cryptocurrency rewards as we speak.

Race for adoption

Central financial institution digital currencies (CBDCs) are lagging behind in crypto adoption, in response to a brand new analysis observe from the Australian funding financial institution Macquarie. “It’s nonetheless unclear how entrenched personal cryptos will change into earlier than CBDCs change into a viable different for extra environment friendly transactions,” with central banks vulnerable to shedding management over the financial system in that case. Whereas crypto is rising extra widespread, there are critical roadblocks to hyperbitcoinization – like brokerages operating out of BTC and ex-Ripple CTO’s shedding their keys.

Safety measures

Grayscale Investments, the world’s largest digital forex asset supervisor, introduced it has begun dissolution of its $19.2 million Grayscale XRP Belief, the newest step to attenuate danger by distancing itself from XRP. The U.S. Securities and Alternate Fee is suing Ripple Labs for unregistered gross sales of XRP. Grayscale, owned by CoinDesk father or mother Digital Forex Group, had already eliminated XRP from its large-cap crypto fund. In the meantime, Japan’s prime monetary regulator has mentioned XRP is a is a crypto asset, not essentially a safety, beneath state regulation.

Fast bites

- 10 ICOs: The place are they now? (Decrypt)

- WITCHING HOUR: When to commerce bitcoin? When Saturn crosses Mercury, after all. (Reuters)

- BTC BOUNTY: Ledger beefs up safety after disastrous information breach. (CoinDesk)

- ARCTIC MINING: Bloomberg takes a photoshoot of an arctic BTC mining rig. (Bloomberg)

- UPPER LIMIT? Deribit gives $400,000 strike on bitcoin futures. (CoinDesk)

- ALMOST THERE: Bitcoin miners and builders close to consensus on the way to activate Bitcoin improve Taproot. (CoinDesk)

- UNHOSTED DEBATE: Remark interval for controversial FinCEN rule proposal prolonged. (CoinDesk)

Market intel

Buying and selling corridor of fame

On Oct. 30, somebody (a single dealer or small group) purchased 16,000 contracts of Jan. 29 expiry name choices on the $36,000 strike for 0.003 bitcoin per contract, in response to information shared by Deribit. The preliminary funding or complete buy price was 48 BTC, or roughly $638,400 as per bitcoin’s worth again then. Omkar Godbole tells the story of this legendary commerce.

At stake

Finance, censorship and Brooks

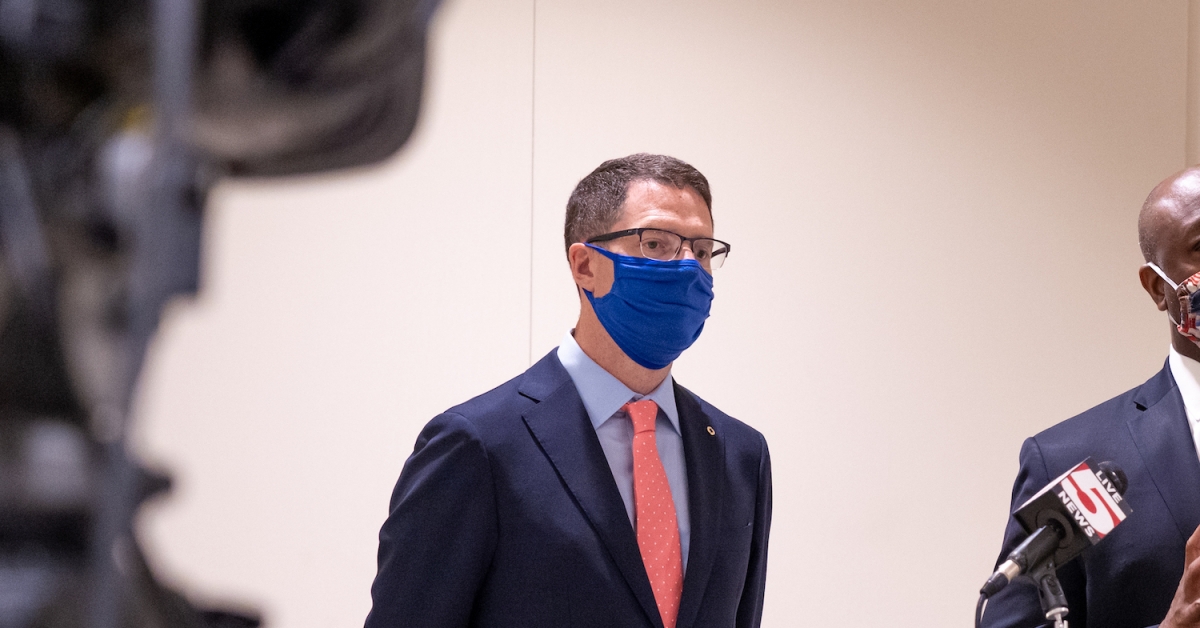

Performing Comptroller of the Forex Brian Brooks is ready to step down as we speak, ending a quick although impactful stint on the U.S.’ prime banking regulator.

Brooks, who got here to the Workplace of the Comptroller of the Forex by means of Coinbase and Fannie Mae, has pushed for larger flexibility and amiability between the banking sector and crypto – together with issuing a number of interpretative letters saying federally regulated banks can custody crypto, course of stablecoin transactions and function nodes in a blockchain community.

As a part of his mandate, Brooks additionally tried to create a extra “open” monetary system by stopping banks from withholding providers from “high-risk” companies, like these in culturally delicate industries reminiscent of tobacco, weapons and fracking, in addition to financially doubtful companies like payday lenders.

Open for a 45-day remark interval, Brooks finalized the rule as we speak in what some are calling 11th-hour decision-making.

In November, Brooks and OCC Chief Economist Charles Calamoris proposed a rule that mentioned banks ought to choose potential purchasers based mostly solely on particular credit score and operational standards. This, the regulators wrote, would stop “politically pushed discrimination.”

Brooks hasn’t given up the theme. “We reside in a world the place not solely data but additionally cash could be managed by a handful of elites who won’t like the best way that anybody of us thinks [about an issue],” Brooks mentioned yesterday at a livestreamed Elliptic occasion.

The outgoing OCC chief was talking obliquely about monetary companies like Shopify, Stripe and Deutsche Financial institution chopping ties with outgoing President Donald Trump within the wake of the Jan. 6 Capital riot that left 5 useless and interrupted the congressional certification of the presidential election outcomes.

“All the pieces is in danger” if monetary know-how is politicized, Brooks mentioned.

The difficulty is, as J.P. Koning famous in a CoinDesk column in December, every part is already politicized. Responding to Brooks’ proposal to foster a politically impartial monetary system, Koning wrote:

“In banking, loans are the fodder for creating protected deposits. So if a financial institution desires to draw trendy customers by organising a clear…