Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes,

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link.

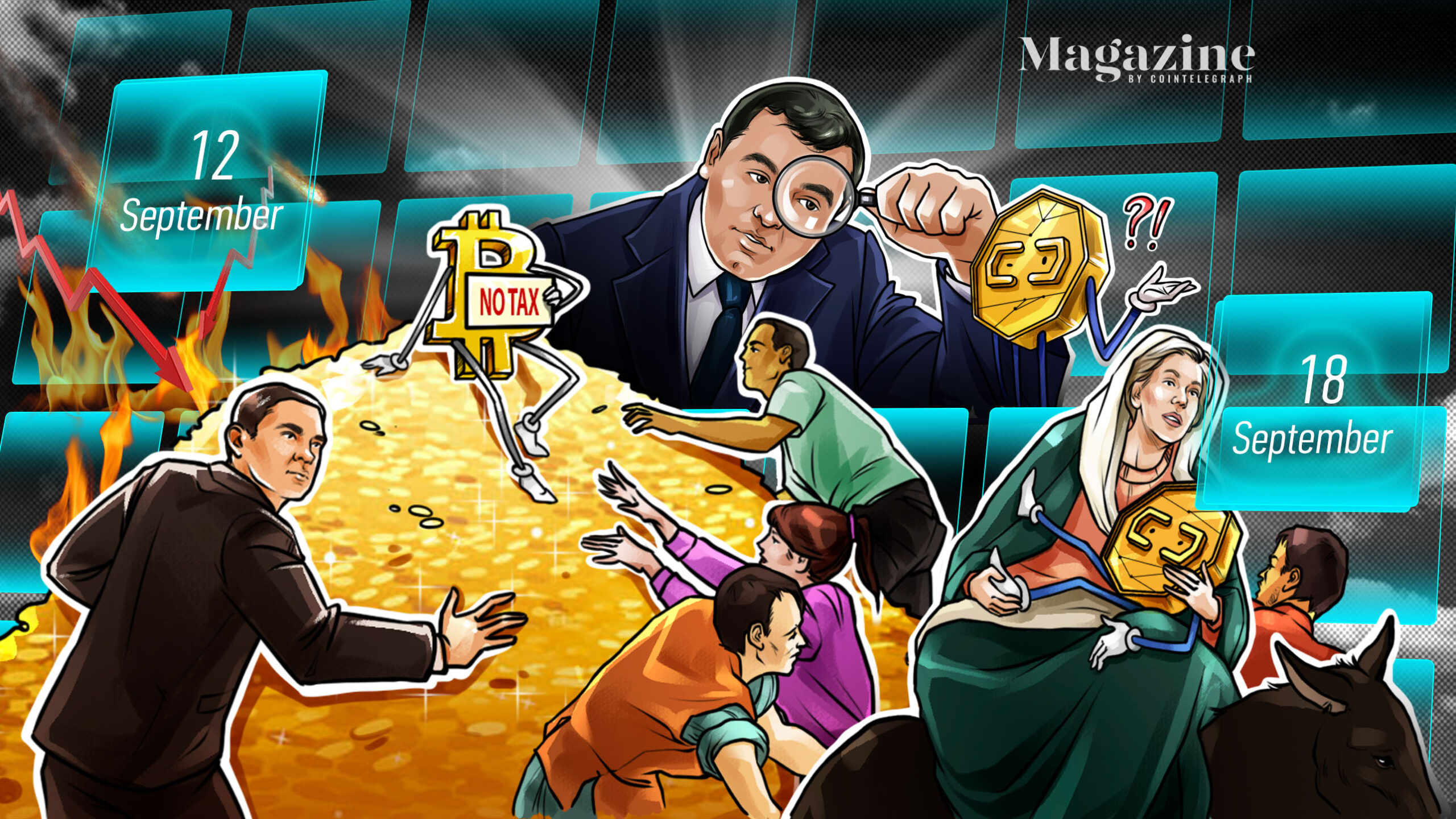

Top Stories This Week

Cardano launches smart contracts after successful hard fork

After years of anticipation, Charles Hoskinson’s brainchild, Cardano, finally launched its smart contract functionality via the Alonzo hard fork on Monday. You’d think the result of this would be some bullish price action for ADA but, alas, its price dropped 10% following the rollout.

While Cardano was keen to celebrate the milestone, it also emphasized in a blog post that it’s still in the “early days” of the project, adding that now is when “the mission truly begins.”

The team also urged its community to not be overzealous in boarding the hype train just yet, and to be patient with the smart contract functionality in its formative stages:

“There are high expectations resting on this upgrade. Some unreasonably so. Cardano watchers may be expecting a sophisticated ecosystem of consumer-ready DApps available immediately after the upgrade. Expectations need to be managed here.”

Fake news: Litecoin price surges 35% following Walmart adoption hoax

While real news made the price of ADA drop, fake news made the price of Litecoin (LTC) pump this week.

Numerous publications reported Monday that Walmart planned to have a “pay with Litecoin option” for its e-commerce websites starting on Oct. 1 as part of a partnership with the Litecoin Foundation. Following the spread of the fake report, the price of LTC surged 35% before sharply falling within hours.

A spokesperson from Walmart confirmed that the news was fake within an hour, while the Litecoin Foundation’s director of marketing, Jay Milla, also told Cointelegraph that the announcement did not come from Litcecoin’s side of things.

“The Litecoin Foundation has yet to enter into a partnership with Walmart,” said Milla.

Vitalik Buterin makes list of Time magazine’s 100 most influential people in 2021

Ethereum co-founder Vitalik Buterin was named by Time Magazine as one of the 100 most influential people of this year, joining the likes of Naomi Osaka, Britney Spears, Xi Jinping and Elon Musk.

Buterin was featured in the “Innovators” section of the Time 100 list, with Reddit co-founder Alexis Ohanian authoring his profile. Ohanian highlighted Buterin’s work in building the Ethereum network and encouraging the development of decentralized apps and NFTs.

“No one person could’ve possibly come up with all of the uses for Ethereum, but it did take one person’s idea to get it started,” Ohanian said. “From there, a new world has opened up, and given rise to new ways of leveraging blockchain technology.”

Coinbase increases junk-bond offering to $2B after investors swarm

After seeing enormous demand for its $1.5 billion junk-bond offering that was announced on Monday, Coinbase reportedly increased the size of the sale to $2 billion.

According to a report from The Economic Times, there was at least $7 billion worth of orders that were placed in competition for seven- and 10-year bonds offering interest rates of 3.375% and 3.625%, respectively.

Coinbase stated on Monday that the raised funds will be put towards “continued investments in product developments” and “potential investments in or acquisitions of other companies, products, or technologies” in the future.

The funds might also come in handy when the U.S. Securities and Exchange Commission, or SEC, comes knocking on the door with a lawsuit if the USD coin lending program is actually launched.

US lawmakers propose adding digital assets to ‘wash sale’ rule and raising capital gains tax

Reports surfaced this week that Democrats in the U.S. House of Representatives proposed tax initiatives that could swipe some extra profits from the gains of “certain high-income” crypto users.

According to a document released by the House Committee on Ways and Means on Monday, the proposal would increase the tax rate on long-term capital gains from the existing 20% to 25%.

On the same day, President Joe Biden said he planned to nominate acting chairman of the Commodity Futures Trading Commission, Rostin Behnam, to assume the role permanently, while also naming Kristin Johnson and Christy Goldsmith Romero to fill two other vacant commissioner seats.

In a private meeting held on Sept. 8 between Fidelity Digital Assets President Tom Jessop, six of the firm’s executives and several SEC officials, the executives outlined a number of reasons why the enforcer should finally approve the Bitcoin (BTC) exchange-traded fund.

These examples included increased demand for digital assets, the prevalence of similar funds in other countries, and the rise of Bitcoin adoption — all of which sound like reasons that would fall on deaf ears for…

cointelegraph.com