They're undoubtedly not fairness, however may "change tokens" be bellwethers for one in all crypto's finest use circumstances? (Spoiler: In all pro

They’re undoubtedly not fairness, however may “change tokens” be bellwethers for one in all crypto’s finest use circumstances? (Spoiler: In all probability not)

Amongst 1000’s of venture-backed startups, tokens, cash, blockchains and open-source expertise tasks, change operators now stand out among the many high income getters within the crypto asset class. Coinbase, not the biggest by buying and selling quantity even amongst exchanges whose commerce knowledge is trusted, reported $173 million in 2018 non-U.S. income, main Reuters to estimate Coinbase’s global revenue as north of $500 million.

If crypto has confirmed itself in a single use case, it’s as a unstable asset for traders hungry to invest. Our estimate of change operators’ fee-based income exhibits this to be true.

As such, crypto tokens issued by the exchanges themselves may very well be among the many most helpful digital property in circulation. “Change tokens,” as they’re known as, supply holders reductions on buying and selling charges and different advantages. This doesn’t make them something like fairness claims on change income, which several analysts have pointed out, it doesn’t matter what buyback mechanisms are employed. It does make them very like the “utility tokens” issued within the preliminary coin providing increase of 2017 and 2018 – or like air miles – and a few traders in these tokens embrace that narrative.

Not like air miles, change tokens commerce freely on quite a lot of venues. As such it’s stunning that, regardless of the success of their issuers, the tokens themselves haven’t been extra profitable as investments. The desk under exhibits the one-, three-, six-, nine- and 12-month returns of Binance’s BNB, Huobi’s HT, Bitfinex’s LEO and OKEx’s OKB, the 4 change tokens that make up the change token index supplied by FTX, a derivatives change operator, as of Jan. 28 (knowledge through Nomics).

The advantages to merchants, nevertheless, may be important. In line with Binance’s payment schedule, the highest tier of BNB token holders should at this time maintain about $176,000 price of the token and commerce about $1.2 billion per 30 days on the change (with BNB and BTC at present costs of about $16 and $8,000 respectively). For customers buying and selling in these volumes,top-tier BNB holdings present payment reductions that may save them about $720,000 every month, off the usual buying and selling charges – extra, if these merchants pay the charges themselves within the Binance token. In addition they present entry to “preliminary change choices” (IEOs), a brand new asset issuance operated by the change.

As such, BNB and different change tokens may be anticipated to function indicators as to the relative success of the issuing exchanges. In any case, if an open marketplace for air miles existed, you would possibly count on one airline’s miles to commerce at a premium to a different’s, relying on flyers’ perceptions of their service.

At one time, that was true of change tokens, however over the course of the previous 12 months it is grow to be much less and fewer so. For many of those change tokens, the correlation between worth and the issuing exchanges’ reported quantity is weakening over time. (Not like the exchanges within the income chart, not all these change token issuers’ reported quantity is rated reliable.)

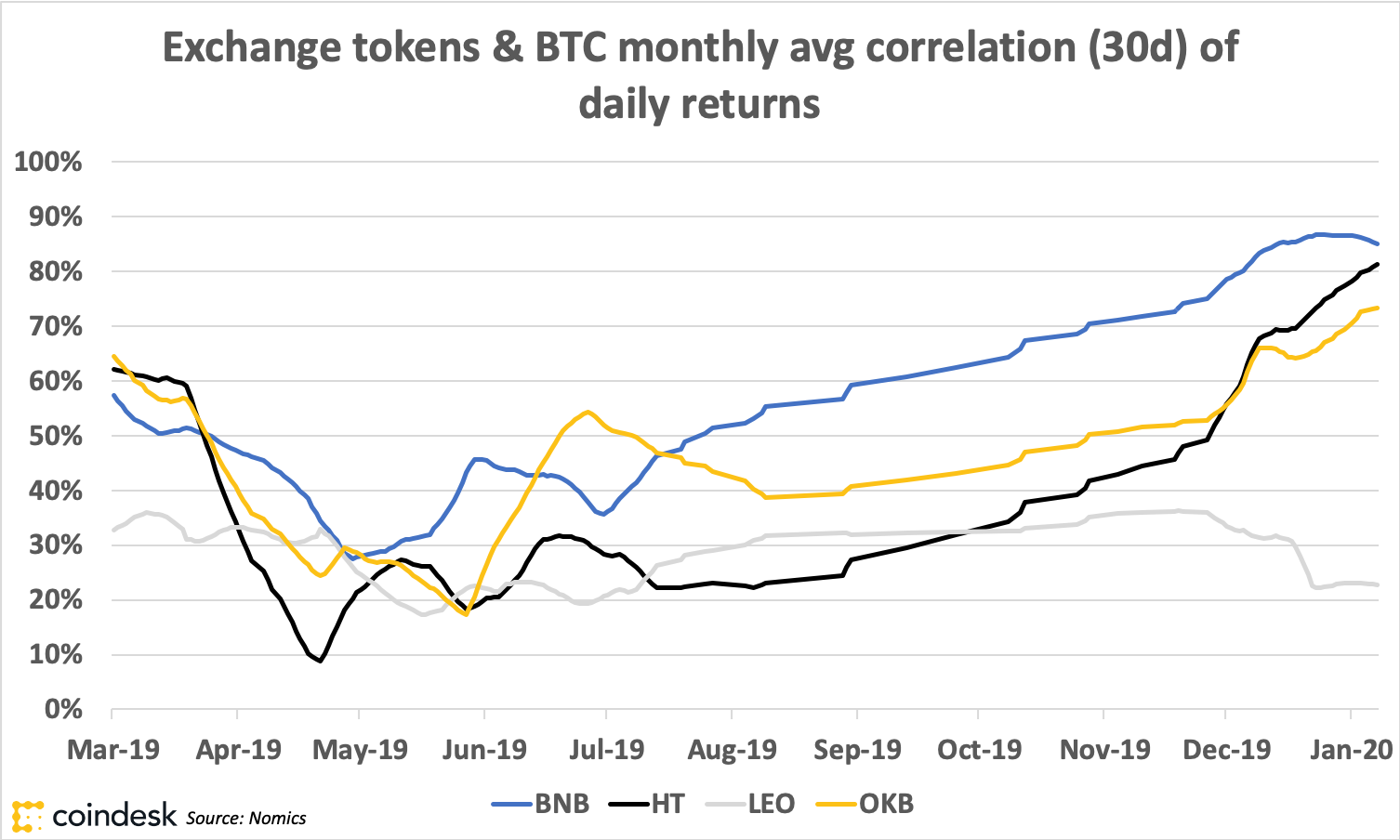

At the same time as a extra normal metric, offering an indicator of the broad demand for crypto property as a speculative funding, change tokens are a weak sign. Or, no less than, they’re no higher than the worth of bitcoin. Concurrently their costs have drifted from the reported quantity of their guardian exchanges, change tokens’ day by day returns have hewed extra carefully to these of bitcoin itself.

It has been 11 years since bitcoin was operational and you may make a case that hypothesis is the best-proven consumer narrative for your complete asset class. And it’s a actual use: not everybody on the earth has entry to unstable property (and for some, maybe no asset is unstable sufficient). For now, change tokens seem like simply one other taste of that volatility. Their worth actions do not but help considering of change tokens as a significant innovation in use or possession.

Disclosure Learn Extra

The chief in blockchain information, CoinDesk is a media outlet that strives for the very best journalistic requirements and abides by a strict set of editorial policies. CoinDesk is an impartial working subsidiary of Digital Forex Group, which invests in cryptocurrencies and blockchain startups.