Coinbase’s former prime authorized advisor offered over $Four million in inventory choices when he left to take the helm at the united statesgovern

Coinbase’s former prime authorized advisor offered over $Four million in inventory choices when he left to take the helm at the united statesgovernment’s banking supervisor.

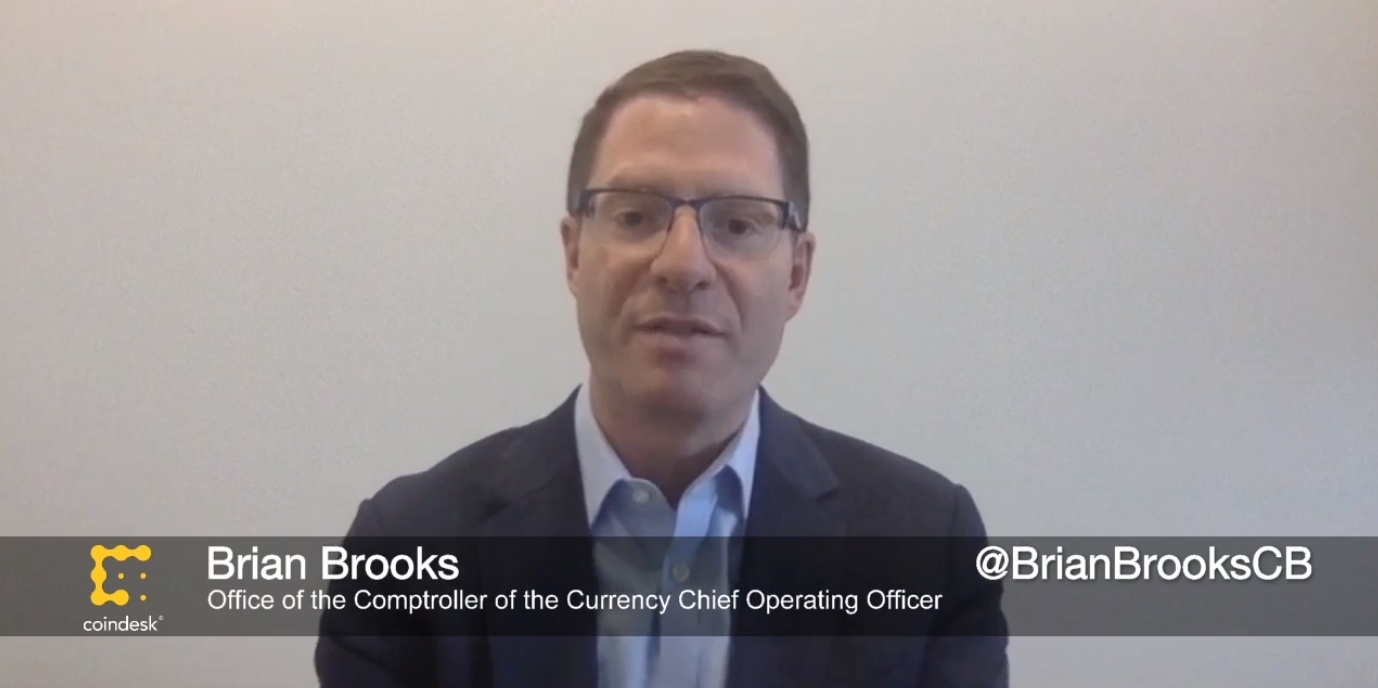

Brian Brooks, who was the cryptocurrency trade’s chief authorized officer from late 2018 till final month, offered his inventory choices to grow to be interim head on the Workplace of the Comptroller of the Foreign money (OCC) – a 3,600-person bureau within the U.S. Treasury Division.

Monetary disclosures seen by Bloomberg present Brooks offered $4.6 million inventory choices in Coinbase, earned on prime of a $1.Four million wage, to take up his new position as appearing comptroller – a place that earns lower than $300,000 a yr.

Brooks had joined the OCC again in March as chief working officer and first deputy controller, however assumed the place of appearing comptroller following the sudden departure of his predecessor, Joseph Otting, midway by means of a five-year time period, in Might.

Brooks was confirmed as appearing comptroller on Might 29.

The OCC’s main position is to take care of the integrity of the U.S. banking system, encourage better competitors and innovation in addition to making certain full regulatory compliance.

Previously, the OCC has been accused of changing into too cozy with the monetary establishments it’s supposed to look at over. In late 2017, in his second week within the job, Otting scrapped longstanding plans to maneuver a whole lot of OCC workers out of the Manhattan places of work of JPMorgan, Citigroup and different large-scale lenders. On the time, he stated the transfer was “not sensible.”

In his inaugural assertion, Brooks stated he deliberate to foster innovation within the banking sector: “We must always assist banks’ use of latest know-how, merchandise, and fashions that safely and pretty speed up the speed of cash, create better monetary inclusion, and empower shoppers and companies with extra management over their monetary affairs.”

In an interview with CoinDesk, Brooks went additional: “My job right here is to not shield incumbents, and it’s to not protect the established order … The job I’ve is to make it possible for the financial institution constitution’s versatile sufficient to take care of a protected, sound, sturdy American economic system and the form of banking needs to be versatile to accommodate.”

As he’s solely appearing comptroller, Brooks doesn’t but face the identical ethics restrictions he would if he led the regulator completely. Nonetheless, he has assured the OCC’s ethics division he’ll steer clear of any investments that would current any battle of curiosity, which embody tech companies comparable to Amazon and Coinbase.

In a letter, Sunday, U.S. Senator and former presidential candidate Elizabeth Warren urged Brooks to undo among the actions from the earlier OCC administration which, she stated, had been “tainted by Comptroller Otting’s personal conflicts of curiosity.”

The chief in blockchain information, CoinDesk is a media outlet that strives for the best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an unbiased working subsidiary of Digital Foreign money Group, which invests in cryptocurrencies and blockchain startups.