It has been over 10 years because the creation of cryptocurrencies, and whereas clear narratives have emerged to justify their existence, none are

It has been over 10 years because the creation of cryptocurrencies, and whereas clear narratives have emerged to justify their existence, none are decisively supported by knowledge.

For instance, charts counsel bitcoin’s use case as a retailer of worth is taking maintain amongst some new traders, who’ve been proven to carry the asset by way of value run-ups. Nevertheless, different metrics similar to bitcoin’s correlation to gold counsel that, throughout your complete physique of bitcoin traders, most are utilizing the asset as one thing far totally different from “digital gold.”

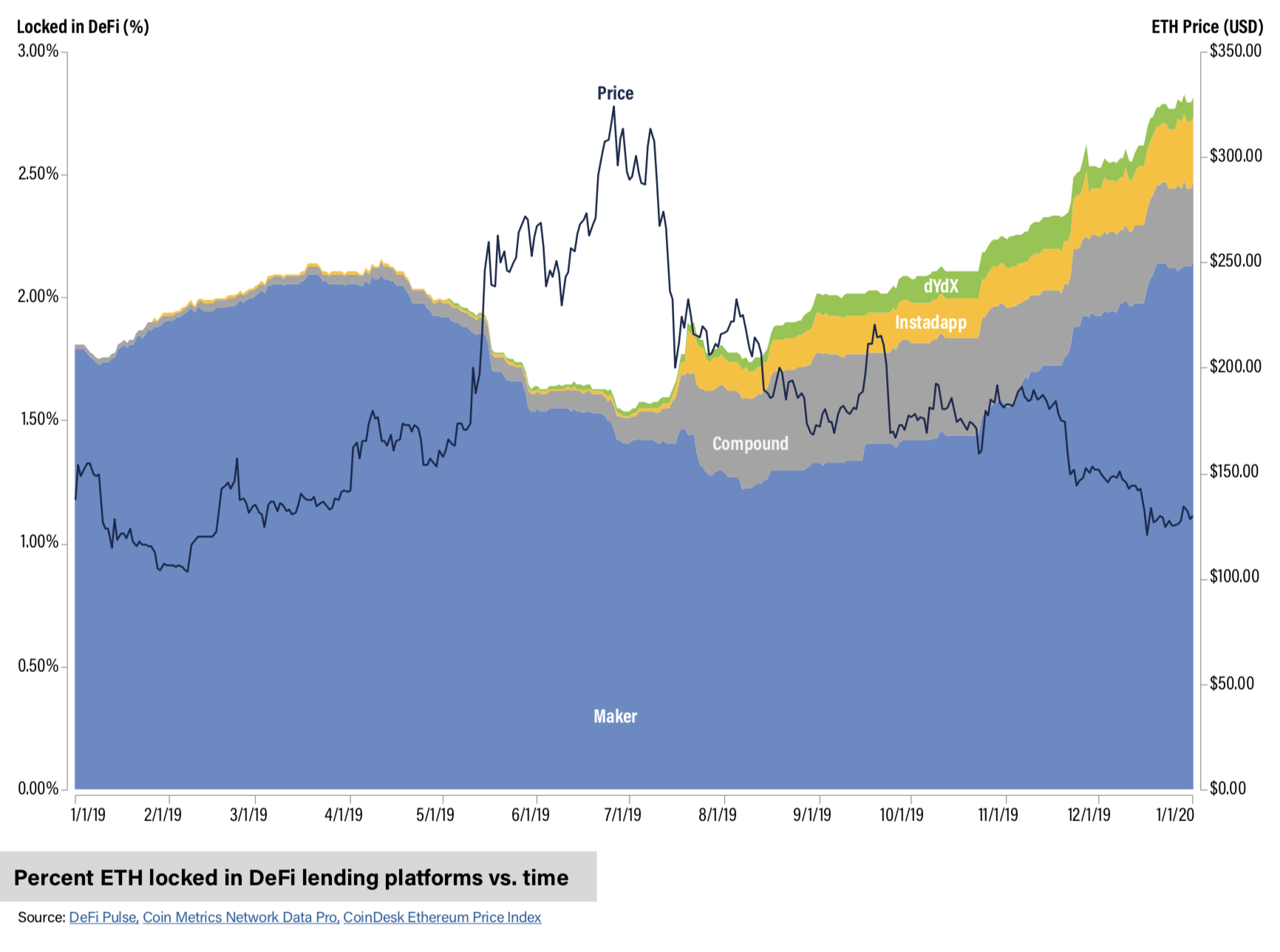

On ethereum, DeFi has made spectacular good points, however the form of that line and a broader decline in consumer numbers counsel that the “internet 3.0” narrative remains to be in its infancy.

Launched as we speak, the CoinDesk Quarterly Review surfaces the important thing knowledge, traits and occasions shaping crypto markets, in a 45-slide presentation format. It evaluates three totally different use instances for crypto throughout greater than 25 totally different knowledge units. The outcomes of this evaluation counsel a dominant narrative for bitcoin and various cryptocurrencies has but to emerge.

Readers of this report are launched to key metrics for monitoring shifts in investor curiosity and international utilization of cryptocurrencies. These embrace bitcoin’s “whale” inhabitants, UTXO age distribution, trade volumes and extra.

The info-driven takeaways embrace:

1. Not everybody who stood to revenue, offered.

Holders of bitcoin who final transacted within the second half of 2017 held by way of the tip of 2019 regardless of rises in market value that may have made it worthwhile to promote. This means there may be investor sentiment for bitcoin as a retailer of worth somewhat than as a speculative asset. The bump in bitcoin holdings that final moved in late 2018 represents a motion of belongings right into a safer type of storage by cryptocurrency trade Coinbase in December 2018.

Coinbase’s bitcoin-fiat markets, among the many world’s hottest for purchases of bitcoin in USD, GBP and EUR, have stalled since 2018. In keeping with knowledge from Nomics, bitcoin-fiat quantity has dropped from an all-time excessive of $46.54 million in 2018 to $44.92 million in 2019. This market is primarily utilized by traders who view bitcoin instead retailer of worth from conventional foreign money, and could be considered a barometer for buy-and-hold sentiment.

2. Bitcoin ‘whale’ inhabitants stays wholesome.

By the tip of 2019, there have been 2,100 bitcoin addresses holding extra $8.5 million-worth of BTC every. The expansion in these kinds of addresses, additionally known as bitcoin “whales,” is a tough indicator of enormous investor participation in cryptocurrencies. Since 2018, the bitcoin whale inhabitants has been multiplying at charges not seen because the early 2000’s when bitcoin was buying and selling beneath $100 or 1/85th of its present market value.

Off-chain exercise on regulated cryptocurrency exchanges within the U.S. doesn’t present related indicators of elevated massive investor participation in cryptocurrencies. Cryptocurrency knowledge supplier Skew reported a decline in quantity for each the CME and Bakkt’s bitcoin futures open curiosity markets in 2019. These markets, not like that of different well-liked cryptocurrency exchanges similar to Coinbase and Binance, are designed to supply institutional traders regulated devices for publicity on bitcoin. Institutional participation in cryptocurrencies could also be lagging on account of persisting imbalances within the underlying liquidity of those belongings throughout varied exchanges.

3. DeFi blooms in winter.

One of many breakout successes of 2019 was decentralized finance (DeFi) purposes. Collectively, these decentralized apps (dapps) managed over $680 million-worth of cryptocurrencies by the tip of This fall, in response to cryptocurrency knowledge supplier DeFi Pulse. the preferred sub-category of DeFi, cryptocurrency lending, consumer traction on ethereum continued to climb even when market value for ETH began to say no.

In different dapp classes similar to gaming and playing, the variety of purposes and customers decreased in 2019. Cryptocurrency knowledge supplier DappRadar stories fewer dapps and dapp customers in This fall 2019 than Q1. “Typically, we’re seeing an increase within the high quality of dapps and over time which means fewer dapps launched and fewer dapps attracting a big viewers,” mentioned Jon Jordan, communications director of DappRadar. It might appear exterior of the DeFi increase on the ethereum blockchain, different dapp platforms and use instances are struggling to develop.

For extra charts and evaluation, download the full CoinDesk Quarterly Review.

Disclosure Learn Extra

The chief in blockchain information, CoinDesk is a media outlet that strives for the best journalistic requirements and abides by a strict set of editorial policies. CoinDesk is an unbiased working subsidiary of Digital Foreign money Group, which invests in cryptocurrencies and blockchain startups.