A key measure of competitors amongst Bitcoin miners simply dropped by 15.95 % – the second-largest decline within the community's historical past.T

A key measure of competitors amongst Bitcoin miners simply dropped by 15.95 % – the second-largest decline within the community’s historical past.

The drop in so-called mining problem indicators some miners have bowed out of the continued race to resolve math issues to win freshly minted bitcoin, as a decline within the cryptocurrency’s worth has made this exercise much less worthwhile. That mentioned, the drop might work in favor for many who have chosen to remain within the recreation as much less competitors means particular person miners would acquire a much bigger lower in Bitcoin’s each day mining output.

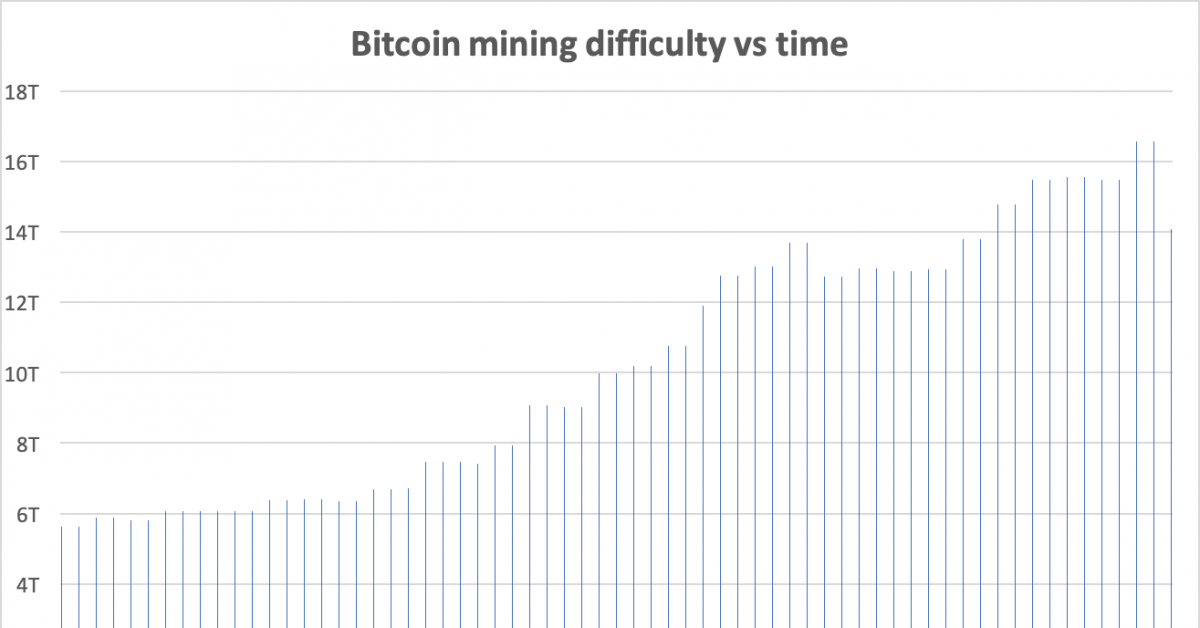

The world’s largest blockchain community by market capitalization adjusted its mining problem round 3:00 UTC on March 26 to 13.91 trillion (T), down from 16.55 T within the earlier cycle recorded on March 9. Two weeks in the past, bitcoin suffered its worst sell-off in seven years, and it has solely partially recovered since.

Mining requires highly effective, specialised computer systems that devour copious quantities of electrical energy, and these companies usually pay these hefty payments by promoting or borrowing towards their bitcoin.

The value drop has erased all beneficial properties in Bitcoin’s computing energy from the final three months, pushing it again to the extent seen round Dec. 20. The scenario was weighing particularly on mining operators which were working with older gear equivalent to Bitmain’s AntMiner S9 and different equal fashions.

The third-biggest drop in Bitcoin mining problem was 15.13 %, recorded in December 2018 amid a worth crash on the time. The biggest problem proportion drop in Bitcoin historical past dates again to October 2011.

Bitcoin’s mining problem is programmed to regulate itself each 2,016 blocks – which usually takes about 14 days – with a view to hold the typical block manufacturing interval at about 10 minutes.

When a large quantity of computing energy on the community has been switched off throughout a 14-day cycle, it will increase the time for remaining miners to provide the two,016 blocks. As such, the bitcoin community would make it more easy to mine within the subsequent cycle.

Equally, if a major quantity of processing energy has plugged into the community in any cycle, shortening the typical block manufacturing interval, the community will enhance its problem within the subsequent cycle. Consequently, particular person miners would generate much less bitcoin since competitors has intensified.

See additionally: How Bitcoin Mining Works

Unhealthy timing

What has worsened the scenario for mining operators within the final 17 days is that mining problem had reached an all-time excessive on March 9 – just some days earlier than the March 12 worth crash – and but nonetheless greater than two weeks away earlier than it might modify itself.

The latest worth plunge, coupled with document mining competitors on the time, had made greater than two dozen outdated bitcoin mining fashions unable to generate each day income previously two weeks, based on knowledge from mining pool f2pool, assuming electrical energy price is at a mean $0.05 per kilowatt-hour.

The whole common computing energy generated by all of the mining gear on the bitcoin community over the previous two weeks has additionally declined from 118 exahashes per second (EH/s) in early March to now about 94 EH/s.

Chris Zhu, co-founder and COO of Chinese language mining pool PoolIn mentioned on March 12, following the worth plunge, that he anticipated the community’s hash charge to drop by 20-30 % within the subsequent weeks, primarily based on the hash charge decline on a number of main mining swimming pools on the time.

And that has led to the rise of the typical block manufacturing interval to just about 12 minutes, subsequently prolonging the adjustment interval to 17 days, that means incumbent miner operators needed to wait three extra days than normal earlier than they may mine extra bitcoin whereas nonetheless having to pay electrical energy prices.

That mentioned, with the numerous mining problem drop within the present cycle and bitcoin’s worth bouncing again above $6,600, older mining gear like Bitmain’s AntMiner S9 is ready to deliver modest each day income once more, based on PoolIn’s knowledge.

In the meantime, the newest and strongest miners delivered by Bitmain, MicroBT and Canaan since late 2019 proceed to generate income as they boast a better mining effectivity.

All the three main mining gear producers have additionally been racing to ship much more top-of-the-line mining machines within the coming months as bitcoin’s halving occasion approaches, which is able to scale back the community’s mining rewards per block from 12.5 to six.25 bitcoin.

See additionally: Bitcoin Halving, Defined

Disclosure Learn Extra

The chief in blockchain information, CoinDesk is a media outlet that strives for the very best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an impartial working subsidiary of Digital Forex Group, which invests in cryptocurrencies and blockchain startups.