Cybercriminals are taking full benefit of the COVID-19 pandemic, which has pressured life right into a digital realm, by leveraging elevated concer

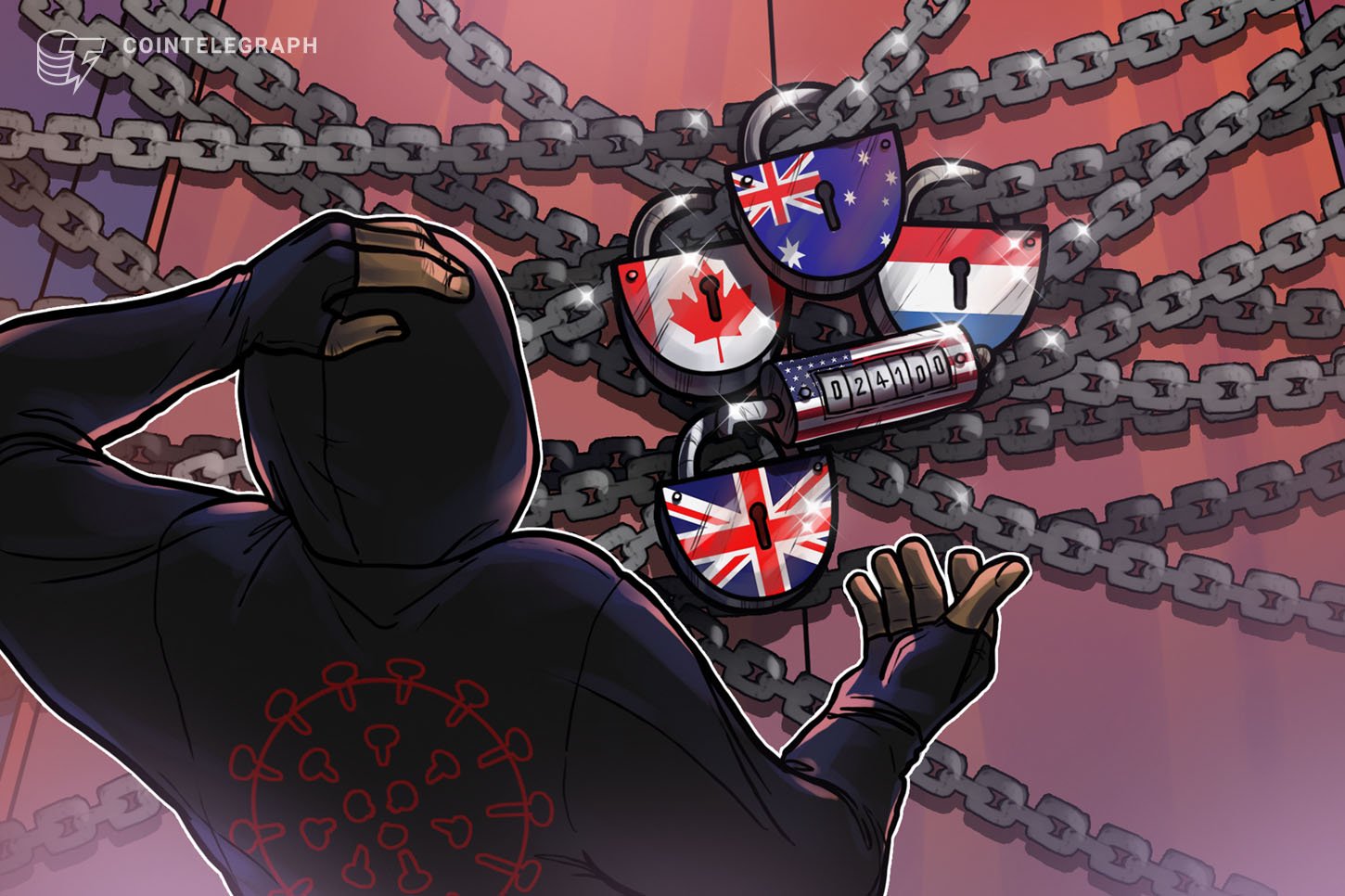

Cybercriminals are taking full benefit of the COVID-19 pandemic, which has pressured life right into a digital realm, by leveraging elevated concern and uncertainty to steal cash and launder it by the advanced cryptocurrency ecosystem. Accordingly, the Joint Chiefs of World Tax Enforcement, often called the J5, has ramped up its efforts by arresting cybercriminals suspected of laundering tens of millions of {dollars} in cryptocurrency, based on a J5 joint assertion. The J5 additionally has been updating its Anti-Cash Laundering and Combatting the Financing of Terrorism legal guidelines for cryptocurrencies in accordance with Monetary Motion Process Power requirements, with Australian researchers having linked half of all yearly transactions within the $250 billion Bitcoin (BTC) market to criminality, based on a brand new report.

Associated: Petro Couldn’t Save the Cartel of the Suns Conspiracy From the Sting of Sanctions

The J5 is a multiagency coalition that features authorities companies from Australia, Canada, the Netherlands, the UK and the US. It was shaped in mid-2018 by the U.S. Inside Income Service in response to a name to motion from the Group for Financial Cooperation and Improvement for nations to do extra to deal with the enablers of cross-border tax and associated crime by these people who’ve entry to sources {and professional} enablers in addition to by organized crime teams.

Associated: US Takes Regulatory Steps for Blockchain Know-how Adoption

The J5’s first globally coordinated day of enforcement motion in opposition to suspected offshore tax evasion and different associated crimes was undertaken originally of this 12 months. The trouble concerned the sharing of proof and intelligence and knowledge assortment actions equivalent to search warrants, interviews and subpoenas.

Associated: Upbeat Dutch Blockchain and Crypto Motion Agenda

Sources: finder.com.au, abc.web.au, therift.eu, europarl.europa.eu, fintrac-canafe.gc.ca

*Efficient June 1

Associated: How Crypto Is Taxed within the US: A Taxpayer’s Dilemma

The brand new Canadian cryptocurrency AML/CTF legal guidelines

Canada’s watchdog for monetary crimes, the Monetary Transactions and Experiences Evaluation Middle of Canada, will start regulating cryptocurrency corporations as of June 1.

Associated: Why Canada has Emerged as a Main Blockchain and Crypto Nation

Such corporations with $10,000 Canadian {dollars} in crypto actions are required to register as a cash service enterprise and are additionally required to doc the identify, beginning date, tackle, telephone quantity and sort of crypto transaction for any transaction over C$1,000. Extra particulars could be required in case of transactions of C$10,000 and larger.

Rod Hsu, the chief working officer of Interlapse Applied sciences Corp., said in a personal interview:

“Constructing shopper belief takes time and this area has had its fair proportion of unfavorable press through the years. Whereas regulation is adapting, by placing preliminary frameworks in place for companies to function inside, this can assist present customers with a stage of consolation and safety. Finally, customers wish to know they’re protected and by having pointers in place, companies may be held accountable for his or her actions. Whereas that is one side of constructing shopper belief, it is a very important one given the character of Bitcoin.”

He additionally added that with regulation “you will notice smaller operators fall off as a result of regulatory necessities and operational overhead. This can result in consolidation of digital forex operators that may operate inside these regulatory frameworks. With these necessities as a prerequisite, this may assist to filter out ‘fly by night time’ operators.” Hsu thinks regulation is an effective factor for constructing shopper belief and inspiring mass adoption of Bitcoin.

The views, ideas and opinions expressed listed here are the writer’s alone and don’t essentially mirror or signify the views and opinions of Cointelegraph.

Selva Ozelli, Esq., CPA, is a global tax legal professional and licensed public accountant who ceaselessly writes about tax, authorized and accounting points for Tax Notes, Bloomberg BNA, different publications and the OECD.