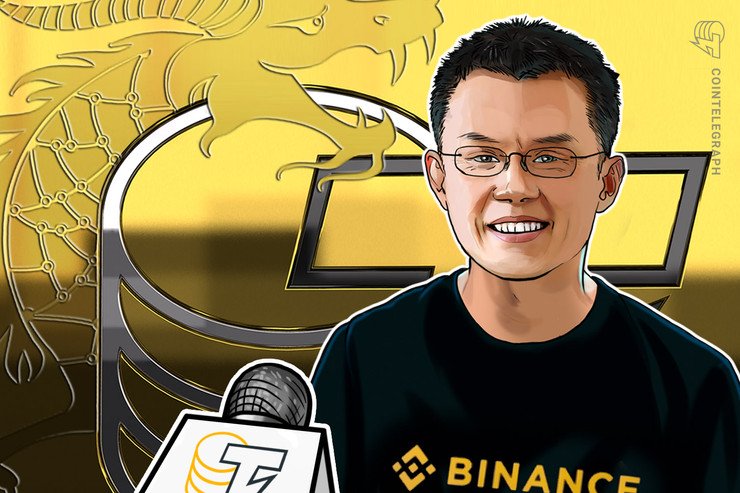

Changpeng Zhao, often called CZ — the person behind Binance, one of many largest cryptocurrency exchanges on this planet — took half in Cointelegr

Changpeng Zhao, often called CZ — the person behind Binance, one of many largest cryptocurrency exchanges on this planet — took half in Cointelegraph China HUB, an internet interview column began by Cointelegraph China.

Cointelegraph:The markets are at the moment seeing excessive volatility, which has challenged Bitcoin’s function as a protected haven and sparked a disaster of religion within the business. However you tweeted: ”Nonetheless frightened about #BTC going to 0? Don’t! As long as I’ve a penny left, it will not occur.” What three phrases would you utilize to explain 2020?

Changpeng Zhao: It’s laborious to outline the yr 2020 with three phrases. If I need to choose three phrases, I’d say: problem, alternative and decentralization. The yr forward will probably be a mixture of challenges and alternatives because the business takes one step additional towards the way forward for decentralization.

The worldwide outbreak of coronavirus does have an effect on sure industries and has brought on many nations to lock down. Industries like touring, tourism and accommodations are tremendously affected within the quick time period. Nonetheless, it additionally creates alternatives for industries like medication, well being care, on-line schooling, and many others. Amongst market actions, nice consideration has been given to the circuit breaker incidents of america inventory market. As a part of the worldwide monetary market, the crypto market has additionally been unstable for the previous couple of days.

There are lots of people asking if Bitcoin is a protected haven, and we see a variety of confusion across the matter. Once we speak about protected havens or the storage of worth of a sure asset, we should always take the context into consideration. There are a variety of elements affecting the worth of an asset, and it additionally varies throughout totally different instances. We can’t say an asset is at all times a protected haven. Bitcoin’s worth drop will not be the results of a single issue. We have to take into account the general crypto market and even the macro financial circumstances. There are totally different dynamics in play.

Within the crypto market, we do have diehard OGs who don’t even maintain fiat, middleman customers who’ve 20%–80% of their wealth in crypto and newcomers who’ve lower than 20% — and even 1% — of their wealth in crypto. Completely different customers will make totally different selections. The inexperienced persons who’ve entered the area lower than 5 months in the past are inclined to promote crypto in concern, uncertainty or doubt as a result of they don’t trust or a deep understanding of crypto.

Some individuals do want cash to maintain life, like paying lease within the context of a worldwide monetary turmoil. In addition they determine to unload. Consequently, the worth has been introduced down. Even when the diehard OGs maintain crypto and maintain the worth as much as some stage, there are nonetheless too many individuals impacting the market.

In comparison with the general monetary market, the market capitalization of the crypto market is way smaller, possibly round 1/1000 of that of the general monetary market. It’s inevitable that the crypto market will probably be affected by actions within the international monetary market. When the monetary market has misplaced trillions of {dollars}, it is going to have an effect on the crypto market. If fiat crashes, the crypto market can’t resolve the problem. However so far as Bitcoin is anxious, it has restricted provide, which stays unchangeable in any situation. So, I’d say Bitcoin is a comparatively protected haven.

But when we have a look at this from the opposite manner, we are going to discover it’s alternative to weed out the low-quality initiatives and continue to grow the nice ones. There isn’t a shortcut for any business to prosper. We’ve had excellent news from the previous two weeks. The Supreme Courtroom of India overturned the Reserve Financial institution of India’s ban on banks coping with crypto companies. Shortly after that, Korea legalized cryptocurrencies. Loads of regulatory works in varied nations are in progress. I imagine all of those will positively affect the business.

“What’s extra, blockchain is way fairer in fixing the elemental issues of the outdated system, which suggests the fiat-based system. It’s unfair to make use of tax incomes to assist inefficient organizations. The inefficient organizations needs to be left there. If the Federal Reserve prints extra money to carry up the inventory worth, it offers CEOs and establishments an opportunity to money out as an alternative of serving to the retail customers.”

A bailout might resolve the issues briefly, nevertheless it creates long-term issues. In actual fact, if the federal government decides to print extra money, it is going to result in the depreciation of fiat currencies. Then, if the customers have two choices — fiat vs. crypto — how will they select? They may in all probability go for Bitcoin and different crypto, which is a good alternative for the business to scale.

So, to talk of decentralization, we have to see via the floor. Bitcoin is the primary software powered by blockchain expertise, and cryptocurrencies solely signify part of the blockchain. The underlying blockchain expertise is what actually issues to us. The opposite instance is the general public blockchain groups, who work from totally different nations and are versatile within the time of…