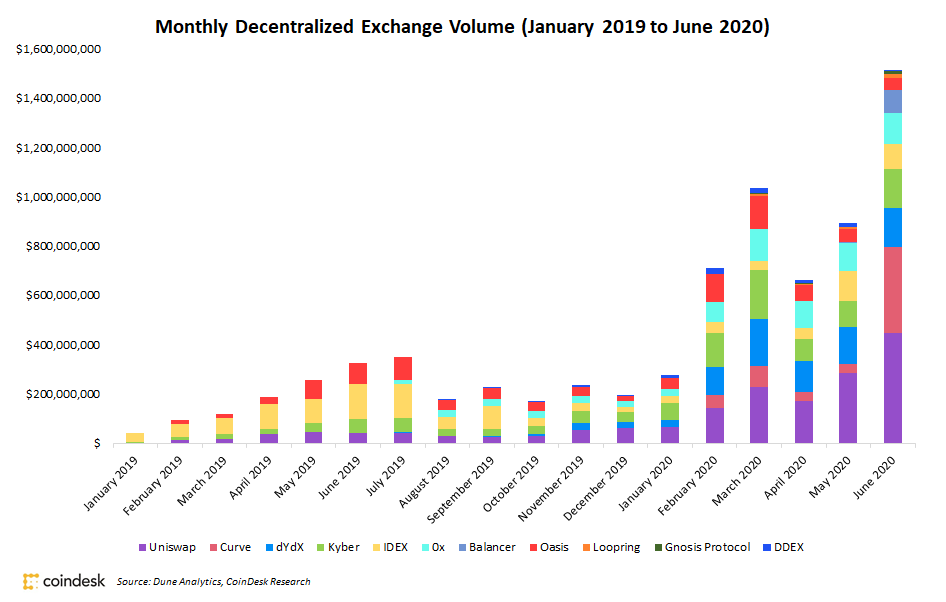

June buying and selling quantity on decentralized exchanges set a report excessive of $1.52 billion, up 70% from Could, in response to information

June buying and selling quantity on decentralized exchanges set a report excessive of $1.52 billion, up 70% from Could, in response to information from Dune Analytics. This double-digit proportion progress is just “the continuation of a pattern courting again to the tip of [2019],” Jack Purdy, decentralized finance analyst at Messari, informed CoinDesk.

Curve and Uniswap management the biggest quantity of traded quantity, recording $350 million and $446 million, respectively, in June. Each protocols are automated market makers that may additionally operate as decentralized exchanges. Balancer, an analogous platform, recorded $93 million in traded quantity, up 2,460% from $3.6 million in Could.

Important progress could be partially attributed to the “proliferation of automated market makers,” in response to Purdy. Because of this, these markets provide better liquidity for “the tail finish of crypto property” and even sometimes much less order slippage than centralized exchanges, Purdy mentioned.

In June, automated market makers grew by greater than 170% whereas pure decentralized alternate platforms grew by solely 10%.

An excessive amount of progress too shortly could possibly be trigger for concern, nevertheless, as decentralized exchanges nonetheless want time for continued growth and stress testing. Current will increase in buying and selling quantity are “beginning to turn into a bit worrisome,” Purdy mentioned, including that an “unnatural rush to deposit property” into these exchanges is fueled, partially, by the “liquidity mining phenomenon.”

Since January, mixture decentralized alternate volumes, together with automated market makers, have greater than quadrupled from $276 million to $1.52 billion.

Though well-liked decentralized finance protocols could also be “extremely audited and deemed secure,” loads of potential assault vectors nonetheless exist, Purdy mentioned. A decentralized liquidity supplier, Balancer, misplaced $500,000 in a classy assault Monday, for instance.

The quantity and sorts of potential assaults solely improve as decentralized finance protocols turn into extra intertwined, Purdy mentioned.

The chief in blockchain information, CoinDesk is a media outlet that strives for the very best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an impartial working subsidiary of Digital Forex Group, which invests in cryptocurrencies and blockchain startups.