It’s costing extra to make use of Ethereum and which may be as a result of extra customers are flocking to the platform than ever earlier than, in

It’s costing extra to make use of Ethereum and which may be as a result of extra customers are flocking to the platform than ever earlier than, in keeping with one key on-chain metric. Analysts say the expansion of each transactions and the fee to course of them is being pushed by a rise in stablecoin utilization and DeFi purposes.

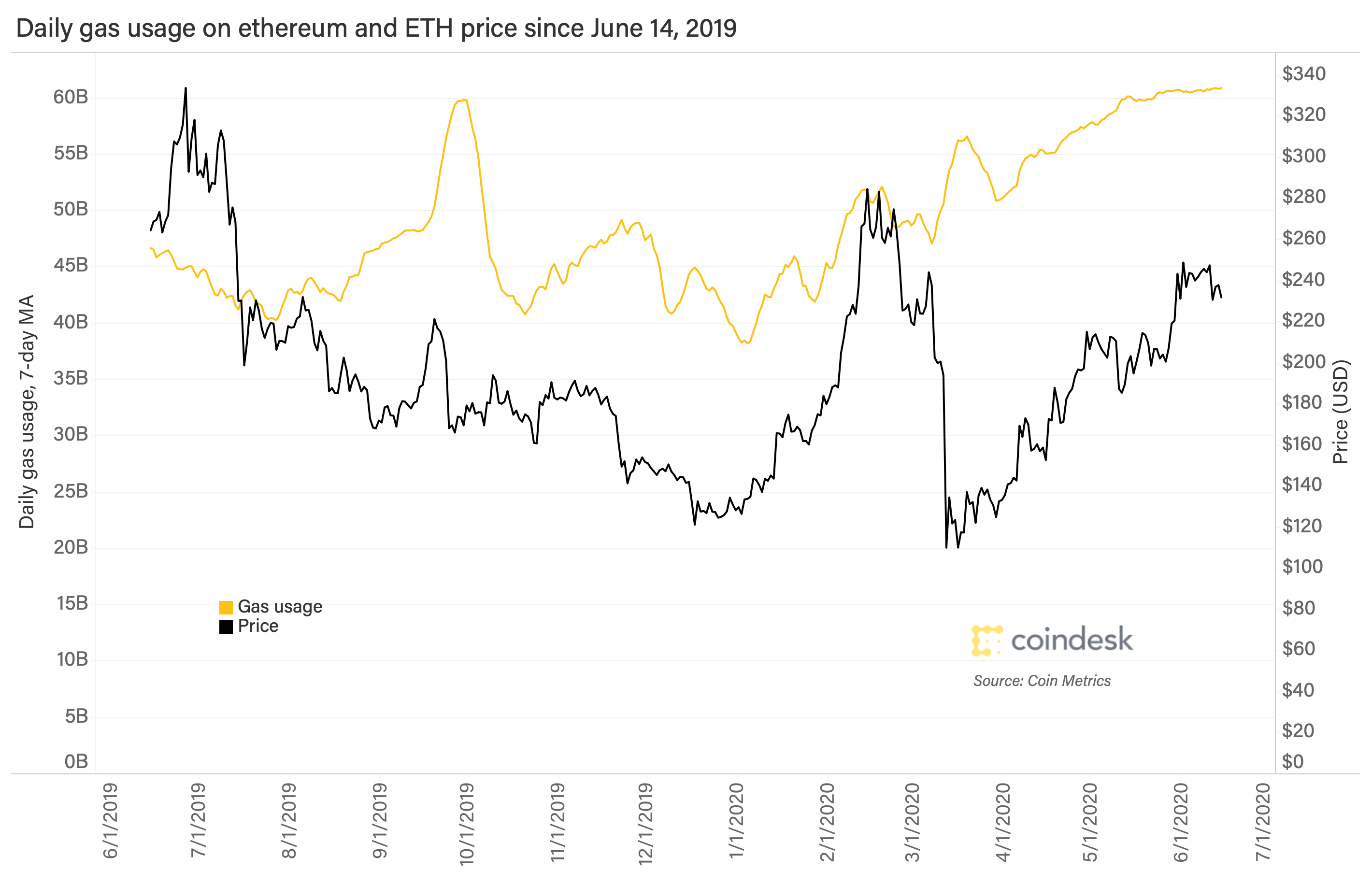

The seven-day shifting common of the whole quantity of “gasoline” utilized in transactions on Ethereum’s blockchain rose to a report excessive of 61.12 billion on Monday, having surpassed the earlier excessive of 60.07 billion reached in September 2019, in keeping with information offered by the blockchain analytics agency CoinMetrics.

Fuel is a token that powers Ethereum’s blockchain. It’s the unit used to calculate the quantity of charges a consumer must pay with the intention to switch good contract information or funds on Ethereum’s blockchain. In the meantime, ether is the reward paid to miners and is equal to the quantity of gasoline wanted to execute a transaction.

Learn extra: Stablecoins Push Ethereum’s Transaction Rely to Highest Since July 2019

“The rise in gasoline utilization signifies a steady development in using Ethereum’s platform, as measured by the variety of transactions, in addition to demand for block area, as measured through gasoline per transaction,” mentioned Wilson Withiam, analysis analyst at information supplier Messari.

Ethereum’s transaction rely not too long ago hit a 27-month excessive of 938,265 and was up almost 45% from lows seen in January as of Monday, in keeping with Glassnode.

Tether and DeFi gas development

“As each tether and Decentralized Finance (DeFi) on Ethereum have exhibited phenomenal development, Ethereum gasoline utilization has skyrocketed to all-time highs,” Kyle Davies, co-founder and chairman at Three Arrows Capital.

Certainly, using the U.S. dollar-backed stablecoin tether (USDT) on Ethereum has elevated sharply this 12 months.

The variety of each day USDT transactions on Ethereum have surged by 450% on a year-to-date foundation, as per CoinMetrics.

Tether has been issued on Ethereum since November 2017 and the platform now holds 65% of tether’s whole provide. “Virtually $6 billion of USDT’s whole provide is now on Ethereum, up from $1.5 billion at first of 2020,” Bendik Norheim Schei, analysis analyst at Arcane Analysis, advised CoinDesk.

Additional, tether has 10 occasions extra transactions on Ethereum than some other ERC-20 token. In the meantime, as per Ether Fuel Station, tether transactions have paid over $2.5 million price of charges on Ethereum within the final 30 days. That makes USDT the most important “gasoline payer” on Ethereum.

Learn extra: First Mover: Cardano’s No Ethereum Killer But, however It’s Profitable in Crypto Markets

Tether and stablecoins generally have witnessed phenomenal development this 12 months amid the coronavirus-induced volatility in conventional markets. Complete provide of all stablecoins has surpassed the $11 billion mark this week, doubling its worth since February, in keeping with Messari information.

Even so, the rise within the gasoline utilization just isn’t solely because of tether. Ethereum-based Decentralized Exchanges (DEXs) comparable to Kyber, Uniswap and IDEX have all skilled stable development in transaction volumes this 12 months.

Kyber Community registered a transaction quantity of $609 million within the first 5 months of this 12 months. That’s 1.5 occasions greater than the quantity of $388 million seen in 2019, in keeping with the official weblog.

Community congestion

“One other issue accountable for the rise in gasoline utilization could also be folks gaming the community by paying extra in gasoline charges with the intention to beat different transactions right into a block to realize revenue,” mentioned Connor Abendschein, analyst at Digital Property Knowledge.

Miners prioritize transactions providing larger charges when the community faces congestion; that’s, the variety of transactions ready to get confirmed by miners rises to excessive ranges. That forces different customers to supply larger charges.

Ethereum’s community has been going through congestion since early March, presumably because of elevated value volatility and the surge in tether transactions. As of June 8, there have been 19,922,385 unconfirmed transactions – up 225% from the March 1 tally of 611,872, in keeping with blockchain information firm Amberdata.

Validating the argument that community congestion might have led to elevated gasoline utilization is the truth that gasoline charges generally have been larger this 12 months. “Fuel per transaction not too long ago reached its highest degree since early 2018,” Messari’s Withiam famous.

Learn extra: ConsenSys Spins Up Staking Service in Anticipation of Ethereum 2.0

Nonetheless, the seven-day common of the each day Ethereum transaction rely stood at 886,882 on Monday – properly in need of the report excessive of 1,244,335 reached in January 2018.

Additionally, extra transactions might be coming from complicated DeFi merchandise, which contain larger computational bills and due to this fact require larger gasoline funds. “Individuals are both paying dearer computations or willingly paying extra to beat different transactions,” mentioned Abendschein.

Trying ahead, the utilization is prone to proceed rising…