Ethereum Traditional needs to play within the decentralized finance (DeFi) area of the blockchain it contentiously forked from in 2016.Introduced W

Ethereum Traditional needs to play within the decentralized finance (DeFi) area of the blockchain it contentiously forked from in 2016.

Introduced Wednesday, Ethereum Traditional Labs, the ETC blockchain’s greatest supporter, launched Wrapped ETC (WETC) – an ERC-20 token that lets ETC holders take part in Ethereum-based DeFi providers like buying and selling, lending and borrowing.

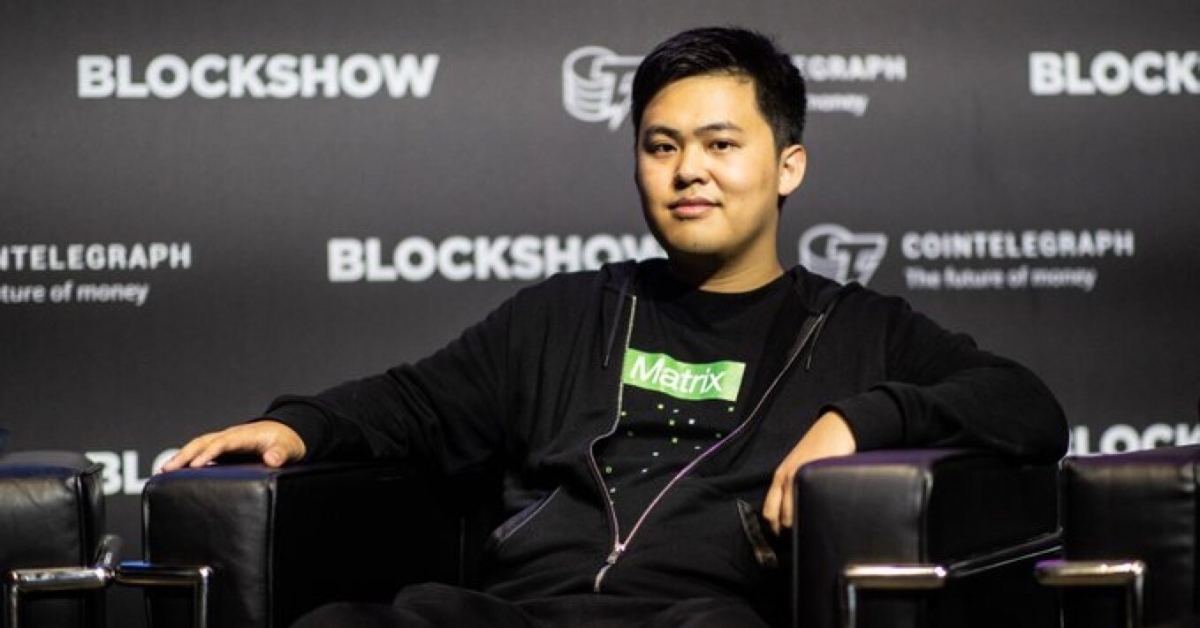

“We wished to ensure ETC might go to a unique ecosystem and use totally different functions on prime of that ecosystem,” mentioned James Wo, founder and chairman of ETC Labs. “I count on at the least 10% of ETC holders will wish to take part and use WETC.”

Wrapping is the act of taking a blockchain asset like bitcoin and issuing an equal illustration on one other blockchain similar to Ethereum. Wrapped Bitcoin (WBTC), as an example, is an ERC-20 token that’s backed on a 1:1 foundation with bitcoin held in reserve by certified custodian BitGo Belief. Extra just lately, Zcash introduced a wrapped, DeFi-ready model of the privateness coin.

Wo of ETC Labs identified that WBTC tokens are backed and assured by BitGo, a centralized entity. “What we’ve achieved right here is use a sensible contract so individuals can simply alternate ETC for WETC utilizing a sensible contract which is completely decentralized,” he mentioned.

WETC could be transferred or saved in any ERC-20-compatible pockets or storage mechanism, mentioned Wo. Beneath the hood, ChainBridge, a decentralized software that interfaces with each the Ethereum Traditional blockchain and the Ethereum mainnet, permits ETC tokens to be transferred to the Ethereum mainnet by way of the bridge. Then a specified quantity of ETC is locked in a sensible contract and a corresponding quantity of WETC is minted on Ethereum.

The discharge of WETC follows the launch of a DAI-ETC bridge, mentioned Wo, which permits ETC customers to achieve entry to MakerDAO’s dai, a preferred stablecoin in DeFi.

Ethereum Traditional has one thing of a checkered historical past, starting with its emergence in July 2016 from the Ethereum fork that adopted the notorious DAO hack.

ETC, which trades at about $5 in the present day, reached an all time excessive of $47 again in December 2017, thanks in no small half to the enthusiastic assist from crypto investor Barry Silbert, CEO of Digital Foreign money Group, which can be the proprietor of CoinDesk. For context, Ethereum’s native asset, ether (ETH), is now buying and selling at almost $500.

The ETC blockchain was subjected to a collection of 51% assaults in August. Wo agreed the emergence of WETC will assist rebuild ETC’s popularity.

“I’ll say that proper now ETC community could be very safe, so you may belief it,” he mentioned. “We’re additionally immediately constructing functions on prime of the ETC community, in addition to utilizing WETC to undergo the Ethereum community.”

In any case, Wo sees a brilliant future forward as ETC sticks to its proof-of-work (PoW) mining weapons, whereas Ethereum embarks on the tough and prolonged leap to proof-of-stake (PoS).

“Not everybody trusts PoS, some tasks imagine in PoW,” mentioned Wo. “So I feel a few of the ecosystem will in all probability persist with ETC or different PoW variations of a blockchain that may do good contracts.”