Slightly-known digital forex fund heavy on math and statistics is popping a gentle revenue beneath a lead dealer who as soon as oversaw a significa

Slightly-known digital forex fund heavy on math and statistics is popping a gentle revenue beneath a lead dealer who as soon as oversaw a significant cryptocurrency alternate.

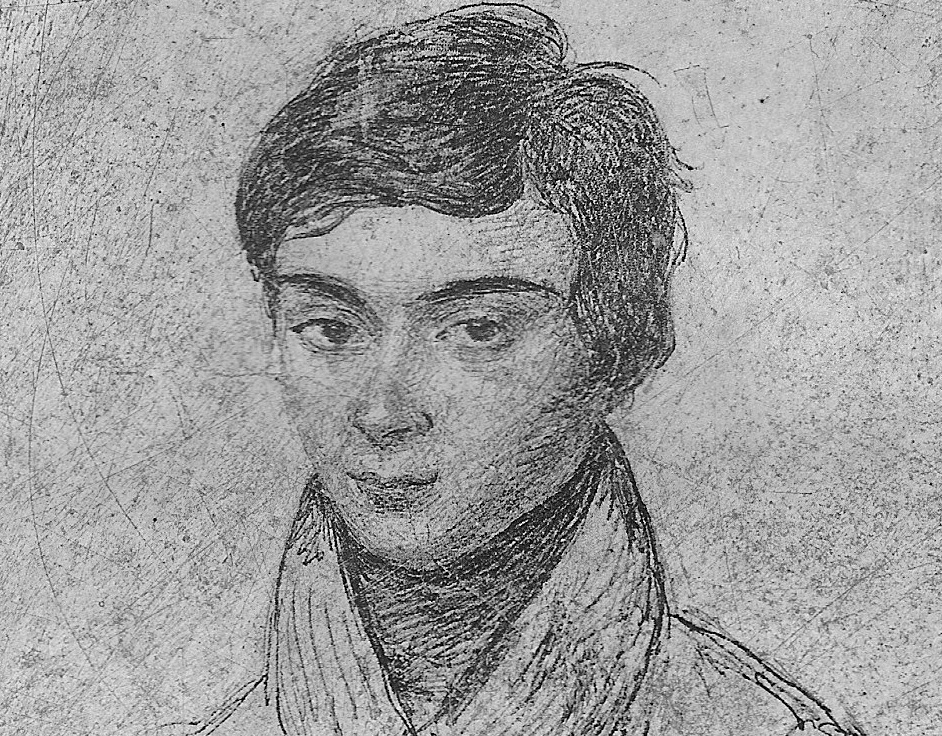

Galois Capital, a San Francisco cryptocurrency hedge fund that launched in January 2018, mentioned in an investor letter and monetary filings that it elevated its holdings from $10 million to $23 million in two years with high-frequency buying and selling and funds from new traders lured by returns. A quantitative fund supervisor, Galois Capital computationally makes bulk volumes of speedy, exact trades formed by its founder and lead dealer Kevin Zhou, beforehand head of buying and selling at American cryptocurrency alternate Kraken, and a crew of technical expertise.

“Most of us are math, physics or laptop science people,” Zhou informed CoinDesk, including that extremely sought Worldwide Mathematical Olympiad rivals have been sending of their resumes.

Quantitative approaches to buying and selling are wide-ranging. They could embody regression modeling, route and magnitude calculations for value prediction or stochastic processes for volatility modeling and choices pricing, Zhou mentioned. On the know-how aspect, programming interfaces, buying and selling software program and {hardware} gear enabling quick communications and knowledge evaluation with exchanges are used.

Galois Capital constructed a lot of this structure from the bottom up, with customized instruments akin to co-located servers and community adapters, on account of what Zhou cites as a dearth of industrial quality choices for cryptocurrency merchants discovered at Hudson River Buying and selling and Jane Avenue Capital, two of the most important Wall Avenue quantitative buying and selling funds.

Learn extra: Hedge Fund Pioneer Turns Bullish on Bitcoin Amid ‘Unprecedented’ Financial Inflation

General, the quantitative bent remains to be comparatively tame at Galois Capital. For Zhou, refined buying and selling fashions and applied sciences, such because the machine studying software program the fund experimented with and shelved, are typically overkill on this period of cryptocurrency markets.

“What works is lots easier than what would work in conventional markets,” mentioned Zhou. “A few of these fashions that now we have proper now wouldn’t work in conventional markets, in additional mature and extra environment friendly markets.”

Whereas buying and selling is less complicated within the crypto-asset class than in conventional asset lessons, Zhou mentioned, the sphere has gotten extra aggressive since he managed from 2013 to 2017 at Buttercoin, a bygone bitcoin alternate backed by Silicon Valley-located startup incubators Google Ventures and Y Combinator, and from 2015 to 2017 on the buying and selling desk at Kraken.

At Buttercoin, “the sizes of transactions had been lots smaller. The spreads had been lots greater. I keep in mind there have been days the place you had been getting 100 bps [basis points] simply buying and selling $100,000,” mentioned Zhou. “At Kraken, spreads tightened up a bit. It was like 40, 50 bps on $200,000. Now, it’s lots tighter, in all probability one million {dollars} will get 10, 15 bps.” A selection is the distinction between a monetary instrument’s bid and ask value; a “bp” (pronounced “bip”), or a foundation level, displays a 0.01% change in a monetary instrument’s worth.

Contemplating Kraken is valued at $four billion and processes thousands and thousands of {dollars} in cryptocurrency flows every month, Kraken’s buying and selling desk was an all-seeing trying glass into why cryptocurrencies are purchased and bought in a big nook of the market. It gave Zhou a knack for sizing up counterparty motivations with Galois Capital’s programmed trades, the place the opposite buying and selling actor is faceless.

“While you’re market-making with bots on all these completely different exchanges, you don’t truly get matched up with on the opposite aspect,” Zhou mentioned. At Kraken, his buying and selling desk handled miners and traders, up shut and private, who gave context into their market actions. “So simply having the ability to learn Kraken’s e book,” as within the alternate’s document of purchase and sale orders, “is certainly informative.”

Market-making as a “safer” line of enterprise

By way of buying and selling quantity, Galois Capital went from processing $671 million to $1.four billion between 2018 and 2019, the investor letter says. Whereas non-algorithmic trades shrunk from $666 million to $562 million, its algorithmic trades blew up from $5 million to $876 million to enlarge the fund’s share in crypto-asset markets.

Based on Zhou, about 85% of Galois operations are geared in direction of liquidity provision, matching crypto-assets at costs quoted by bidders, much like companies supplied by Genesis Buying and selling, Cumberland DRW and Circle. The opposite 15% of operations had been centered on hedge fund administration of cryptocurrency performs. Galois Capital began with over-the-counter (OTC) buying and selling — guide liquidity provision and Zhou’s specialty at Kraken — and branched out into algorithmic market-making — automated liquidity provision — and discretionary buying and selling.

With market-making, usually you don’t wish to be holding onto threat for that lengthy. What I imply by that’s greater than 30 seconds.

www.coindesk.com