Cryptocurrency markets are sending robust alerts proper now that the improvements coming from fast-emerging applied sciences like decentralized fin

Cryptocurrency markets are sending robust alerts proper now that the improvements coming from fast-emerging applied sciences like decentralized finance, or DeFi, may shake up the worldwide order of banks and cash managers and insurance coverage firms.

A recurring theme at CoinDesk’s “make investments: ethereum financial system” digital convention Wednesday was simply how a lot cash there may be to be made within the fast-growing digital-asset business.

Speak of returns and yields was salted all through the technical discussions of protocols and governance techniques and blockchain arcana like “layer 1” and “layer 2” and “rollups” and “shards.”

Even traditional-market regulators are beginning to acknowledge the expansion prospects that cryptocurrency bulls have been betting on for years.

The technological motion is “clearly revolutionary, and I believe on the finish of the day may result in a large disintermediation of the monetary system and the normal gamers,” Heath Tarbert, chair of the U.S. Commodity Futures Buying and selling Fee, informed CoinDesk Chief Content material Officer Michael Casey. (Hyperlink right here to the video interview.)

DeFi, through which builders are utilizing open-source software program to create semi-automated lending and buying and selling techniques atop blockchain networks, proved its potential in latest months as initiatives like Compound and Uniswap attracted billions of {dollars} of crypto collateral. A collection of “yield farming” initiatives like Yearn.Finance have made it simple to rack up additional token rewards, a method of juicing fixed-income returns in digital-asset markets.

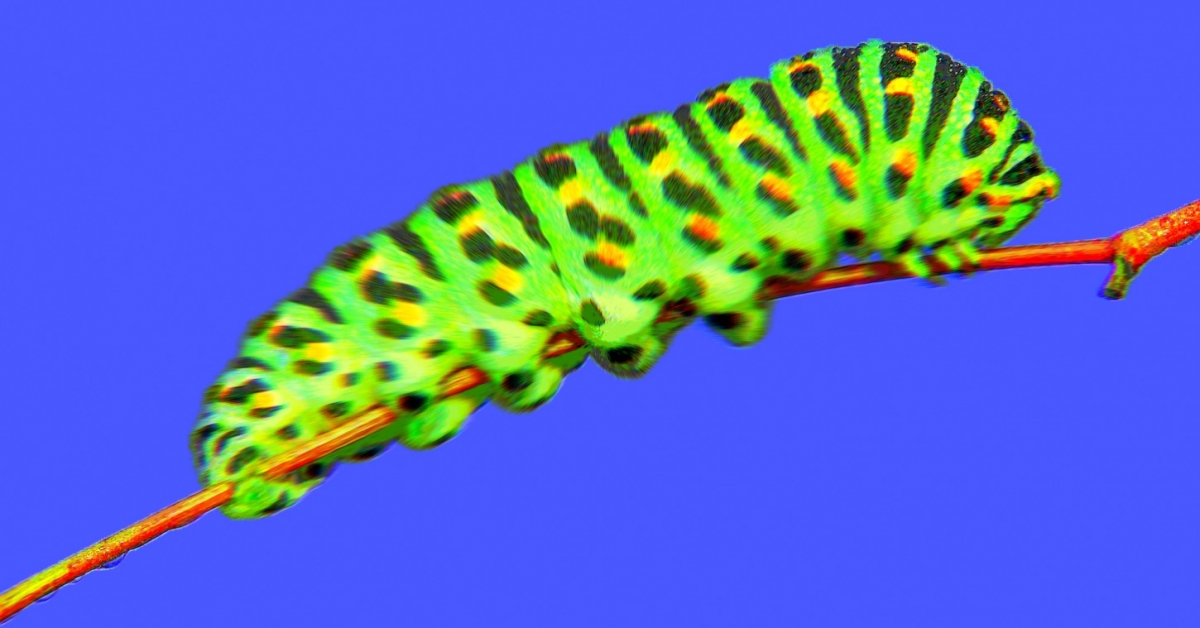

The crypto business seems to have emerged from its larval section into the pupal: The shape is taking form, however coming-of-age challenges are but to be overcome, from reliability to advertising and marketing and naturally scaling to the purpose the place thousands and thousands of customers may be accommodated.

There are steep dangers, as with the previous few months’ flame-outs of DeFi initiatives like SushiSwap, whose founder instantly determined to money out tokens on the high of the market, crashing the market, and Yam, which succumbed to a bug.

“In lots of circumstances you possibly can threat everlasting lack of your capital by taking part in a few of these actions,” Ryan Watkins, a senior analysis analyst at Messari, stated on one of many panels.

And it’s untimely to examine the size of cryptocurrencies to the normal monetary system.

“Immediately, 99.9% of the cash continues to be in fiat,” Binance CEO Changpeng “CZ” Zhao stated in a one-on-one session with journalist Leigh Cuen, through the CoinDesk convention. “We nonetheless want gateways.”

These too are beginning to emerge. Bloq, a blockchain infrastructure agency led by former CNN.com internet developer Jeff Garzik, is rolling out a brand new product that permits customers to earn cash by shopping for custom-made “holding swimming pools” of digital property, CoinDesk’s Jaspreet Kalra reported Wednesday.

“The long run is dynamic portfolios which might be costly to assemble in conventional finance,” stated Tarun Chitra, CEO of Gauntlet, a simulation platform for crypto networks. His Zoom feed was probably the most colourful by far:

One other firm, Blox, plans to assist prospects pool ether (ETH) to get previous a threshold wanted to “stake” on the Ethereum blockchain. Staking is just like holding an interest-bearing deposit and can go stay with a significant improve purportedly to reach by the tip of 2020.

However annual returns may vary from 4.6% to 10.3%, CoinDesk’s Sebastian Sinclair wrote. Evaluate that with the 0.01% provided on a JPMorgan Chase financial savings account.

In one of many panels on the convention, David Hoffman, founding father of the DeFi-focused publication Bankless, mapped out the bullish case for ether and stated costs may climb to $10,000 or increased, from about $380 now.

In a subsequent session, Vishal Shah, founder and CEO of the crypto derivatives alternate Alpha5, mapped out the bearish case however concluded by saying costs may double beneath that situation.

Ether costs have already tripled this yr. The lofty valuations would possibly simply be hype. Or they may be an indication that cryptocurrency merchants are looking forward to the business’s maturation.

Bitcoin Watch

The bitcoin market has turned indecisive, in response to Wednesday’s doji candle.

Key indicators just like the 14-day relative energy index stay biased bullish. Moreover, the 5- and 10-day averages proceed to pattern north, indicating the trail of least resistance is to the upper aspect.

From the macro perspective, the rising stockpile of the worldwide negative-yielding debt is a significant bullish improvement for perceived inflation-hedges or retailer of worth property like bitcoin. “Going ahead, the seek for yield is more likely to be a significant driver of development in bitcoins worth and adoption,” Stack Fund’s CEO Matthew Dibb informed CoinDesk in a WhatsApp chat.

Additional, latest disclosures of bitcoin holdings by funds…