(Edited by James Rubin)Good morning. Here’s what’s happening:Market moves: Bitcoin broke $52,000 briefly, while its supply outside of exchanges rea

(Edited by James Rubin)

Good morning. Here’s what’s happening:

Market moves: Bitcoin broke $52,000 briefly, while its supply outside of exchanges reached record highs.

Technician’s take (Editor’s note): Technician’s Take is taking a holiday hiatus. In its place, First Mover Asia is publishing a column by CoinDesk Chief Content Officer Michael Casey.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Prices

Bitcoin (BTC): $50,866 +.09%

Ether (ETH): $4,043 -0.8%

Markets

S&P 500: $4,791 +1.38%

DJIA: $36,302 +0.9%

Nasdaq: $15,871 +1.39%

Gold: $1,811 +0.2%

Market moves

Bitcoin, the oldest cryptocurrency, remained at the $51,000 level after it briefly broke above $52,000 during U.S. trading hours on Monday. At the time of publication, bitcoin was hovering just below $51,000. Ether was down slightly just above the $4,000 mark.

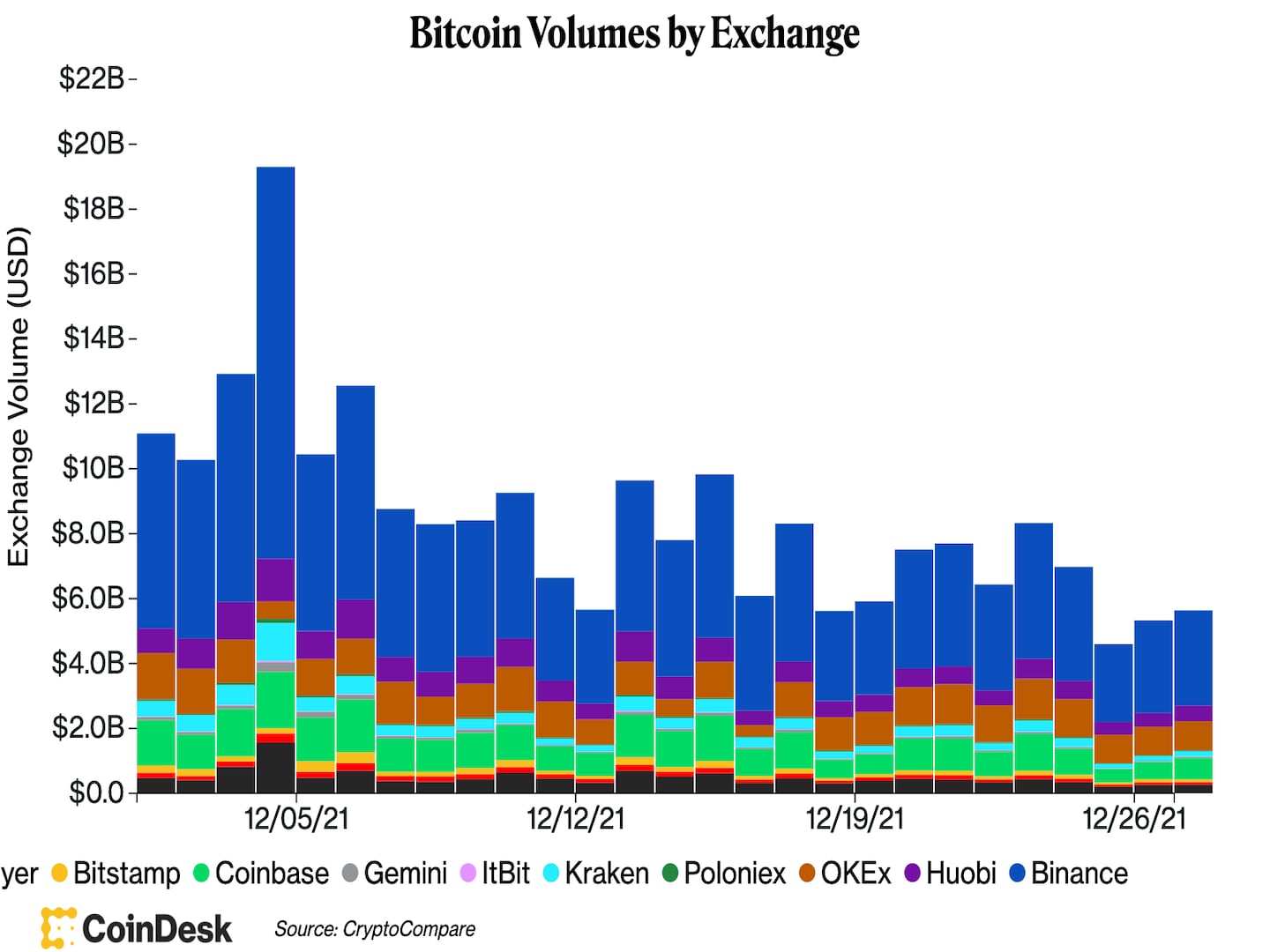

But trading activities were mostly muted, as the trading volume of the No. 1 cryptocurrency by market capitalization across major centralized exchanges was only slightly higher than it was on Sunday. Bitcoin’s low-volume rally came as stocks in the U.S. also rose in a week that’s traditionally marked by light but bullish trading.

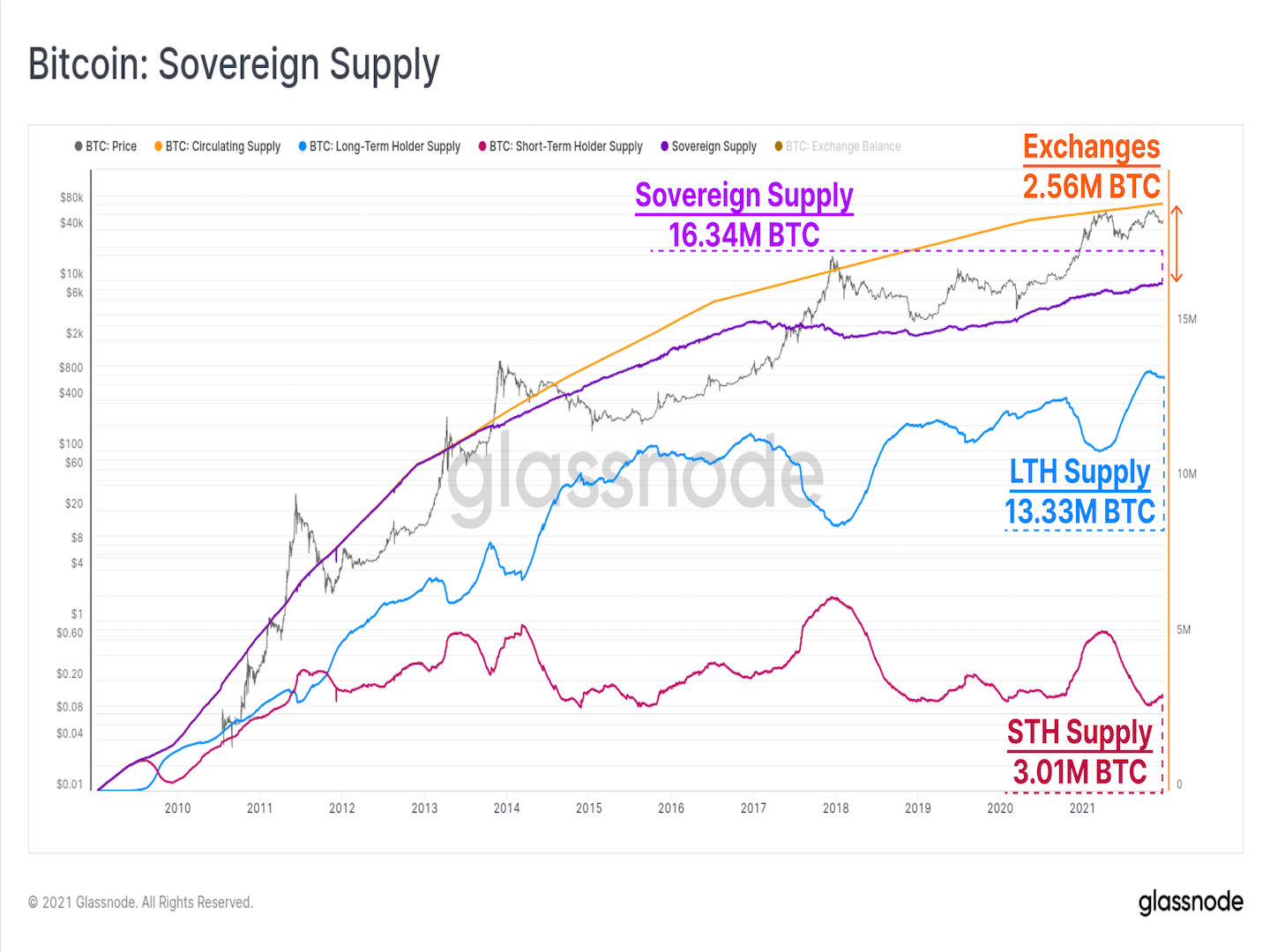

Meanwhile, as the market enters the end of the year, the so-called sovereign supply of bitcoin – total coins held outside of exchange reserves – reached an all-time high, according to blockchain data firm Glassnode.

The growth of bitcoin’s sovereign supply came as its long-term holders saw their ownership stake increase by 4.8% to reach 74.8% of all sovereign supply over the past year, Glassnode noted in its Dec. 27 newsletter. Short-term holders’ bitcoin ownership dropped from 28% this past January to 25.2% now.

“Such on-chain behavior is more typically observed during bitcoin bear markets, which in hindsight are effectively lengthy periods of coin redistribution from weaker hands, to those with stronger, and longer-term conviction,” Glassnode wrote.

Column

5 Ways Money Was Reimagined in 2021: Michael Casey looks back at a tumultuous year for money. (By CoinDesk Chief Content Officer Michael Casey)

It was the year of crypto!

For this, the first of two holiday editions of this Money Reimagined column, we frame this remarkable year in terms of how, in different ways, money was reimagined in 2021. We look at five themes, with links to past newsletters and podcasts.

You’re reading Money Reimagined, a weekly look at the technological, economic and social events and trends that are redefining our relationship with money and transforming the global financial system. Subscribe to get the full newsletter here.

In 2021, money became…

A meme

Whether it was the mania for dogecoin, the surge of interest in non-fungible tokens or the capacity for Wall Street Bets to set the price of “meme stocks” like GameStop, we witnessed a strange merging of finance and popular culture. As incredulous as people were in both traditional financial and Bitcoin circles, we at Money Reimagined felt somewhat vindicated. The trend underscored a theme we’ve explored in both the newsletter and the podcast: that monetary systems require a shared belief in their common value. This era of reimagined money is bound to see the deployment of art, iconography, stories and other cultural products to bolster the sense of belonging and belief among communities that form around these new systems.

A politicized idea

For the past century, no one really questioned the nature and structure of our systems of money. Money was issued by governments and it was run by banks. End of story. With the emergence of Bitcoin, there was suddenly a new way to think about things. But for most of its existence, the political class felt it could simply ignore it.

In 2021, that blissful ignorance suddenly became impossible. We first saw this with the debate over the infrastructure bill, most importantly in the U.S. Senate, when the impositions of a contentious tax reporting provision for cryptocurrency sales had the ironic effect of demonstrating that crypto had arrived in Washington. The fact that legislators wanted to tax crypto was a sign that it was recognized as a long-term prospect, a reliable source of tax revenue. Just as importantly, the crypto lobby, though ultimately unsuccessful in its bid to force changes to those more draconian parts of the provision, showed its clout on Capitol Hill has grown significantly. It forged a large, bipartisan coalition of lawmakers to support its preferred amendments and showed it will be a force.

Around the same time, the conversation around stablecoins as alternatives to central bank digital currencies started taking on greater appreciation in Washington. Randal Quarles, who was vice chairman of the Federal Reserve until he resigned from the post in November, even argued that stablecoins could bolster U.S. power overseas by tapping into private sector innovation that central banks inherently won’t have access to. That…

www.coindesk.com