Ether's worth is perhaps getting a lift from the crypto trade's model of the sprint for money.The coronavirus disaster has despatched traders in ea

Ether’s worth is perhaps getting a lift from the crypto trade’s model of the sprint for money.

The coronavirus disaster has despatched traders in each digital and conventional markets scrambling for U.S. {dollars}, seen as probably the greatest belongings to park cash in throughout a deflationary recession. In conventional markets, that is meant promoting dangerous belongings like shares, junk bonds and developing-country currencies, and parking the proceeds in money.

You are studying First Mover, CoinDesk’s each day markets publication. Assembled by the CoinDesk Markets Crew, First Mover begins your day with essentially the most up-to-date sentiment round crypto markets, which in fact by no means shut, placing in context each wild swing in bitcoin and extra. We comply with the cash so that you don’t need to. You may subscribe right here.

In digital-asset markets, there’s been a flurry of demand for tether and different dollar-linked stablecoins, lots of them constructed atop the ethereum blockchain community. Led by tether (USDT), the full excellent quantity of stablecoins surged this month to just about $9 billion, from lower than $6 billion in early March.

Some cryptocurrency analysts are actually beginning to ask if the stablecoin surge will enhance the value of ether (ETH), which is used to pay charges referred to as “fuel” to assist course of transactions on the Ethereum blockchain, together with for different tokens.

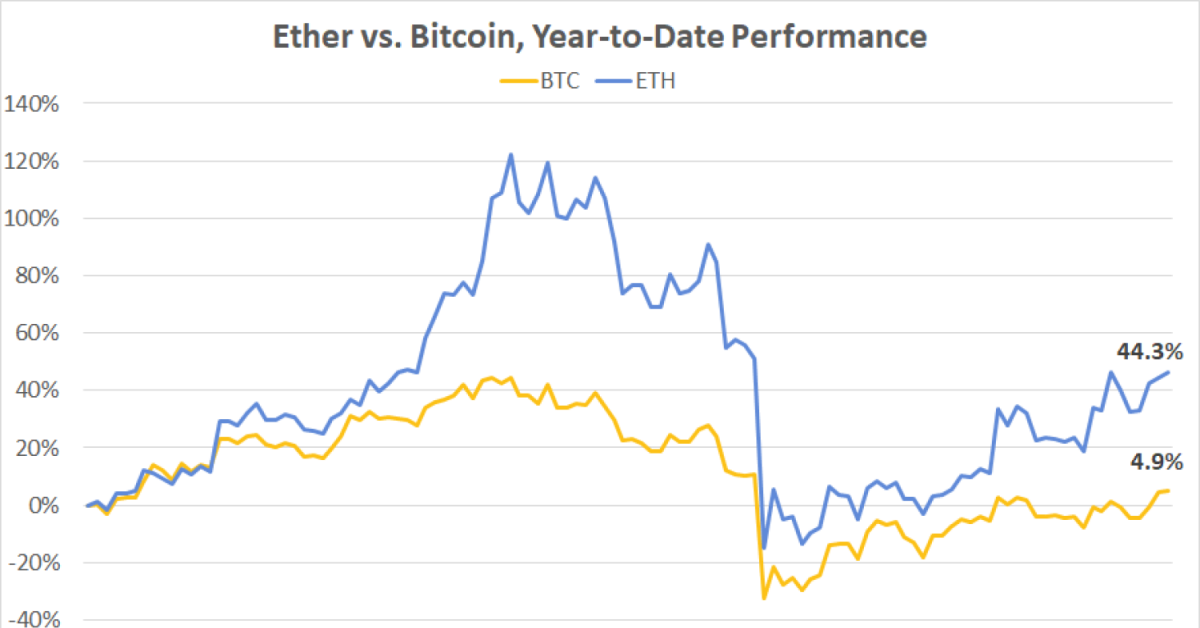

Costs for ether, the second-biggest cryptocurrency by market worth, have jumped 53 % thus far in 2020 to about $195. That compares with an eight % year-to-date achieve for bigger bitcoin.

Ryan Watkins, a analysis analyst on the cryptocurrency information agency Messari, wrote final week in a report that tether’s use of the ethereum blockchain “needs to be optimistic for ETH.”

“It is onerous to disregard the promise of decentralized programmable cash when you’re spending time within the ethereum financial system,” he wrote. “It will present a bid for ETH.”

Ether, generally described because the “digital oil ” to bitcoin’s “digital gold,” is the native forex for the ethereum blockchain, which is understood as a platform for straightforward issuance of recent digital tokens in addition to for its “sensible contract” programming capabilities. In recent times ethereum has develop into the premier ecosystem for the white-hot area of “decentralized finance,” the place startup corporations and developer groups are designing automated lending and buying and selling protocols which may ultimately problem banks.

But ether is notoriously troublesome to worth, with merchants counting on all the pieces from price-chart patterns to supply-and-demand predictions to discounted money move evaluation. Earlier this yr, one blockchain marketing consultant estimated that the cryptocurrency’s worth would possibly shoot as excessive as $10,000 if half of Argentina’s cash provide deserted the peso for dai, a decentralized dollar-linked stablecoin that is backed by ether.

“I do not assume we’re at a degree the place fundamentals are driving these tokens,” says Gary Zigmond, co-founder of Digico Capital, a cryptocurrency hedge fund. “We’re nonetheless on the story stage, the place all the pieces’s sooner or later.”

Messari’s Watkins says the rise of stablecoins would possibly really pose a longer-term risk to ether, since they may usurp its potential use case as a “medium of change.”

“On this situation, ETH can have devolved into its naive early branding of digital oil, a commodity-like lubricant for the ethereum blockchain,” he wrote. “ETH would nonetheless be helpful like many commodities are, however ETH wouldn’t be valued like cash is.”

However with the value efficiency beating bitcoin’s so handily this yr, ether bulls in all probability aren’t worrying an excessive amount of in regards to the valuation metrics.

Tweet of the day

Bitcoin watch

Pattern: Bitcoin has almost erased the losses seen on March 12 – the so-called “Black Thursday” – with a transfer to $7,800 early Monday, and now seems set to increase its five-week profitable development.

The highest cryptocurrency by market worth is buying and selling close to $7,714 at press time, representing a 0.2 % achieve on the day. Costs rose greater than eight % within the seven days to April 26 to verify bitcoin’s sixth straight weekly rise, the longest profitable streak since March 2019.

The value rise could possibly be prolonged additional, as bitcoin balances on exchanges continues to slip forward of the miner reward halving – an indication traders are withdrawing their belongings for long-term holding forward of the supply-cutting occasion, as famous by the blockchain intelligence agency Glassnode.

Bitcoin has traditionally put in a optimistic efficiency within the weeks main as much as halving, Marcus Swanepoel, CEO of cryptocurrency platform Luno, advised CoinDesk. The bullish narrative surrounding the halving may proceed to attract bids for the cryptocurrency within the quick time period.

Additional, hypothesis that savvy traders would possibly use lately minted tether (USDT) and different stablecoins to fund bitcoin purchases is more likely to preserve retail curiosity excessive. “Merchants will wish to pay shut consideration to the issuing of recent USDT, which has traditionally led to a surge in bitcoin’s worth. With…