Frances Coppola, a CoinDesk columnist, is a contract author and speaker on banking, finance and economics. Her e book “The Case for Folks’s Quantit

Frances Coppola, a CoinDesk columnist, is a contract author and speaker on banking, finance and economics. Her e book “The Case for Folks’s Quantitative Easing” explains how trendy cash creation and quantitative easing work, and advocates “helicopter cash” to assist economies out of recession.

The Federal Reserve has simply introduced a change to its inflation focusing on regime. As a substitute of taking pictures to hit 2% yearly, it’ll intention to realize 2% “on common” over an unspecified time period. So, if inflation runs beneath goal in 2020 and 2021 due to a pandemic-induced recession, the Fed may permit inflation to rise above 2% and keep there throughout 2022 and 2023, thus attaining a mean of two% from 2020 to 2024. The concept is that by permitting inflation to run “reasonably” larger, the Fed may preserve low rates of interest and quantitative easing [QE] lengthy sufficient to realize full employment, reasonably than beginning to withdraw it earlier than full employment is reached.

There’s just one drawback with this. There’s completely no motive by any means to assume that briefly elevating the Fed’s inflation goal would elevate inflation.

Ever for the reason that monetary disaster of 2008, the Fed has struggled to satisfy its inflation goal. As this chart exhibits, the Fed’s most well-liked measure of inflation, core private consumption expenditures (PCE), has hardly ever come near 2%, not to mention exceeded it:

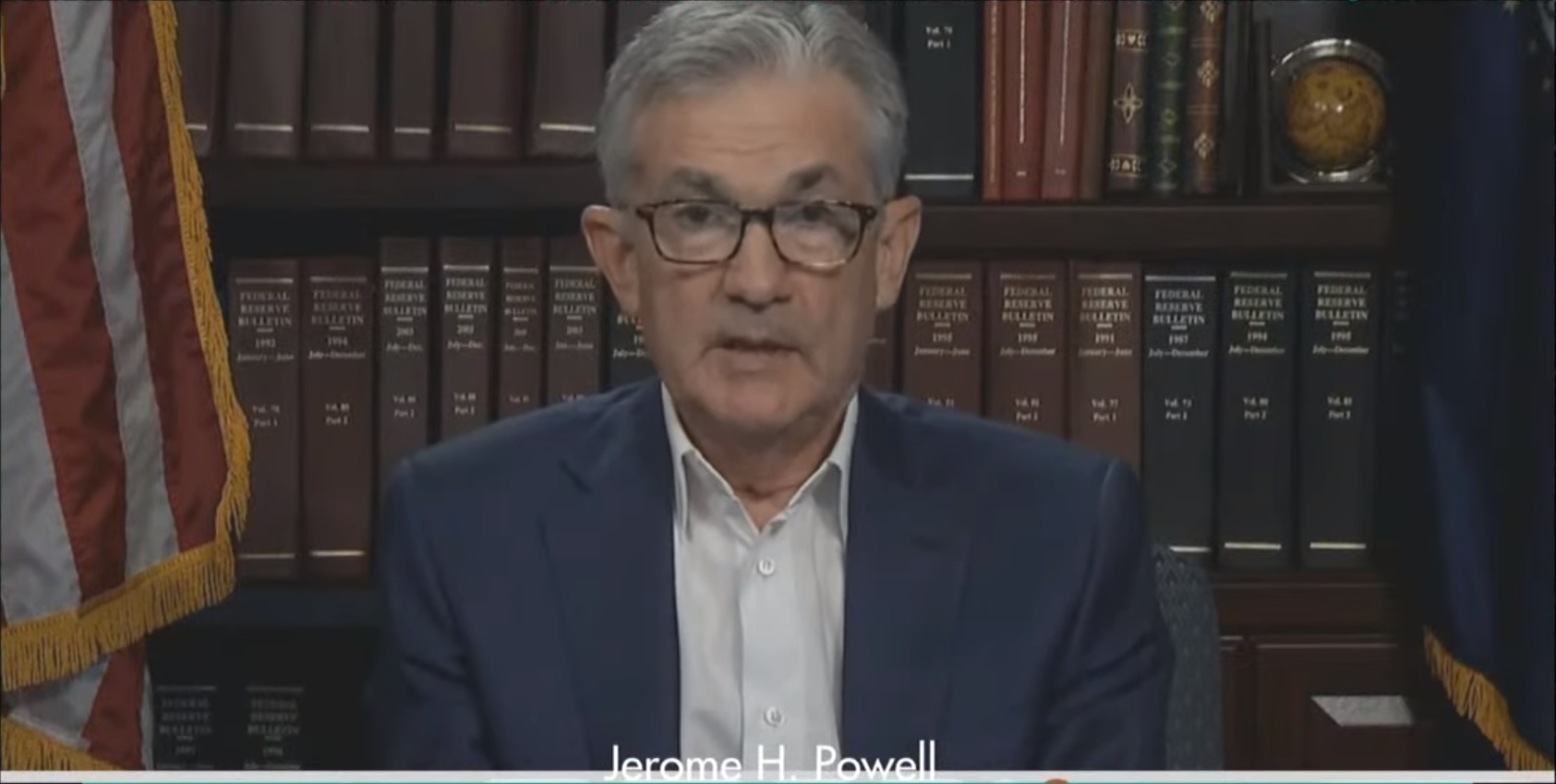

That is regardless of rates of interest at historic lows and, latterly, an especially robust labor market. In his speech on the Jackson Gap convention, the Chairman of the Federal Reserve, Jay Powell, commented that the inverse relationship between inflation and unemployment, upon which Fed rate of interest coverage has historically relied, seems to be damaged:

The traditionally robust labor market didn’t set off a big rise in inflation. Through the years, forecasts from [Federal Open Market Committee] individuals and private-sector analysts routinely confirmed a return to 2 % inflation, however these forecasts have been by no means realized on a sustained foundation.

Mainly, till the pandemic hit, everybody was working however they weren’t getting pay rises. So there was no sustained upwards strain on client costs from wage calls for.

There wasn’t any sustained inflationary strain from cash creation, both. The failure of QE to return inflation to the Fed’s goal is likely one of the huge mysteries of the final decade. All that new cash ought to have set off an inflationary spiral – nevertheless it didn’t. Nicely, not in client costs, anyway, although it has inflated asset costs, and continues to take action.

To make sure, the Fed is much from the one central financial institution struggling to get inflation off the ground. The ECB has failed to satisfy its 2% goal for the entire of the final decade. And the Financial institution of Japan has by no means managed to boost inflation above zero for any size of time, regardless of detrimental rates of interest, large QE packages, and the largest authorities debt pile on this planet.

See additionally: Commentary: Fed Chair Jerome Powell Particulars Inflation Goal Modifications

However why is the Fed so intent on getting inflation off the ground, anyway? Isn’t inflation an unfair tax on savers? Isn’t deflation an excellent factor for shoppers? Based on Mr. Powell, “inflation that’s persistently too low can pose critical dangers to the economic system. Inflation that runs beneath its desired stage can result in an unwelcome fall in longer-term inflation expectations, which, in flip, can pull precise inflation even decrease, leading to an adversarial cycle of ever-lower inflation and inflation expectations.”

That is the dreaded “deflation spiral” described by the American economist Irving Fisher in his essay “The Debt Deflation Concept of Nice Depressions.” When there’s sustained deflation, those that owe cash grew to become ever extra indebted. As Fisher put it, “the extra the debtors pay, the extra they owe”.

In right this moment’s debt-laden economic system, American households and companies are too indebted to deal with sustained deflation. Low, steady inflation not less than provides them an opportunity of paying their money owed. If we’re to have any likelihood of decreasing the dominance of personal sector debt within the economic system, deflation must be averted in any respect prices.

However inflation that’s too excessive can also be dangerous. It discourages saving and punishes those that have managed their funds prudently. Most individuals agree that the double-digit inflation of the 1970s was far too excessive. On this new regime, the query is how excessive will the Fed permit inflation to rise? At current, we don’t know – and that isn’t a recipe for confidence within the Fed’s new framework.

But when Japan is something to go by, the Fed’s new framework gained’t make any distinction anyway. In 2013, the Financial institution of Japan raised its inflation goal from 1% to 2%. Six years later, there was virtually no impact on precise inflation. A central financial institution’s means to boost inflation is restricted by its instruments. The proof appears to be that when…