Cryptocurrency change FTX has launched eight distinctive index futures and volatility markets in lower than 12 months. However attractive refined m

Cryptocurrency change FTX has launched eight distinctive index futures and volatility markets in lower than 12 months. However attractive refined merchants to make use of these novel merchandise has proved difficult.

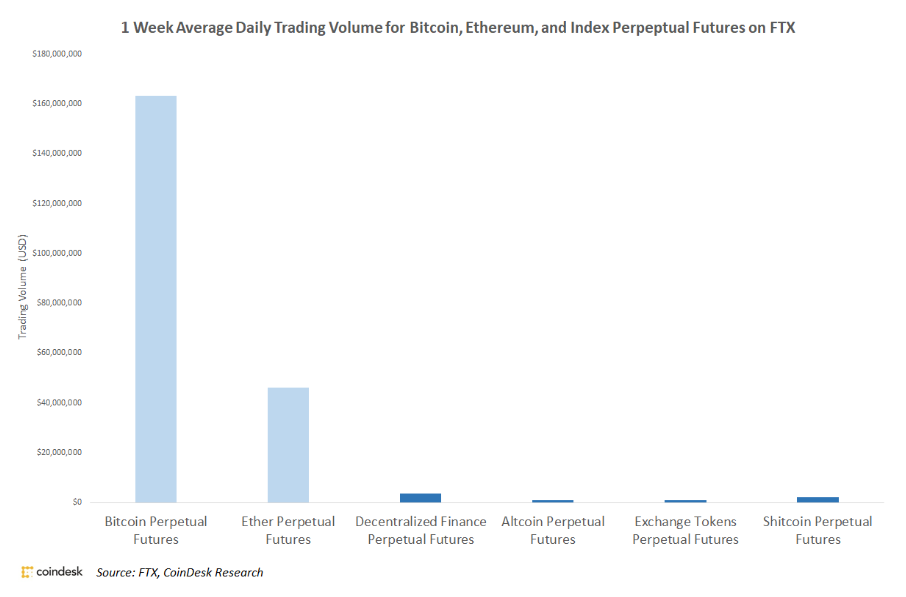

On the time of publication, Antigua and Barbuda-based FTX helps 115 totally different cryptocurrency futures markets. BitMEX, at present the most important cryptocurrency derivatives change by open curiosity, helps 23. FTX’s distinctive futures markets, together with decentralized finance and “shitcoin” perpetual futures, rank in its prime 25 traded markets by 24-hour quantity.

Since August 2019, when FTX launched its altcoin index futures, the product technique for these progressive markets has been to construct and launch quickly to capitalize on developments inside cryptocurrency communities. “Lots of these merchandise are actually essential to launch whereas well-liked,” mentioned CEO Sam Bankman-Fried.

The ostensible recognition of those indices’ underlying belongings, nonetheless, hasn’t all the time translated into equal demand from skilled merchants to enter the brand new markets. In actual fact, these indices report a tiny fraction of the buying and selling quantity for FTX’s bitcoin and ether futures markets. A one-week common of each day buying and selling quantity for FTX’s prime indices exhibits none of them broke above even $four million in traded quantity.

“Every of those new merchandise are fascinating and doubtlessly very enticing hedging devices sooner or later,” mentioned Jeff Dorman, the chief funding officer at Arca. However at current, bigger buyers could also be precluded from “totally using” FTX’s progressive merchandise as a consequence of “low liquidity and low underlying AUM per product.”

“With that mentioned, if FTX is ready to proceed rising its person base and onboards extra market makers, liquidity will naturally move in the direction of these merchandise and funds will observe,” Dorman added.

FTX’s distinctive futures markets are designed for each retail speculators {and professional} merchants, based on Bankman-Fried. However to some merchants, the change seems to be primarily designed for skilled algorithmic and quantitative merchants.

See additionally: In Banking First, ING Develops FATF-Pleasant Protocol for Monitoring Crypto Transfers

“FTX is a battlefield for quants,” mentioned Nik Yaremchuk, an impartial quantitative bitcoin dealer. To Yaremchuk, the change’s person interface alone indicators that it has “few retail merchants.” He added that roughly 90% of all FTX trades are additionally executed through its utility programming interface (API). Merchants use an change’s API to programmatically enter and exit trades as an alternative of finishing the commerce manually through a web based net interface. In line with Bankman-Fried, that quantity is nearer to 75 %.

Snowball impact

Producing liquidity takes time however can have a snowball impact as soon as a brand new market features momentum. One resolution to boosting a brand new market’s liquidity is having different exchanges launch related markets. This generates curiosity amongst their very own customers and creates alternatives for arbitrage buying and selling. However different exchanges could possibly be “fearful concerning the lack of liquidity” on FTX’s markets, and therefore “they don’t launch these merchandise,” mentioned Qiao Wang, an impartial bitcoin dealer, beforehand a quantitative dealer at Tower Analysis.

One other impediment, based on Bankman-Fried, is the difficulties of coordinating the product designers and preliminary market makers “on actually brief discover” for these popularity-driven product releases.

See additionally: Veteran Commodities Dealer Chris Hehmeyer Goes All In on Crypto

FTX doesn’t appear fearful concerning the liquidity in its new, eye-catching merchandise. “Over time, an increasing number of liquidity suppliers begin to present,” mentioned Bankman-Fried. “As a result of the majority of maker orders are despatched by automated bots, it takes a while for a lot of market making companies so as to add a brand new product to their fashions.” Regularly, extra companies will add these markets to their “repertoire” and, thus, present extra liquidity, he informed CoinDesk.

In line with Yaremchuk, the progressive futures markets on FTX are each nice “instruments” and “toys” for quantitative merchants. However to this point, these merchandise aren’t as enticing or helpful as they could possibly be as a consequence of low liquidity.

The chief in blockchain information, CoinDesk is a media outlet that strives for the best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an impartial working subsidiary of Digital Forex Group, which invests in cryptocurrencies and blockchain startups.