In Hong Kong, some native residents are turning to crypto belongings and encrypted communication to withstand monetary surveillance and web censors

In Hong Kong, some native residents are turning to crypto belongings and encrypted communication to withstand monetary surveillance and web censorship.

Hong Kong’s nationwide safety legislation, enacted on June 30, goals to quell opposition to China’s ruling Communist Occasion. The legislation has raised widespread fears of a clampdown on free speech and tighter management over the town’s monetary system. Underneath the brand new legislation, the Hong Kong authorities will be capable of freeze and confiscate belongings from individuals or organizations which might be suspected of being concerned in nationwide safety crimes.

Information suggests individuals in Hong Kong are more and more utilizing stablecoins, that are digital tokens whose worth is pegged to fiat currencies, as a means of holding their belongings unbiased of a banking system that’s topic to authorities management.

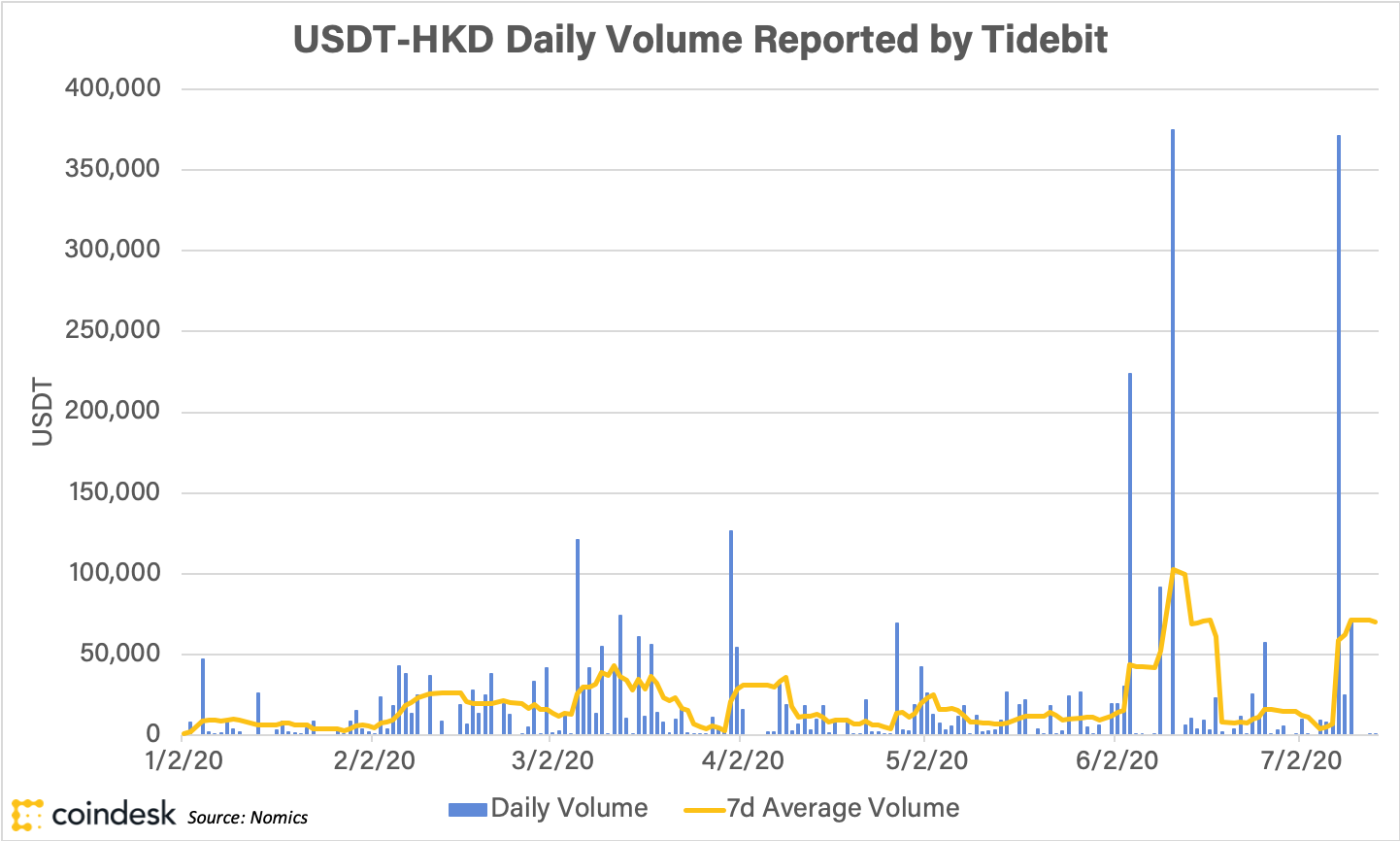

Because the chart above demonstrates, buying and selling quantity between Hong Kong {dollars} and the U.S.-dollar pegged stablecoin USDT noticed a surge in early June on the fiat-crypto buying and selling platform TideBit. The surge adopted the choice to strengthen Hong Kong’s nationwide safety legislation, which was unveiled by Chinese language legislators through the Two Periods, the most important annual political gathering in mainland China. The second buying and selling surge on the alternate adopted the enactment of the brand new legislation on June 30.

The information evaluation by CoinDesk was based mostly on a comparatively small pattern as a result of restricted entry to stablecoin buying and selling volumes and the truth that many stablecoin purchases have been through over-the counter (OTC) trades in Hong Kong and mainland China. The pattern may be influenced by a handful of “whales,” or the traders holding numerous belongings, buying and selling throughout these intervals of time.

However the surge within the stablecoin commerce may additionally sign Hong Kong residents’ want to guard their belongings.

“Many individuals don’t consider they’ll belief the federal government or banks to maintain their belongings secure anymore,” stated Brian Yim, a college pupil within the UK whose household continues to be in Hong Kong. Yim says individuals he is aware of try to purchase crypto belongings in Hong Kong. “If the Hong Kong police and authorities take into account you as a nationwide safety suspect, they’ll seize your belongings and even simply take them,” he stated

Learn Extra: Hong Kong’s Nationwide Safety Regulation May Threaten Native Crypto Brokerages

Cryptocurrencies may serve one other function as effectively: fundraising for protestors. HSBC froze the financial institution accounts protesters have been utilizing to pay bail for arrested protesters final November.

Stablecoins in Asia

Even earlier than the nationwide safety legislation, stablecoins performed a particular position in Asia. Stablecoins equivalent to USDT are a well-liked solution to keep away from capital controls and make cross-border cash transactions much less traceable. Mainland China residents may use stablecoins in Hong Kong to make cash transfers that exceed the yearly capital management of $50,000 that’s imposed by the Individuals’s Financial institution of China.

“The adoption of crypto in China, Hong Kong, Asia could be very underground,” stated Darius Sit, founder and chief funding officer of Singapore-based crypto agency QCP Capital, in a panel dialogue at CoinDesk’s Asia Make investments convention final September. “In the event you go to Hong Kong, the cash exchanges to commerce tether are bodily on the spot.” stated Sit, whose firm runs an over-the-counter (OTC) buying and selling desk.

Sit stated capital controls are one of many key traits differentiating Asian over-the-counter (OTC) buying and selling desks from these within the West. OTC buying and selling desks are a sort of market the place the intermediary matches merchants with their counterparties with an agreed value versus a centralized alternate the place individuals commerce cryptocurrencies based mostly on the spot market value.

“Whereas a western OTC desk might even see 80% in BTC, ethereum and 20% in stablecoins buying and selling, you flip it in Asia desks,” Sit stated. “We commerce much more tether, USDC, TUSD.”

Safer communications

Along with considerations over the safety of monetary belongings, the nationwide safety legislation additionally sparks fears of web censorship and extra intensive surveillance over private information.

Main U.S. tech corporations together with Fb, Google and Zoom stated they might briefly cease cooperating and sharing consumer information with Hong Kong authorities. Native authorities stated corporations violating the brand new legislation would face penalties, together with the jailing of firm’s staff.

Chinese language video app TikTok has determined to withdraw from shops in Hong Kong and make its providers inaccessible to its native customers.

Concern over elevated Chinese language management has been rising in Hong Kong for a while now. “Even earlier than the legislation was enacted, individuals have been deleting Fb accounts and posts,” stated Maya Wang, senior China researcher at Human Rights Watch. “Individuals have been transferring off of WhatsAPP to Sign and so they have develop into much more acutely aware about what they are saying on social media and securing their communication.”

“For somebody who has labored each in China and Hong Kong, it’s fairly putting as a result of…