Not everybody is completely enthusiastic about DeFi.Risky crypto is nurturing its fixed-income facet. Crypto lending exercise is rising on decentra

Not everybody is completely enthusiastic about DeFi.

Risky crypto is nurturing its fixed-income facet. Crypto lending exercise is rising on decentralized finance (DeFi) networks. Staking, the place traders reap funds for locking up property in features important to community protocols, is shifting into crypto’s mainstream, with giant crypto exchanges providing staking providers for customers.

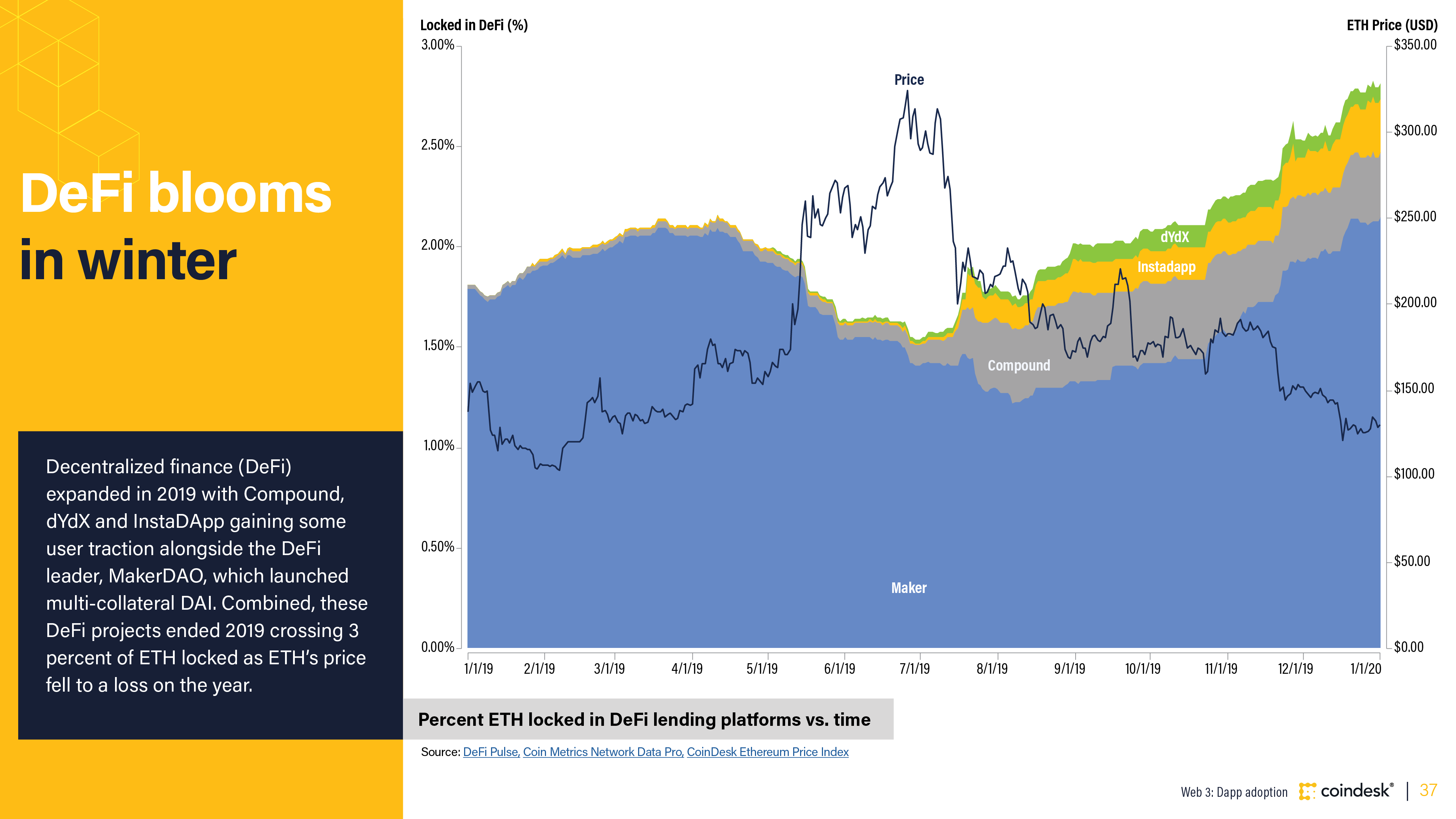

The slide above exhibits the rising reputation of 1 class of crypto lending, DeFi, amongst ethereum traders. (You possibly can see that slide and others measuring the Net three use case of crypto property in CoinDesk Analysis’s quarterly evaluate; we’ll current the leads to a webinar on Tuesday, Feb. 4: sign up here.)

There’s some irony on this, like a penny inventory providing a dividend, however each lending and staking are rising as potential elements in funding selections for crypto traders. In December, we invited two fund managers, each lengthy bitcoin and different crypto property, for a CoinDesk Analysis webinar on lending and staking. Jordan Clifford of Scalar Capital and Kyle Samani of Multicoin Capital joined us to debate how they consider danger and returns in crypto lending and staking, what crypto property’ risk-free fee may appear to be and what DeFi must do to draw traders and new customers.

Listed below are three takeaways from that dialog. Watch & listen to the entire webinar here.

For background and extra data, obtain our free “Crypto Lending 101” report here.

1. DeFi danger elements hold some traders out.

Clifford and Samani had a back-and-forth in regards to the determination to place property to work in DeFi networks that earn returns. From Clifford’s perspective, the know-how dangers are manageable; Samani stated at this level the returns do not justify the chance of dropping investor funds to a “good contract” glitch, for any allocation of property to DeFi.

Here is Clifford on how Scalar evaluates dangers. He talked about bug bounties, safety audits and formal verification as methods DeFi networks can de-risk themselves as platforms for incomes fixed-income returns on crypto. Human danger is an element, too: “You actually are enthusiastic about counterparty danger as the primary one. … And that is available in many types, really. Many of those DeFi contracts, they’ve administrator entry that may do numerous issues with these funds on the contract degree. That is form of an early stop-gate for a lot of of those good contracts to go reside earlier than they are often actually decentralized. That’s one thing to consider. It says it’s a DeFi protocol however typically there’s a single group that has keys to it.”

Whether or not or not there’s human counterparty danger to think about, there’s at all times technological counterparty danger, Clifford stated, which might be evaluated alongside the strains of a Lindy effect: “Usually, the good contracts themselves, they act as a counterparty in a manner, they usually must be vetted for know-how danger. … What you’re actually searching for is sensible contracts which have had numerous worth custodied inside them. The extra time that’s elapsed, the safer it tends to be. If the contract’s held a billion {dollars} for a number of years the percentages of it having a severe vulnerability diminish over time.”

For Samani, present rates of interest on DeFilending networks do not justify the dangers, which embrace probably having to ship an e mail to traders explaining how the fund misplaced their cash. “It wouldn’t be significant to our portfolio, so it simply wasn’t well worth the time,” he stated. “What fee can be significant? Samani stated Multicoin hasn’t made that willpower, but. Is it a 1 % premium over centralized? Is it a 2 % premium? At what level are we keen to underwrite that? We’re not there but; we hope to be there within the subsequent six to 12 months.”

Samani stated he isn’t bullish that decentralized lending will have the ability to supply substantial premiums over centralized. “There are at all times going to be individuals who will bridge that arbitrage,” he stated.

2. What’s crypto’s risk-free fee?

Selections about what’s a significant fee come all the way down to a premium earned for danger taken. That is normally calculated in reference to a “risk-free” fee. After all, no funding is danger free, and that applies acutely in crypto property. Nevertheless, dialog in our crypto lending webinar turned to risk-free charges in crypto and the way staking may play a job in figuring out such a reference level for pricing danger.

“Normally my expectation is that lending and borrowing charges will probably be larger than staking charges,” Samani stated. “I believe for probably the most half staking charges, not less than inside every ecosystem, will probably be thought of the risk-free fee.”

Components like staking protocols’ programmed unbonding interval make it totally different, however there will probably be workarounds to such lockups, Samani stated. For instance, exchanges providing staking providers could possibly return capital to their customers extra rapidly than direct staking would permit.

Staking is not free…