India’s crypto commerce volumes have soared for the reason that Supreme Courtroom of India lifted banking restrictions for exchanges in March. In

India’s crypto commerce volumes have soared for the reason that Supreme Courtroom of India lifted banking restrictions for exchanges in March.

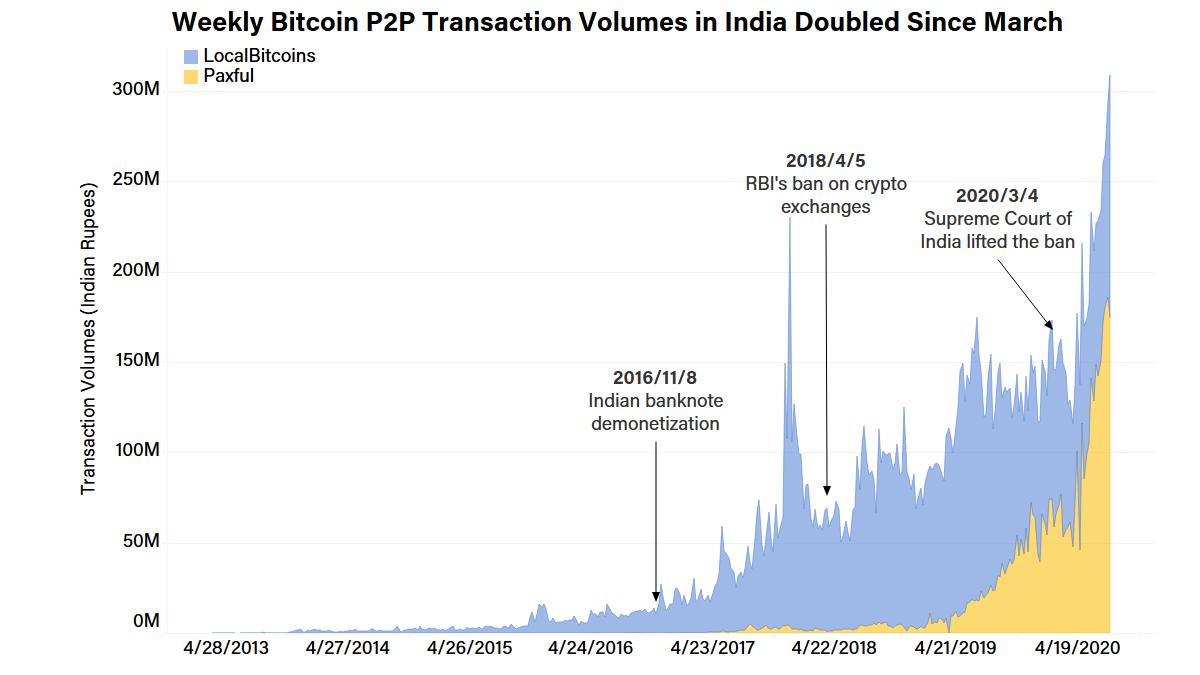

In response to Coin Dance’s Paxful and LocalBitcoins quantity knowledge, India’s bitcoin peer-to-peer commerce quantity reached an all-time excessive in July.

Siddhartha Dutta, CEO of Marlin, a tech startup in Bangalore, stated the latest spike in demand for bitcoin mirrors Indians’ response to demonetization in 2016. Again then some folks discovered the worth of holding bitcoin, whose issuance is just not managed by any authorities, when the Indian authorities recalled an enormous share of paper foreign money.

The outdated payments all of the sudden misplaced worth because of a authorities decree. The concept that bitcoin’s worth relies on market ideas, as a substitute of fickle authorities insurance policies, made it significantly engaging.

The worth of bitcoin on Zebpay, an Indian crypto trade, had surged from $757 to $1,020 in 18 days after demonetization, whereas the bitcoin worth within the U.S. remained comparatively static. For some Indian buyers, investing in bitcoin was a protected choice to retailer their wealth and decrease the uncertainties attributable to demonetization and a doable gold ban.

India’s rising crypto market dramatically slowed in 2018, when the Reserve Financial institution of India (RBI) ordered monetary establishments to keep away from working with crypto exchanges.

Learn extra: The Large Factor Holding Again India’s Crypto Growth

Now, the lifting of banking restrictions seems to have unleashed pent-up demand for cryptocurrency, which no authorities can declare nugatory. Nowadays bitcoin exercise is ramping up throughout India on peer-to-peer exchanges comparable to Paxful and LocalBitcoins.

Because the chart under reveals, India’s peer-to-peer bitcoin transaction volumes have doubled over the past 5 months.

In response to a spokeswoman for Paxful, one of many main peer-to-peer buying and selling platforms, India is now among the many 5 fastest-growing bitcoin consumer teams on this planet. Paxful’s Indian volumes surged from round $576,000 in Could 2019 to $8.97 million in July 2020, and the full peer-to-peer Indian volumes on Paxful and LocalBitcoins reached $13.7 million. Smaller exchanges serving the Indian market, like Delta Change, are additionally seeing speedy development. Delta Change CEO Pankaj Balani stated new signups are rising 100% month-over-month.

Dutta believes crypto has additionally been slowly gaining traction because of mesh networks that assist present connectivity and quick streaming in rural areas. This might sign the beginning of an excellent larger adoption cycle.

“Individuals in India are getting uncovered to the web, cell first,” Dutta stated. Nevertheless, he added, this development shouldn’t be mistaken for “mainstream” adoption.

Learn extra: CoinDCX Turns into First India Change to Provide Customers Crypto Staking

Crypto startups

The bull market, mixed with coronavirus journey restrictions, may energize India’s startup scene.

Bangalore-based entrepreneur Prashanth Balasubramanian is the co-founder of the Lightning pockets startup Lastbit. Lastbit goals to succeed in past the Indian market to serve Europe and finally North America. However since 2020 might be a yr of relative quarantine, Balasubramanian is pondering it’s an excellent time to construct at dwelling.

“Silicon Valley is a improbable place for enterprise, however as a younger firm we’re in a position to operate extra successfully and hold issues lean with a 10x distinction in runway by utilizing our Indian roots,” he stated.

Dutta stated he expects that cryptocurrency tasks will proceed to proliferate throughout India’s tech trade throughout the coronavirus recession.

“There’s definitely potential to develop rather more,” Dutta stated.

Learn Extra: Why Bitcoin Bulls Are Betting on Explosive Progress in India

The chief in blockchain information, CoinDesk is a media outlet that strives for the very best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an impartial working subsidiary of Digital Foreign money Group, which invests in cryptocurrencies and blockchain startups.