Cryptocurrency customers within the U.S. keep in mind July 26, 2019, because the day the Inside Income Service (IRS) got here out swinging. It now

Cryptocurrency customers within the U.S. keep in mind July 26, 2019, because the day the Inside Income Service (IRS) got here out swinging. It now seems the company might have been hitting beneath the belt.

That day, for the primary time in its historical past, the IRS demanded hundreds of digital currency-holding taxpayers fess as much as unreported crypto buying and selling beneficial properties.

“We’ve data” in your cryptocurrency accounts, the company warned these presumably tax-flouting taxpayers in a so-called “smooth letter” that took an oddly laborious line for being a compliance-promoting mass mailing. What this “data” was or how the IRS had gotten it was left unexplained by Letter 6173.

Extra clear was this: If these taxpayers didn’t refile their tax returns, tackle the obvious crypto discrepancies or, in the event that they believed themselves already compliant, meticulously clarify how and why in a sworn response, the letter warned they might be referred for “an examination” – an audit.

The letters didn’t spell out to those taxpayers that they weren’t but beneath IRS examination. America’s Taxman needed solutions – and it needed them in 30 days or much less.

Crypto and Taxes 2020: Wednesday is that this yr’s deadline for People to file their tax returns, and cryptocurrency customers’ obligations are as complicated as ever. This sequence of articles explores the complicated points dealing with digital asset buyers.

Learn extra:

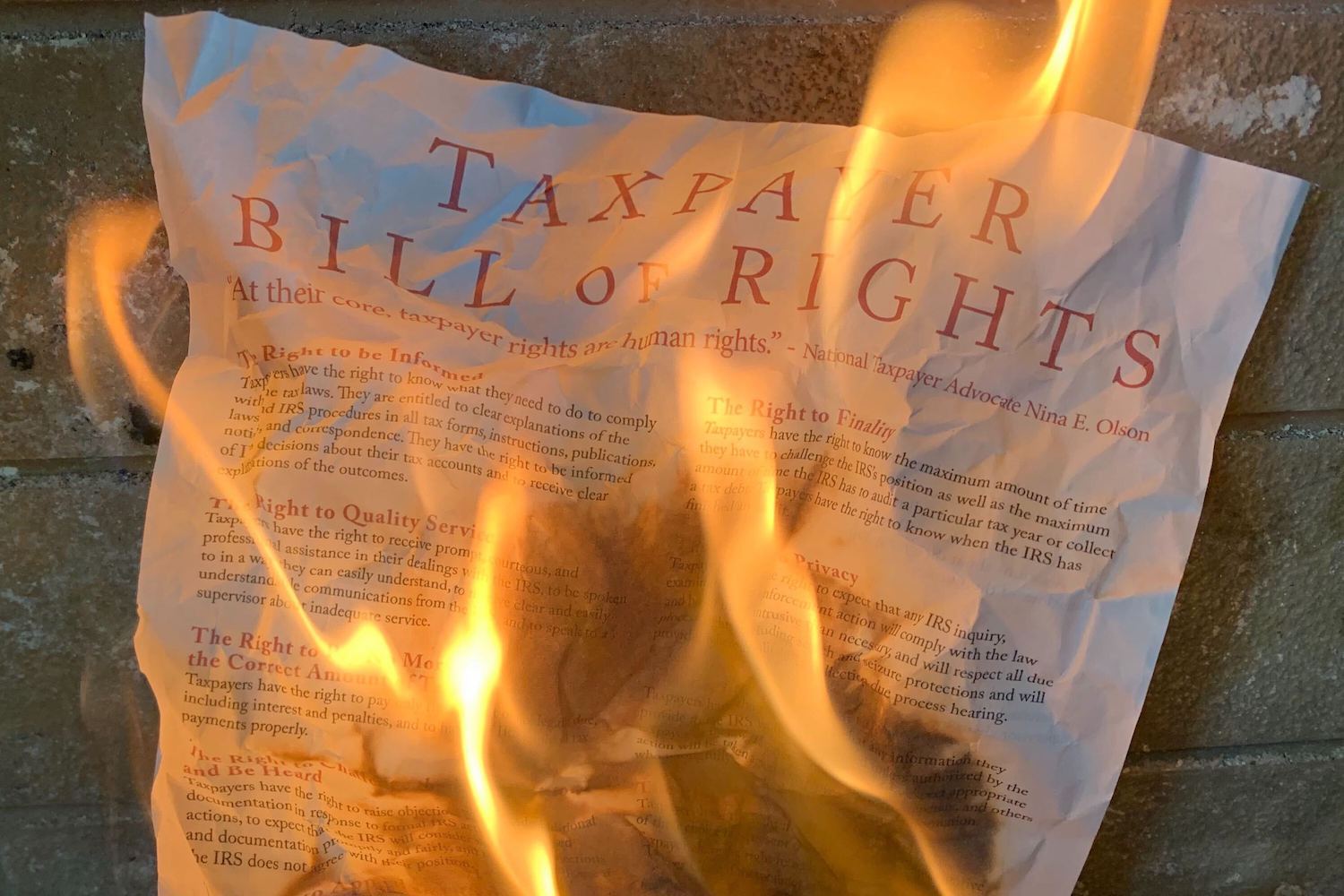

IRS Violated ‘Taxpayer Invoice of Rights’ With 2019 Crypto Letters: Watchdog

Crypto Taxes: Nonetheless Confused After All These Years

Hodlers Can Donate Crypto to Charity to Reduce Tax Funds

Almost a yr later, the company’s personal Taxpayer Advocate Service is alleging that letter violated the Taxpayer Invoice of Rights, adopted by the IRS beneath strain from Congress.

The little-noticed controversy over Letter 6173 is a part of an rising wrestle over codified rights supposedly assured to each federal taxpayer in the US. It additionally comes because the IRS mounts a definite however intimately associated marketing campaign to implement cryptocurrency tax compliance throughout all sectors of the cryptocurrency house.

A not-so-soft letter

In 2014, the IRS adopted 10 U.S. Structure’s Invoice of Rights-like safeguards in an try to coach and defend a U.S public skeptical they’d any rights earlier than the IRS, in keeping with WeiserMazars LLP. The Taxpayer Invoice of Rights is codified within the Inside Income Code.

In line with Erin M. Collins, the Nationwide Taxpayer Advocate, an impartial workplace inside the IRS that mixes the roles of an ombudsman and a public defender, Letter 6173 ran roughshod over these rights.

Learn extra: IRS Solicits Contractors to Assist Look at Crypto Merchants’ Tax Returns

“The Code, Congress and the IRS have repeatedly acknowledged taxpayers’ rights and protections, and this letter not solely doesn’t present them — it undermines them,” Collins wrote in her “2021 Targets Report back to Congress,” launched June 29. Collins heads the IRS’ almost 2,000-strong staff of impartial advocates.

The digital foreign money letter smashed by two tenets of the Taxpayer Invoice of Rights – the precise to privateness and the precise to learn – when it ordered taxpayers who weren’t beneath audit to submit examination-esque data to the IRS, she argued.

The Code, Congress and the IRS have repeatedly acknowledged taxpayers’ rights and protections, and this letter not solely doesn’t present them — it undermines them.

Amongst Letter 6173’s calls for: the taxpayer’s complete crypto buying and selling historical past; a “assertion of information”; a proof of how they received their crypto books clear; and copies of tax paperwork from 2013 by 2017, although the statute of limitations caps the variety of reviewable years at three. Recipients had 30 days to submit the sworn bundle “beneath penalty of perjury,” the letter stated.

The IRS and the Taxpayer Advocate Service didn’t reply to particular person requests for remark. However tax consultants interviewed by CoinDesk typically agreed with Collins’ evaluation of the letter.

“It does sound a bit of ominous,” stated Mark Mazur, director of the City-Brookings Tax Coverage Heart. “Usually, in my expertise, smooth letters are softer in that the deadlines are, you already know, indefinite – sooner or later or one thing. However this one does appear a bit of more durable.”

Collins referred to as that ominous toughness “disturbing” in her congressional report. Letter 6173 “seems to be a risk directed at taxpayers who imagine they’re compliant,” she stated, and recognized it as half of a bigger sample of the IRS utilizing smooth letters to “bypass” examinations and the procedural protections they afford.

She requested the IRS take away the examination-like calls for from Letter 6173 and a second unrelated smooth letter on the grounds they violated compliant taxpayers’ proper to privateness and proper to learn. The IRS refused.

Nothing private

Observers acquainted with the house advised CoinDesk the IRS’ smooth letter was unlikely a focused assault…