Jeff Dorman, a CoinDesk columnist, is chief funding officer at Arca the place he leads the funding committee and is accountable for portfolio sizin

Jeff Dorman, a CoinDesk columnist, is chief funding officer at Arca the place he leads the funding committee and is accountable for portfolio sizing and danger administration. He has greater than 17 years of buying and selling and asset administration expertise at companies together with Merrill Lynch and Citadel Securities.

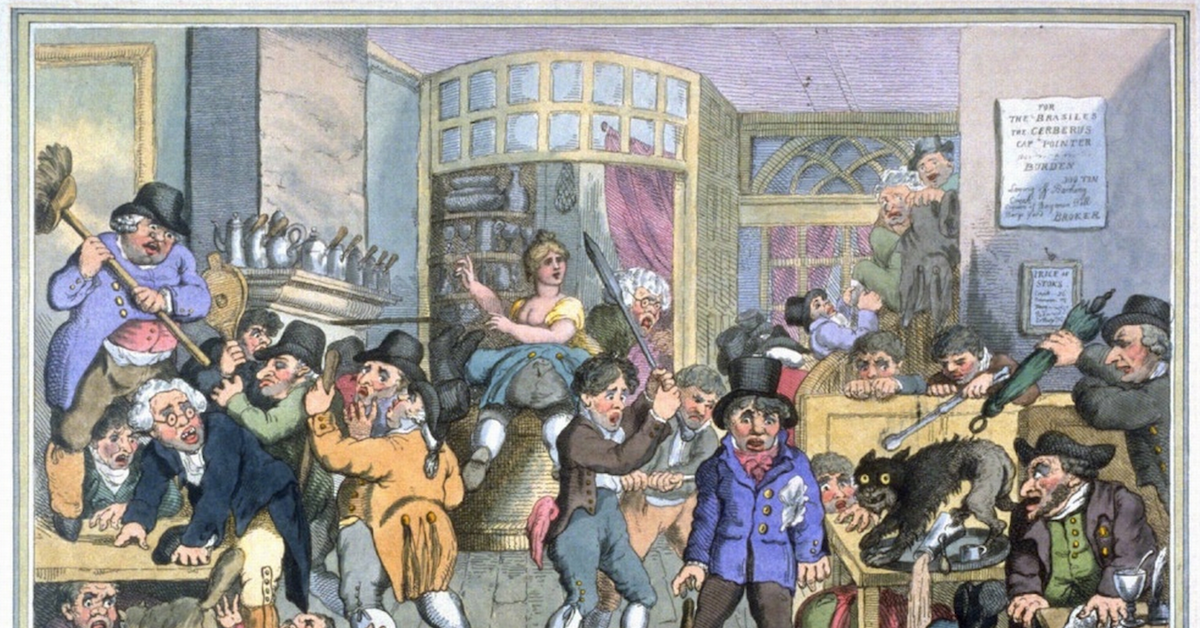

Investing in digital belongings is a sham! Contributors on this business are merely attempting to anticipate worth actions, quite than use basic evaluation to find out why a token or coin may go greater or decrease. There isn’t any intrinsic worth. It’s pure hypothesis primarily based on technical evaluation. It’s outright playing.

It’s additionally precisely how inventory and bond markets traded for the primary 300 years.

In 1602, the Dutch East India Firm issued the primary paper shares. This exchangeable medium allowed shareholders to conveniently purchase, promote and commerce their inventory with different shareholders and traders. For a whole lot of years thereafter, traders and merchants did their greatest to anticipate worth strikes, with none of the instruments accessible as we speak for valuing these securities. Again then, a inventory buying and selling at $100 was considered dearer than a inventory buying and selling at $10, unbiased of variety of shares excellent, underlying revenues, or enterprise prospects.

It wasn’t till the 1920s, following the inventory market crash and the Nice Despair, that two Columbia Professors (Benjamin Graham and David Dodd) got here up with a technique for figuring out and shopping for securities priced effectively beneath their true worth. Their e-book, “Security Analysis,” was revealed in 1934, and Graham and Dodd’s rules supplied a rational foundation for funding choices which might be nonetheless utilized as we speak by the world’s prime worth traders.

See additionally: Securities Law Helped Build Modern Capitalism. Crypto Should Embrace It

Warren Buffett selected to attend Columbia particularly to be taught from Professor Graham (and acquired an A+ in his class). Virtually 50 years later, Professor Frank Fabozzi introduced similar valuation techniques and concepts for investing in mounted revenue securities. And shortly thereafter, even newer valuation strategies (like Metcalfe’s Law) had been launched to assist worth computing networks, and these strategies had been utilized many years later to worth pre-revenue web giants like Fb, Tencent and Netflix.

In line with Gisli Eyland, who has written in regards to the worth investing philosophy, Graham and Dodd “described a fundamentally different approach to inventory choosing and investing in company securities by proposing that the investor ought to chorus from attempting to anticipate worth actions solely. As an alternative, the investor ought to attempt to estimate the true Intrinsic Worth of the underlying asset. Given time, the Intrinsic Worth and market worth would converge.” Right now, traders and monetary media throw round monetary ratios like P/E, P/B, EV/EBITDA, P/S, Dividend Yield and plenty of others as in the event that they’ve been round ceaselessly, whereas smugly chastising digital belongings for having no intrinsic value. This can be an excellent time to remind readers that digital belongings are lower than 10 years outdated.

Elementary fashions rising in crypto

When will the Graham and Dodd of crypto emerge? They’re possible already right here, working tirelessly behind the scenes on valuation strategies that might be utilized by the Warren Buffets of crypto 50 years from now. Digital belongings are nonetheless of their infancy, however new basic valuation strategies are being constructed, examined, and found day-after-day, from the unique MV = PQ analysis, to discounted sum of utility fashions, to everything else in between. Most of the fashions in existence are unproven, with just a few years’ price of information to help their methodologies, whereas different fashions have possible but to be conceived.

Every of those strategies has benefits in addition to shortcomings. Digital belongings are distinctive, just like company bonds, making totally different valuation strategies applicable for particular token varieties. Similar to a bond has totally different coupons, totally different maturities, totally different covenants and totally different options (callable, putable, convertible, warrants, and so on.), most digital belongings have distinctive options as effectively, making every evaluation totally different than the final (there’s a motive Fabozzi’s mounted revenue bible is over 1,800 pages lengthy).

In our view, the DCF evaluation is greatest used for tokens issued by cash-producing corporations reminiscent of trade tokens like Binance Coin (BNB) or Unus Sed Leo (LEO). The NVT Ratio could also be higher when evaluating throughout good contract platforms reminiscent of Ethereum (ETH), EOS (EOS) and NEO (NEO). A variation of Metcalfe’s regulation or whole addressable market evaluation can be utilized for tokens which might be within the early pre-launch stage or are servicing a sector that’s tough to at the moment measure.

See additionally: Never Mind Hodlers, Crypto Needs More Opportunist Investors

The neatest crypto analysts (together with our personal inner group at Arca) are growing new methodologies to worth digital belongings. As soon as these metrics develop into broadly accepted, worth…