Lex Sokolin, a CoinDesk columnist, is World Fintech co-head at ConsenSys, a Brooklyn, N.Y.-based blockchain software program firm. The next is cust

Lex Sokolin, a CoinDesk columnist, is World Fintech co-head at ConsenSys, a Brooklyn, N.Y.-based blockchain software program firm. The next is customized from his Future of Finance publication.

As I write this, Fb is value about $500 billion in market capitalization. The opposite members of the Libra Affiliation (and the 1,500 different organizations fascinated about connecting to it) are in all probability value one other few $ trillion. Ethereum, then again, is just about $20 billion in worth. And but, there are profound explanation why we needs to be paying consideration to not regulatory motion round Libra, however to decentralized finance brewing on the open supply community.

See additionally: Lex Sokolin: Software Ate the World, Here’s How It Eats Finance

The important thing mainstream piece of stories is that Libra’s method to constructing its foreign money and funds community is likely to change as a result of governmental pressure. What began out as a need to construct a multi-currency portfolio of {dollars}, euros, and different Fb-selected moneys, ended up working into the wall of sovereign opposition. Whereas bitcoin faces an analogous wall, it’s permissionless and due to this fact too squiggly to close down. Not so with Fb. We all know precisely the place its shareholders and operators are. In consequence, we observe that you just can not create a brand new cash with no new nation (e.g., Anon or 4chan nation). And in the event you dwell inside one other nation topic to its legal guidelines (e.g., the US), properly, you might be topic to its legal guidelines.

There continues to be a deep confusion about (1) an asset itself, and (2) the working infrastructure on which it travels. These are two fully completely different propositions, and the distinction can’t be hand-waved away. The character of holding some funding and the publicity it provides you to the funding class may be very completely different from the software program on which it runs. The greenback and sterling might go up and down in worth relative to one another – however that does not have a lot implication for the standard of the venue on which the buying and selling happens. Fb was attempting to do the previous exercise – re-build the precise greenback in a regulated, managed atmosphere.

Fb was attempting to…rebuild the precise greenback in a regulated, managed atmosphere. As an alternative, it needs to be rebuilding the cost rails.

As an alternative, it needs to be rebuilding the cost rails, which is why it’s no shock that the Libra Affiliation quitters are the businesses that make cost rails: Stripe, PayPal, Visa, and MasterCard. These gamers are in all probability open to channeling new models of worth throughout their tremendous highways, however they should not need to construct competing ones. As soon as it turns into clear that the brand new unit of worth ain’t occurring, what is the level of consuming your individual tail?

Astute JP Morgan report

JP Morgan lately revealed a fantastic equity-research style report on 2020 blockchain. There are just a few related, worthwhile factors on the concept of cryptocurrency as an asset class value referencing. First, in case you are constructing the cash itself, you might be within the finance enterprise and are taking financial publicity. Which means, for instance, that world yield curves turn out to be an issue. If 33 % of world debt has destructive rates of interest, it could be onerous so that you can earn internet curiosity revenue to maintain operations, which in flip might require clients to pay transaction charges on transfers, which will get you again to the prevailing banking/funds system already in place. To repair the mathematics, you would wish to construct out an actual capital markets enterprise, which has at-scale liquidity networks, counter-parties that may present credit score, and the buy-in of all of the central banks within the system. That is a troublesome one for Fb right this moment.

One other conclusion I discovered compelling is the continuing dialogue concerning the diversification usefulness of digital property. On the one hand, many individuals nonetheless maintain the view that bitcoin is an apocalypse hedge and may go up when the complete world burns down. Hoard the digital gold subsequent to your online game weapons! Nevertheless, the monitor report on this declare is just not notably clear as of but, and correlations are inclined to creep up with world markets as shocks turn out to be extra systemic. For instance, bitcoin correlation with the S&P 500 and Gold each approached 30 percent at one level in 2019.

The JP Morgan takeaway is that crypto property might be nation fragility hedges, slightly than normal hedges. In superior nations, they signify novel and completely different idiosyncratic dangers associated to know-how adoption curves, web meme virality, and the temper of Federal Reserve and different officers. However nations with challenged financial and monetary infrastructure supply clearer proof factors for financial enchancment.

Which will get me again to the core level: Cease serious about the asset, and begin serious about its gears and engines.

DeFi is an even bigger revolution, doubtlessly

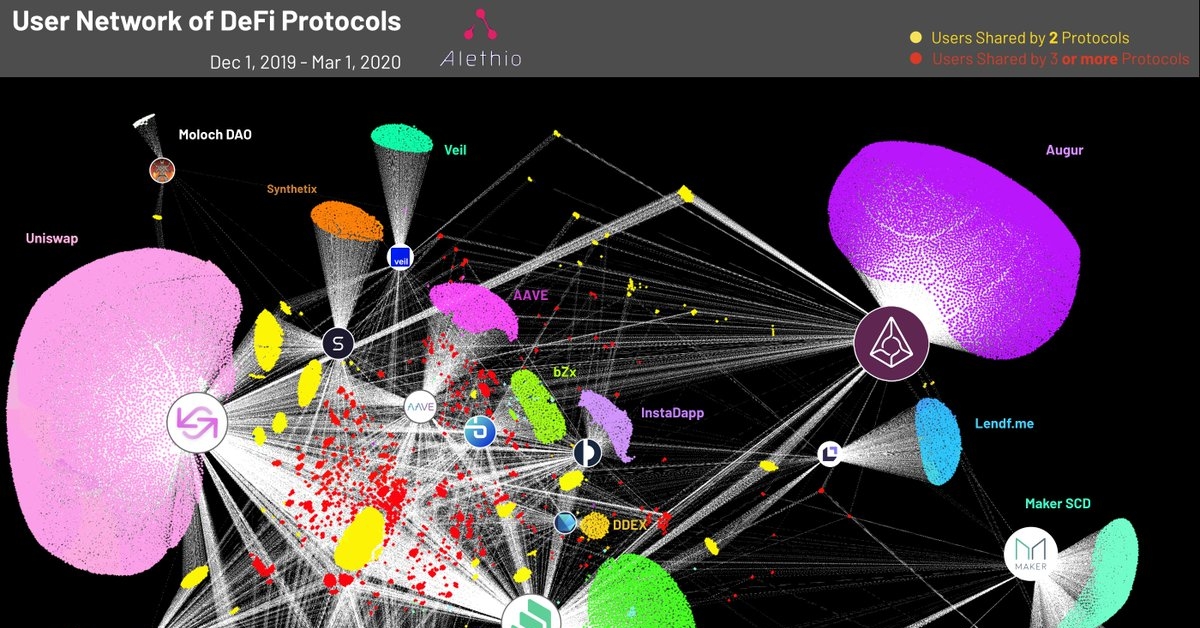

Whereas the political responses to Libra are shifting affect and know-how approaches, ethereum is the place the experiment is already happening. It boasts …