Bitcoin broke above $9,250 for the primary time since Friday because the main cryptocurrency continues to commerce in a good vary simply above $9,0

Bitcoin broke above $9,250 for the primary time since Friday because the main cryptocurrency continues to commerce in a good vary simply above $9,000 for a number of weeks. However cryptocurrency markets have stayed quiet as merchants count on a giant transfer. Bitcoin was buying and selling fingers round $9,250 as of 20:00 UTC (Four p.m. ET).

Ether, the second-largest cryptocurrency by market capitalization, gained 3%, buying and selling round $232 as of 20:00 UTC (Four p.m. ET), in accordance with Bitstamp.

Regardless of buying and selling above $9,250, bitcoin remains to be caught inside a good vary of some hundred {dollars} above $9,000. Consequently, 30-day volatility continues to say no. Actually, bitcoin’s volatility reached its lowest mark since Feb. 23, in accordance with Coin Metrics.

As bitcoin stagnates, conventional markets soar. Tesla made an all-time excessive Wednesday, climbing $1,134, up greater than 6% from its every day open. Zoom additionally bounced again towards its all-time excessive of $262 after dropping Friday via Monday, up 3.6% from its Wednesday open.

Why is bitcoin so quiet? There are merely “extra eyeballs away from the crypto market and extra in direction of conventional monetary markets,” stated Eliézer Ndinga, analysis affiliate at digital asset supervisor 21Shares. Many retail merchants are utilizing the favored retail equities buying and selling platform Robinhood to invest as conventional markets rally amid the on-going coronavirus pandemic.

“Regardless of numerous efforts to spice up institutional adoption, retail merchants account for 96% of all exchanges’ transfers,” Ndinga added. For a lot of of those merchants, the inventory market could also be extra attention-grabbing than cryptocurrency markets.

Regardless of retail buyers’ briefly waning curiosity, institutional buyers proceed to develop the cryptocurrency market’s infrastructure. New York Digital Investments Group (NYDIG) raised $190 million from 24 buyers for a brand new bitcoin fund, CoinDesk reported Wednesday. The New York-based asset supervisor, which has held a New York BitLicense since 2018, raised $140 million in Could for the same funding car, the Bitcoin Yield Enhancement Fund.

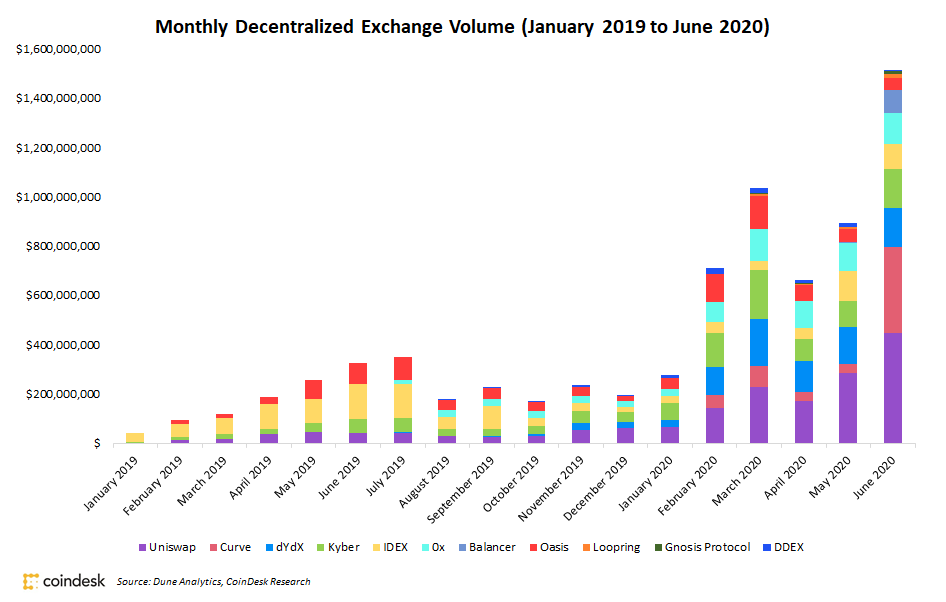

This speedy development carries some safety issues, nevertheless. Decentralized finance analyst Jack Purdy informed CoinDesk the spike in buying and selling volumes on these nascent platforms is “beginning to turn into a bit worrisome” because of the truth that a wide range of complicated assault vectors nonetheless exist.

Stablecoin markets confirmed power as USDC’s complete circulating provide handed 1 billion tokens. Tether, the most important stablecoin, grew to $10.Three billion, in accordance with knowledge from Messari.

Change tokens had been largely up Tuesday as the whole sector gained 2.4%, in accordance with Messari. A number of the greatest gainers had been kyber community (KNC) up 11.4% and binance coin (BNB) up 2.5%. All value adjustments had been as of 20:00 UTC (4:00 p.m. ET).

The chief in blockchain information, CoinDesk is a media outlet that strives for the very best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an unbiased working subsidiary of Digital Foreign money Group, which invests in cryptocurrencies and blockchain startups.