The worth of bitcoin hit new 2020 highs because the “various to gold” narrative will increase. In the meantime, smaller crypto tokens is likely to

The worth of bitcoin hit new 2020 highs because the “various to gold” narrative will increase. In the meantime, smaller crypto tokens is likely to be serving to push DeFi to new heights.

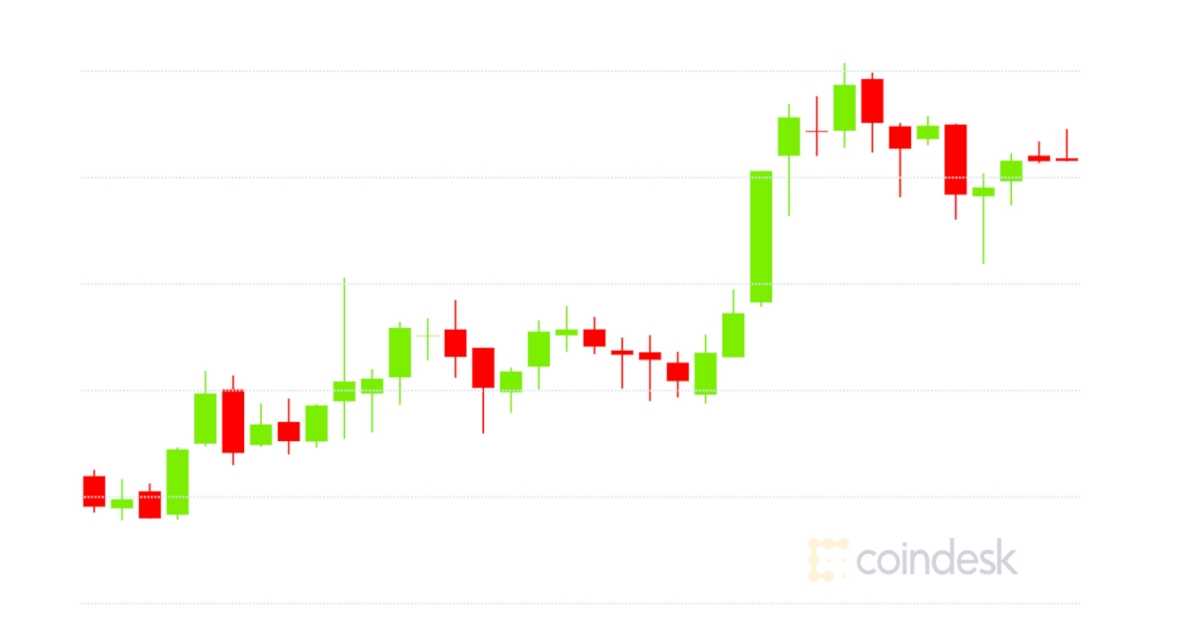

- Bitcoin (BTC) buying and selling round $18,638 as of 21:00 UTC (Four p.m. ET). Gaining 3.5% over the earlier 24 hours.

- Bitcoin’s 24-hour vary: $17,723-$18,813 (CoinDesk 20)

- BTC above its 10-day and 50-day shifting averages, a bullish sign for market technicians.

Bitcoin’s worth made features Friday, going as excessive as $18,813, in response to CoinDesk 20 information. The world’s oldest cryptocurrency then dropped a bit, to $18,638 as of press time. The final time bitcoin traded on the $18,800 degree was again on Dec. 19, 2017, when the worth went as excessive as $18,984.

Some analysts see $19,000 as actually inside attain, however bitcoin gained’t shoot straight up getting there, famous John Kramer, a dealer at crypto agency GSR. “It feels an increasing number of like we’re hitting a bitcoin tipping level,” Kramer advised CoinDesk. “That’s to not say that the worth will rocket previous $19,000; actually, a cooldown is to be anticipated.”

Learn Extra: BlackRock’s Chief Funding Officer Says Bitcoin Might Substitute Gold

Regardless of any cooldown that will happen, bitcoin is actually hotter than gold thus far in 2020, with bitcoin up 147% yr so far versus the yellow steel’s 22% efficiency.

“I anticipate much more media protection and reinforcement of the narrative round bitcoin being a greater various to gold within the close to future as an increasing number of outstanding Wall Road buyers like BlackRock are brazenly sharing their optimistic views,” mentioned Jason Lau, chief working officer for San Francisco-based cryptocurrency trade OKCoin.

Learn Extra: Y Combinator, Pantera Backs $3M in New Crypto Derivatives Alternate

Lau was referring to an look on CNBC’s “Squawk Field” by Rick Rieder, fastened earnings CIO at BlackRock, the $7 trillion assert supervisor. “Do I feel it’s a sturdy mechanism that … may take the place of gold to a big extent? Yeah, I do, as a result of it’s a lot extra useful than passing a bar of gold round,” Rieder mentioned of bitcoin throughout this system.

Within the derivatives market, choices merchants are betting on some bitcoin uncertainty for December expiration. Merchants anticipate a 54% probability of bitcoin staying over $18,000, a 44% probability of $19,000 per 1 BTC and a 35% probability of $20,000.

Denis Vinokourov, head of analysis at digital asset prime dealer Bequant, mentioned many are dismissing the affect ether may have on the derivatives market heading into 2021.

“If one goes by the notion that bitcoin will develop into a extra generally held asset in conventional house, then there’s little that might stop [ether] in following go well with,” Vinokourov advised CoinDesk. “Anticipate the CME to launch ether futures and choices sooner or later, as the present market positioning and move clearly present rising demand.”

TVL in DeFi going up, however not from BTC, ETH

Ether (ETH), the second-largest cryptocurrency by market capitalization, was up Friday, buying and selling round $510 and climbing 7.5% in 24 hours as of 21:00 UTC (4:00 p.m. ET).

The overall quantity of cryptocurrency “locked” (TVL) in decentralized finance, or DeFi, has handed $14 billion for the primary time, at $14.1 billion as of press time.

Nevertheless, the quantity of ETH locked has been declining, maybe as a result of some stakers are shifting the asset over to Ethereum 2.Zero contract.

As well as, the quantity of bitcoin locked can be dipping in DeFi.

Evidently smaller tokens are seeing main features together with BTC and ETH, possible contributing to TVL features, though as of press time DeFi Pulse didn’t reply to a request for touch upon the way it accounts for these tokens in its metrics.

“The substantial latest worth run-up in ETH and BTC have prompted in nominal greenback phrases the TVL to balloon because the smaller absolute variety of tokens of every continues to be representing a a lot bigger greenback quantity,” famous John Willock, chief govt officer of crypto custody supplier Tritium.

Different markets

Digital belongings on the CoinDesk 20 are principally inexperienced Friday. Notable winners as of 21:00 UTC (4:00 p.m. ET):

Learn Extra: US Agency Launches Firm-Sponsored Bitcoin Retirement Plans

- Oil was up 1.6%. Worth per barrel of West Texas Intermediate crude: $42.40.

- Gold was within the inexperienced 0.43% and at $1,873 as of press time.

- The 10-year U.S. Treasury bond yield fell Friday dipping to 0.826 and within the pink 0.19%.