Bitcoin merchants anticipate a major improve in volatility because the main cryptocurrency continues to recoup practically all its losses since top

Bitcoin merchants anticipate a major improve in volatility because the main cryptocurrency continues to recoup practically all its losses since topping out slightly below $20,000 in late 2017. Whether or not the volatility comes from elevated shopping for or promoting is a matter of disagreement.

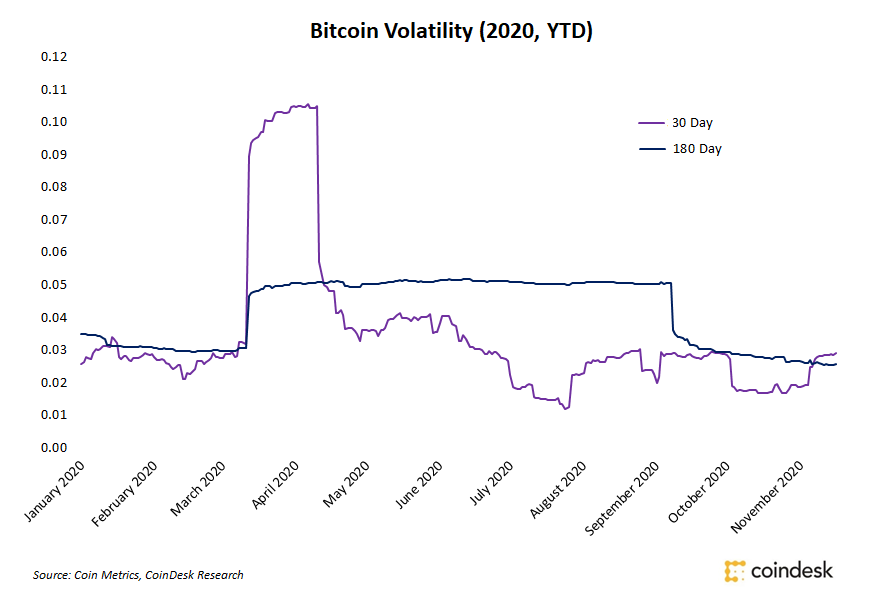

By way of bitcoin’s present rally, volatility has remained low. Since late August, 30-day volatility has remained beneath 0.03 and 180-day volatility has steadily decreased from 0.05, in keeping with information from Coin Metrics.

Over the identical interval, bitcoin has gained practically 80% after a quick dip to $10,000 initially of September.

As bitcoin closes in on the a lot anticipated all-time excessive mark, some responsive promoting needs to be anticipated, mentioned Mike McGlone, senior commodity strategist for Bloomberg Intelligence, in an electronic mail to CoinDesk.

However a “wave of institutional flows seems to be simply getting began and offsetting the relative youth of Bitcoin’s previous, conserving its upward trajectory intact,” McGlone added. Any promoting at report highs ought to solely “act as a velocity bump” to bitcoin’s long-term trajectory, he mentioned.

No matter which aspect of the market buyers select to pile onto, “elevated” volatility within the very close to future appears doubtless, in keeping with Sam Trabucco, quantitative dealer at Alameda Analysis.

Some promoting may come from buyers trying to understand some paper positive aspects after reaching a historic worth degree because the variety of bitcoin addresses in revenue surpassed 98% Monday, in keeping with Glassnode. Not since early December 2017 had been there this many addresses in revenue on paper.

To Joseph Todaro, accomplice at Greymatter Capital, reaching a brand new all-time excessive will in all probability set off important promoting because the market is more likely to repeat its response to earlier all-time highs on condition that “merchants lean closely on historic worth motion,” he advised CoinDesk in an electronic mail.

In 2016, for instance, bitcoin’s method to the then-all-time excessive was “met with important sell-side stress,” Todaro defined. He expects the identical response as bitcoin nears $20,000, adopted by consolidation after which renewed upward momentum.

The earlier all-time excessive represents a major inflection level in mainstream curiosity for bitcoin, mentioned Kyle Davies, co-founder of Three Arrows Capital, in a direct message with CoinDesk. At that time, he expects mainstream curiosity to speed up.

Mainstream consideration ought to set off important upside volatility, now downward, in keeping with Davies. “We won’t see resistance. We’ll see worth discovery,” he mentioned.