For the primary time in almost 40 years, the U.S. Securities and Change Fee is decreasing the limitations to investing in personal securities. How

For the primary time in almost 40 years, the U.S. Securities and Change Fee is decreasing the limitations to investing in personal securities. How a lot decrease is unclear, nevertheless.

Three of the 5 SEC commissioners voted to publish a proposal for updating the definition of “accredited traders,” a class of people and establishments which might be allowed to participate in personal monetary markets, on Dec. 18. Most of the people has 60 days from the proposal’s publication within the Federal Register (the official document for the U.S. authorities) to touch upon whether or not the securities regulator ought to approve the expanded definition.

The proposal was lauded by many within the cryptocurrency neighborhood, who hoped the brand new definition would permit people to take part in unregistered token choices primarily based on how properly they perceive the merchandise, not arbitrary requirements of wealth.

Nonetheless, although the proposal lists quite a few standards and issues that the SEC is evaluating, the ultimate expanded definition won’t widen the pool of recent accredited traders all that a lot, trade legal professionals mentioned.

“To date it seems that this enlargement of accredited investor standing is usually relevant to Wall Road insiders akin to licensed brokers or ‘educated staff’ of personal funding funds,” mentioned Zachary Kelman, a companion at Kelman Regulation. “It’s not as expansive as individuals wish to suppose.”

Whereas the proposals look promising, “as in all issues, the satan is within the particulars,” mentioned Drew Hinkes, normal counsel at Athena Blockchain and an lawyer with Carlton Fields.

The textual content offers a tentative framework for which credentials from tutorial establishments would qualify, together with an examination or sequence of exams administered by a self-regulatory group.

That half “might have a large influence,” Hinkes mentioned.

However in keeping with the complete textual content of the proposal, the SEC must designate the precise certifications, designations or credentials that might qualify an investor.

“Does that imply anybody with a four-year diploma from an accredited college, which might in all probability embrace thousands and thousands of recent traders, or is it restricted to Ph.D.s, which might in all probability not be materials?” Hinkes mentioned. “We’ll discover out after we get extra particulars from the Fee. For now, it is promising however not but actionable.”

The proposal

The SEC proposal touches on suggestions stretching over a decade, with among the amendments stemming from a 2015 report and others reaching way back to 2007.

Some $1.7 trillion was raised in 2018 in Rule 506 choices, together with fairness and debt, in comparison with $1.four million raised in registered choices, the textual content mentioned, indicating important demand for these kinds of exempt choices.

“We’re aware that an excessively broad definition might doubtlessly undermine vital investor protections and cut back public confidence on this very important market,” the proposal mentioned. “On the identical time, an unnecessarily slender definition might restrict investor entry to funding alternatives the place there could also be sufficient investor safety given components akin to that investor’s monetary sophistication, web value, data and expertise in monetary issues, or quantity of property underneath administration.”

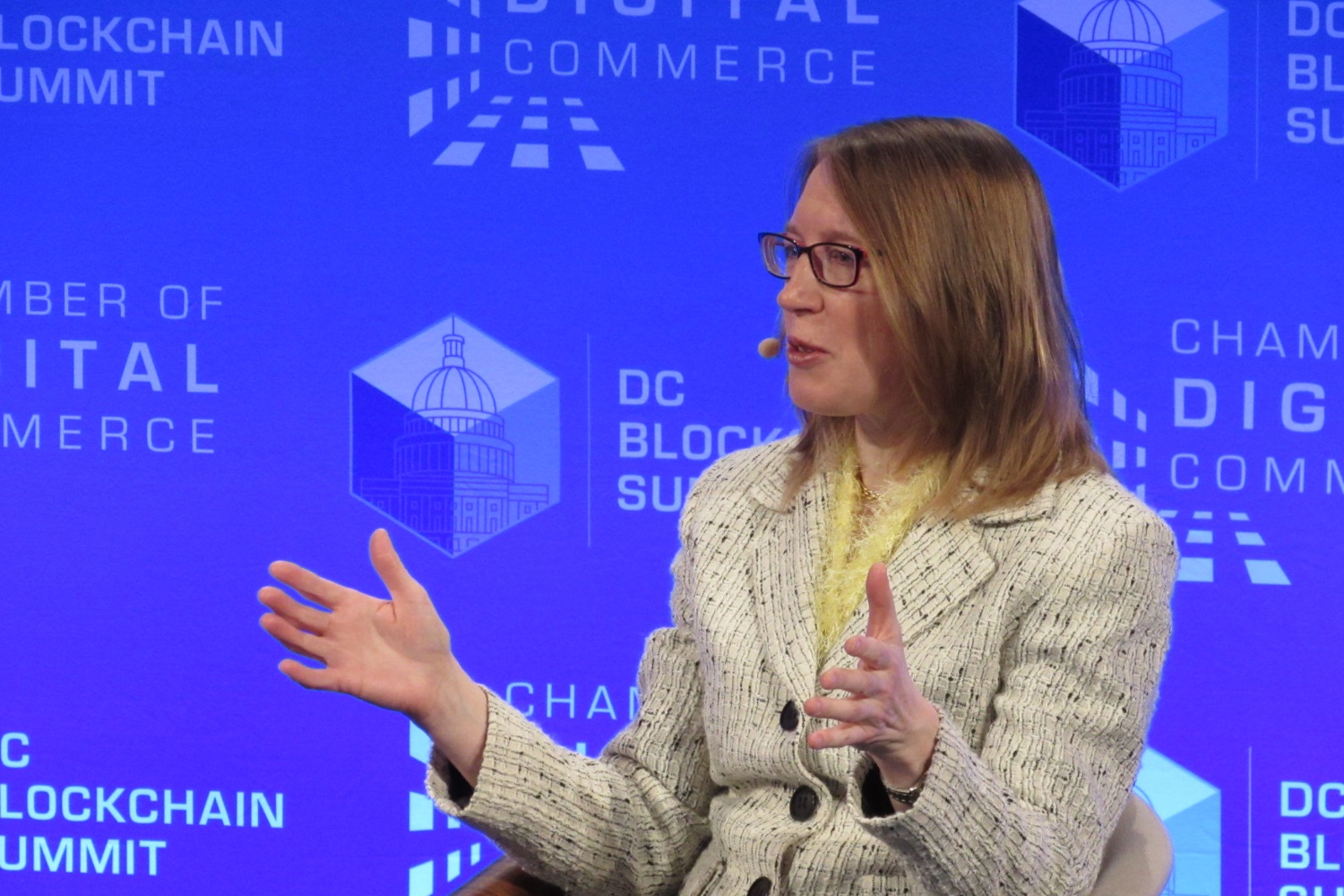

Commissioner Hester Peirce mentioned an investor’s sophistication – that’s, their understanding of the markets they’re investing in – must be used to find out accreditation standing.

“Our present definition consists of traders that spend their days cruising round in a Ferrari that Daddy purchased them, but excludes traders whose weeks are spent incomes cash and weekends are spent determining how finest to speculate it,” she mentioned in a statement.

Nonetheless, Commissioner Allison Lee, who voted against the proposal, mentioned in a statement that the proposal might create some “severe threat to retail traders,” citing aged people and retirees as examples.

Equally, Christopher Gerold, president of the North American Securities Directors Affiliation, mentioned the proposal might expose retail traders “to the numerous potential harms related to unregistered, illiquid choices” with no ongoing disclosures.

The proposal “affords a number of modifications to the definition, however few if any enhancements, and clearly misses a chance to offer significant reform to this outdated customary,” he mentioned.

Historic context

Whereas increasing the definition of “accredited investor” to incorporate extra people and entities is broadly being hailed, the framing of the dialog on-line has largely ignored the time period’s historic context, Kelman mentioned.

Beneath present legislation, an accredited investor is a person with $1 million in property or not less than $200,000 in annual revenue; a married couple with not less than $300,000 in annual revenue; banks, financial savings or mortgage establishments outlined underneath the Securities Act of 1933; brokers or sellers outlined underneath the Securities Change Act of 1934; funding corporations registered…