Federally regulated banks can use stablecoins to conduct funds and different actions, the Workplace of the Comptroller of the Forex (OCC) stated Mo

Federally regulated banks can use stablecoins to conduct funds and different actions, the Workplace of the Comptroller of the Forex (OCC) stated Monday.

The federal banking regulator printed an interpretive letter addressing whether or not nationwide banks and federal financial savings associations may take part in unbiased node verification networks (INVNs, in any other case often known as blockchain networks) or use stablecoins. The letter stated that these monetary establishments can take part as nodes on a blockchain and retailer or validate funds.

Any banks that do take part in an INVN should pay attention to the operational, compliance or fraud dangers when doing so, an OCC press launch warned.

Nonetheless, the OCC stated INVNs “could also be extra resilient than different fee networks” as a result of giant variety of nodes wanted to confirm transactions, which may in flip restrict tampering.

Kristin Smith, government director of the Blockchain Affiliation, stated on Twitter that “the letter states that blockchains have the identical standing as different world monetary networks, reminiscent of SWIFT, ACH, and FedWire.”

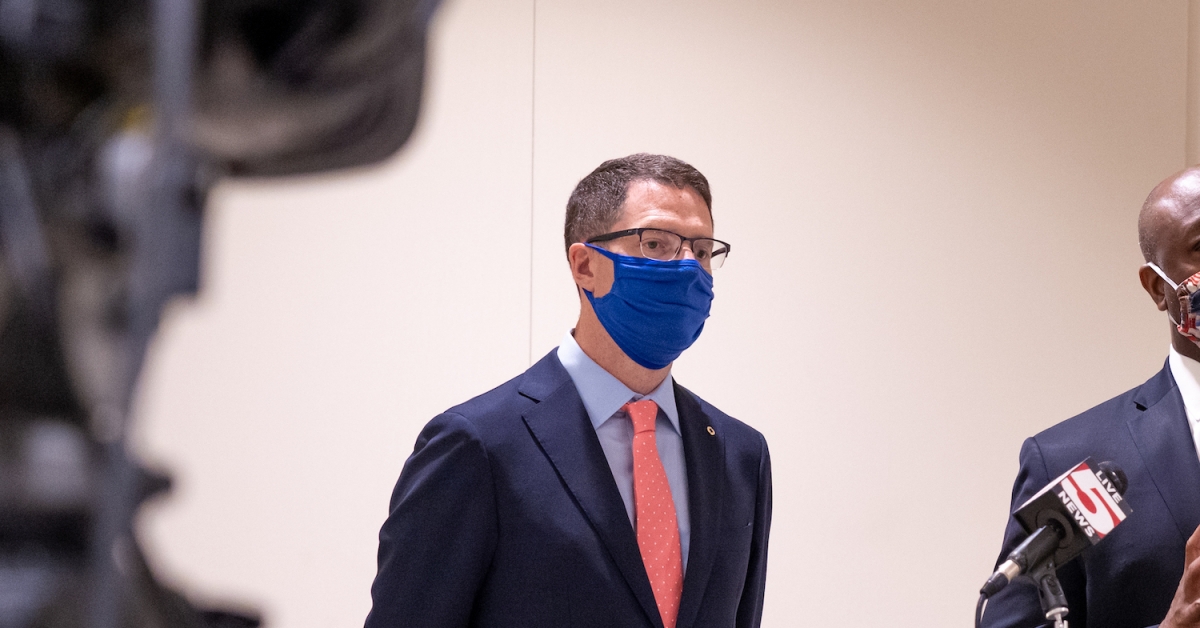

Brian Brooks, the Performing Comptroller of the Forex, stated in a press release that whereas different nations have constructed real-time funds methods, the U.S. “has relied on” the non-public sector to create such applied sciences, seemingly endorsing the usage of cryptocurrencies – particularly stablecoins – as a substitute for different real-time fee methods.

Brooks has overseen the publication of two different interpretative letters and quite a lot of different crypto-friendly strikes throughout his time overseeing the company, together with a letter telling federal banks they will present companies to stablecoin issuers and retailer reserves for stablecoins.

Final month, Brooks introduced his assist of a letter by the President’s Working Group on Monetary Markets that outlined how stablecoins ought to be regulated throughout the U.S.

President Donald Trump has twice nominated Brooks to serve a full five-year time period heading up the company, together with earlier this week. Nonetheless, it’s unclear whether or not the U.S. Senate will schedule a affirmation vote.As of press time, it doesn’t seem seemingly it can achieve this earlier than President-elect Joe Biden takes workplace on Jan. 20.

Monday’s interpretive letter additionally comes on the identical day as a public remark interval for a proposed Monetary Crime Enforcement Community (FinCEN) rule closes. The controversial rule solely had a 15-day remark interval, and has reportedly been spearheaded by Treasury Secretary Steven Mnuchin, who appointed Brooks to the OCC in early 2020.

“[Monday’s OCC letter] goes to point out that there’s not an all-out assault on cryptocurrencies, that there are shiny spots within the authorities that understand that crypto networks are going to be the muse of future funds methods and different monetary companies purposes, so we welcome such a interpretive steering,” Smith advised CoinDesk in a telephone name.

Learn the total letter beneath: