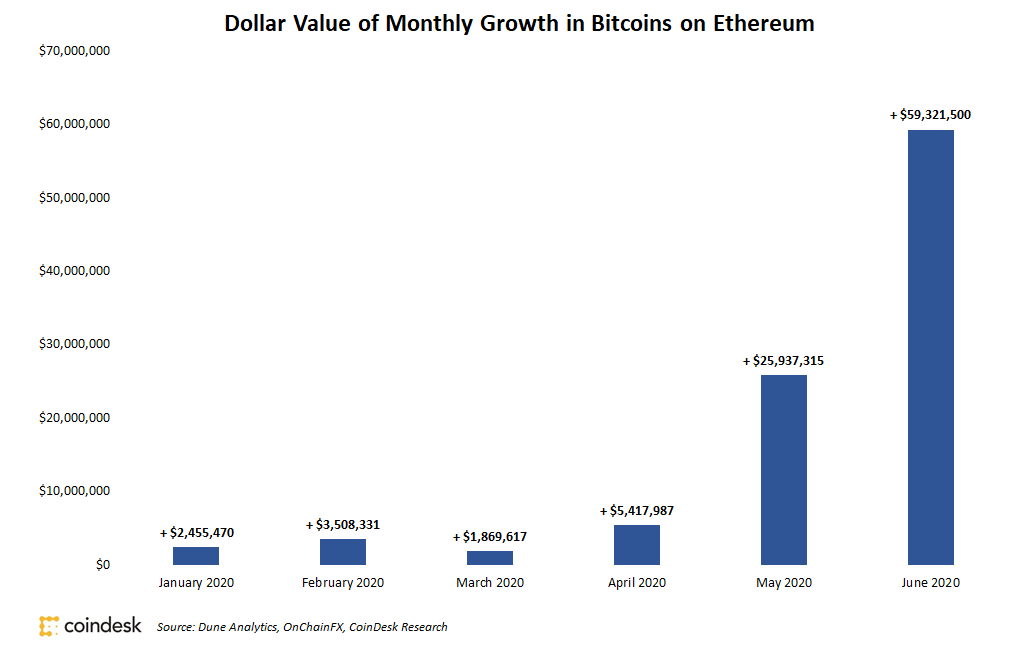

Practically $60 million price of bitcoins moved to Ethereum throughout June, in keeping with knowledge estimates from Dune Analytics. Wrapped Bitco

Practically $60 million price of bitcoins moved to Ethereum throughout June, in keeping with knowledge estimates from Dune Analytics. Wrapped Bitcoin, the oldest tokenized bitcoin protocol on Ethereum, is liable for roughly 75% of that development after shifting greater than 4,800 BTC to Ethereum final month.

Demand has elevated for utilizing bitcoin in a wide range of decentralized monetary providers as Ethereum continues to be the preferred off-chain vacation spot for bitcoins. Extra particularly, yield farming and MakerDAO including tokenized bitcoin as collateral are seemingly robust catalysts, stated Medio Demarco, former affiliate at Deutsche Financial institution and co-founder of cryptocurrency analysis agency Delphi Digital.

“The latest pattern shouldn’t come as a shock and can most likely proceed,” Demarco advised CoinDesk.

The rising reputation of tokenized bitcoin can also be no shock to Ben Chan, CTO at BitGo, the cryptocurrency funds processor that spearheaded Wrapped Bitcoin. “The aim of WBTC is to deliver bitcoin to the world of decentralized finance,” Chan stated. “Yield alternatives for lending and supplying WBTC” in Ethereum-based functions are driving latest development, he added.

Presently $132 million price of bitcoin is on Ethereum, on the time of publication, or roughly 0.08% of the main cryptocurrency’s market capitalization, in keeping with OnChainFX.

Is the rising demand to make use of bitcoin on Ethereum a optimistic sign for the main cryptocurrency? Based on Demarco, the pattern has a “synergistic” impact for each blockchains.

Chan agreed, telling CoinDesk that, for Ethereum, development within the worth of property on decentralized finance functions is “a step in the direction of the maturation of trustless and clear monetary providers.” For Bitcoin, the profit comes from with the ability to earn yield and collateralize bitcoin,” which “provides incentive” for customers to spend money on the cryptocurrency, in keeping with Chan.

Utilizing bitcoin on Ethereum is “doubtlessly bullish for each networks,” Chan stated.

The chief in blockchain information, CoinDesk is a media outlet that strives for the very best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an impartial working subsidiary of Digital Foreign money Group, which invests in cryptocurrencies and blockchain startups.