Bitcoin mining machines are on sale.Final month’s crash in cryptocurrency costs has prompted producers to promote inventories at a reduction, in so

Bitcoin mining machines are on sale.

Final month’s crash in cryptocurrency costs has prompted producers to promote inventories at a reduction, in some instances as steep as 20 %, over the previous few weeks. Each the latest fashions and barely older machines have been marked down.

Complicating the matter is the upcoming bitcoin halving in Could that can cut back the community’s mining reward by half, inflicting most miners to be much less worthwhile if bitcoin’s value doesn’t enhance considerably by then.

See additionally: Bitcoin Halving, Defined

For example, DJ Miner, an abroad distributor for Shenzhen, China-based MicroBT, was promoting about $2,500 per unit of the producer’s flagship WhatsMiner M30S early final month. After bitcoin’s March 12 crash – the worst sell-off in seven years – the value is now lower by 20 % to $2,000 per unit.

The WhatsMiner M20S, a much less superior however common mannequin that boosted MicroBT’s market share in opposition to main rival Bitmain in 2019, can also be seeing a 20 % value lower from $1,679 to now $1,340, DJ Miner’s web site reveals. Pangolinminers, one other distributor for MicroBT reveals related pricing rollbacks on its web site.

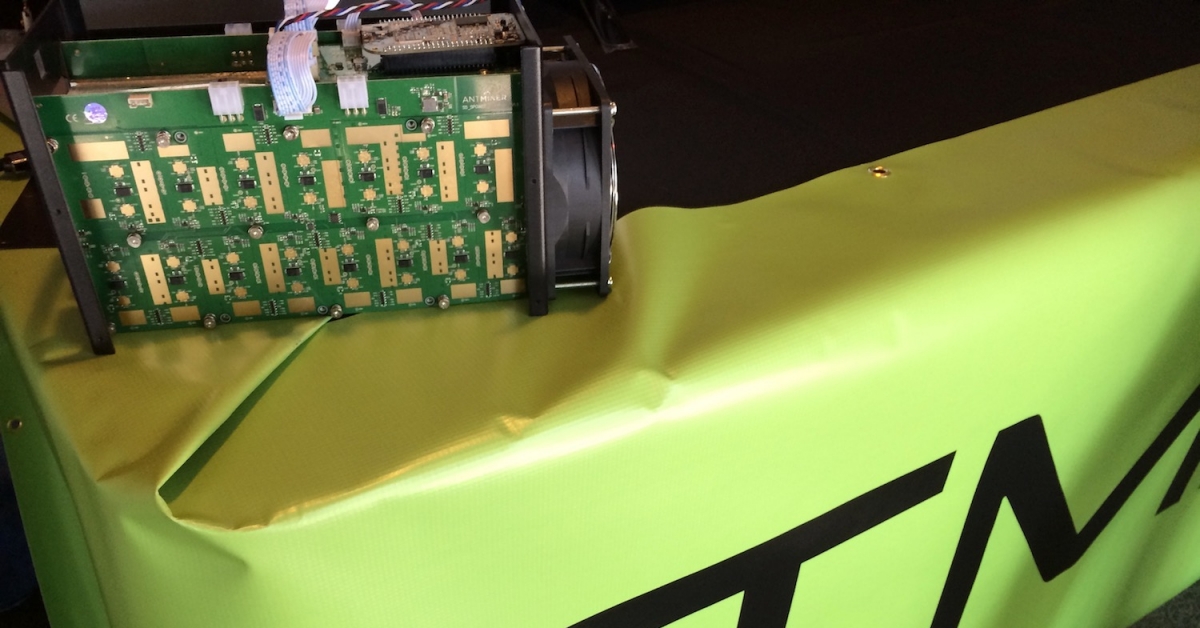

Equally, whereas Bitmain is promoting $1,567 for its AntMiner S17+ with a computing energy of 67 terahashes per second, numerous resellers are posting quotes on WeChat seen by CoinDesk at round $1,300 per unit.

The Beijing-based mining big has beforehand introduced the pricing for its newest flagship AntMiner S19 Professional at about $2,900 per unit however the cargo received’t happen till Could and up to now is just out there for buyers inside China.

See additionally: How Bitcoin’s Value Droop Is Altering the Geography of Mining

It is very important word that the majority specialised bitcoin computer systems, generally known as ASICs, had already been dropping in value for the reason that fourth quarter of final 12 months, because the producers adjusted their methods according to bitcoin’s value swing.

These machines are priced assuming it could take the client on common 15 months to make again their gear funding. Holding the payback interval comparatively fixed, producers would regulate the costs of their gear in line with bitcoin’s market value and the extent of competitors on the community – the 2 components that decide how a lot income a miner can generate in a day.

Miner pricing knowledge compiled by analysis startup TokenInsight reveals that, for instance, the Whatsminer M20S and the AntMiner S17 Professional have been priced at round $2,400 and $3,000, respectively, in mid-October 2019. The worth for each had dropped to round $1,500 as of March 10.

“ASIC miners have skilled a comparatively massive market devaluation since This fall 2019. Nonetheless, the miner market has discovered some stage of value flooring throughout Q1 2020 regardless of the latest crypto market downturn,” mentioned TokenInsight analyst Johnson Xu. “Some skilled miners are at the moment seeking to buy some secondhand ASICs at a major low cost … primarily based on their fastidiously structured mannequin.”

See additionally: A New York Energy Plant Is Mining $50Okay Value of Bitcoin a Day

Blockware Options, a reseller of bitcoin ASIC miners in North America that additionally operates mining amenities, mentioned in a latest analysis report that the market crash in March, along with the approaching halving, has led to a major lower of bitcoin’s mining computing energy – which in the long term, could possibly be an encouraging signal for the market’s effectivity.

“If Bitcoin stays at cheaper price ranges for 2-Four months, post-halving, many miners working at a loss might be pressured to close off,” Blockware mentioned. “After all of the miners which are working at a loss shut off, the miners that survive expertise vital margin reduction. We are going to witness a community in short-term chaos, however problem changes will reinstate stability as soon as the inefficient miners shut off.”

The agency believes that after the Bitcoin community experiences sustained favorable competitors changes, the “probability of a backside in bitcoin’s value is enhanced.”

“It is because newly mined Bitcoin is now being distributed to and accrued by probably the most environment friendly miners with wholesome steadiness sheets,” the agency mentioned. “The quantity of bitcoin … that the surviving miners obtain are straight proportional with the quantity of Bitcoin that was being distributed to the miners which have shut off. These uncommon, profitable alternatives enable surviving miners to build up copious quantities of bitcoin.”

See additionally: Binance Crypto Change Is Launching Its First Bitcoin Mining Pool

Disclosure Learn Extra

The chief in blockchain information, CoinDesk is a media outlet that strives for the best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an impartial working subsidiary of Digital Forex Group, which invests in cryptocurrencies and blockchain startups.