When the US first started going after crypto firms for violating its financial sanctions guidelines, it didn’t precisely begin with a bang.In Decem

When the US first started going after crypto firms for violating its financial sanctions guidelines, it didn’t precisely begin with a bang.

In December, the Treasury Division’s Workplace of Overseas Belongings Management (OFAC) introduced a settlement with crypto pockets supplier BitGo after the Palo Alto agency failed to forestall individuals apparently situated within the Crimea area, Iran, Sudan, Cuba and Syria “from utilizing its non-custodial safe digital pockets administration service.” The penalty for the “183 obvious violations” of U.S. sanctions? An underwhelming $98,830.

This was “the primary printed OFAC enforcement motion in opposition to a enterprise within the blockchain trade,” in accordance to regulation agency Steptoe, although six weeks later, the OFAC reached an analogous settlement with BitPay, a fee processing agency, for two,102 “obvious violations of a number of sanctions applications,” through which BitPay reportedly allowed individuals in the identical nations as within the BitGo case — however with the addition of North Korea — “to transact with retailers in the US and elsewhere utilizing digital foreign money on BitPay’s platform though BitPay had location data, together with Web Protocol addresses and different location knowledge, about these individuals previous to effecting the transactions.” BitPay agreed to pay $507,375 to resolve its potential civil legal responsibility.

However future violators is probably not handled so leniently.

It’s price mentioning that financial sanctions are sometimes utilized “in opposition to nations and teams of people, similar to terrorists and narcotics traffickers,” in accordance to the US Treasury, sometimes “utilizing the blocking of belongings and commerce restrictions to perform international coverage and nationwide safety targets.”

Extra enforcement actions are coming

“The crypto trade ought to completely anticipate extra enforcement actions from OFAC, and it may possibly anticipate that there shall be a lot bigger penalties as nicely,” David Carlisle, director of coverage and regulatory affairs at Elliptic, tells Journal. “OFAC’s first two enforcement actions on this area had been pretty easy circumstances, the place the underlying violations weren’t egregious, and the fines had been small. However the subsequent circumstances may very well be completely different,” he says, including:

“There’ll undoubtedly be different circumstances on the market that contain rather more critical and egregious violations — and we are able to anticipate that OFAC will problem fines in opposition to crypto companies which might be a lot bigger than these we’ve seen up to now.”

Anticipate extra enforcement actions like these focusing on BitPay and BitGo, Doug McCalmont, founding father of BlocAlt Consulting LLC, tells Journal, in addition to “the growth of focused people, similar to coders linked to the expertise.”

Sanctions regimes have been utilized extensively lately by the US, in addition to the European Union and United Nations, usually focusing on “rogue” nation-states, similar to North Korea and Iran. Probably the greatest-known early crypto circumstances concerned Virgil Griffith, a former hacker, who was arrested in April 2019 after he spoke at a blockchain and cryptocurrency convention in North Korea, in violation of sanctions in opposition to that outcast nation, the U.S. charged.

“Sanctions violations are an actual drawback,” says David Jevans, CEO of CipherTrace, whose crypto forensics agency lately discovered that greater than 72,000 distinctive Iranian IP addresses are linked to greater than 4.5 million distinctive Bitcoin addresses, “suggesting that sanction violations are seemingly rampant and principally undetected by digital asset service suppliers,” he tells Journal.

It’s not solely U.S. authorities who’re involved about “dangerous actors” utilizing the nascent blockchain expertise to dodge financial sanctions. Agata Ferreira, assistant professor on the Warsaw College of Know-how, tells Journal that authorities in Europe “have gotten extra lively and extra targeted. The crypto area is beneath rising scrutiny, and I do suppose this development will stay and speed up.”

Neither is OFAC’s latest crypto focus stunning, in line with Robert A. Schwinger, companion within the business litigation group at Norton Rose Fulbright. America authorities has no selection however to rein on this new, cryptocurrency asset class as a result of “not to take action would expose it to the danger that its sanctions regime may very well be rendered toothless by new monetary expertise. Gamers within the cryptocurrency area who ignore the restrictions imposed by U.S. worldwide sanctions are being placed on discover that they accomplish that at their peril,” he wrote on Regulation.com.

Is DeFi problematic?

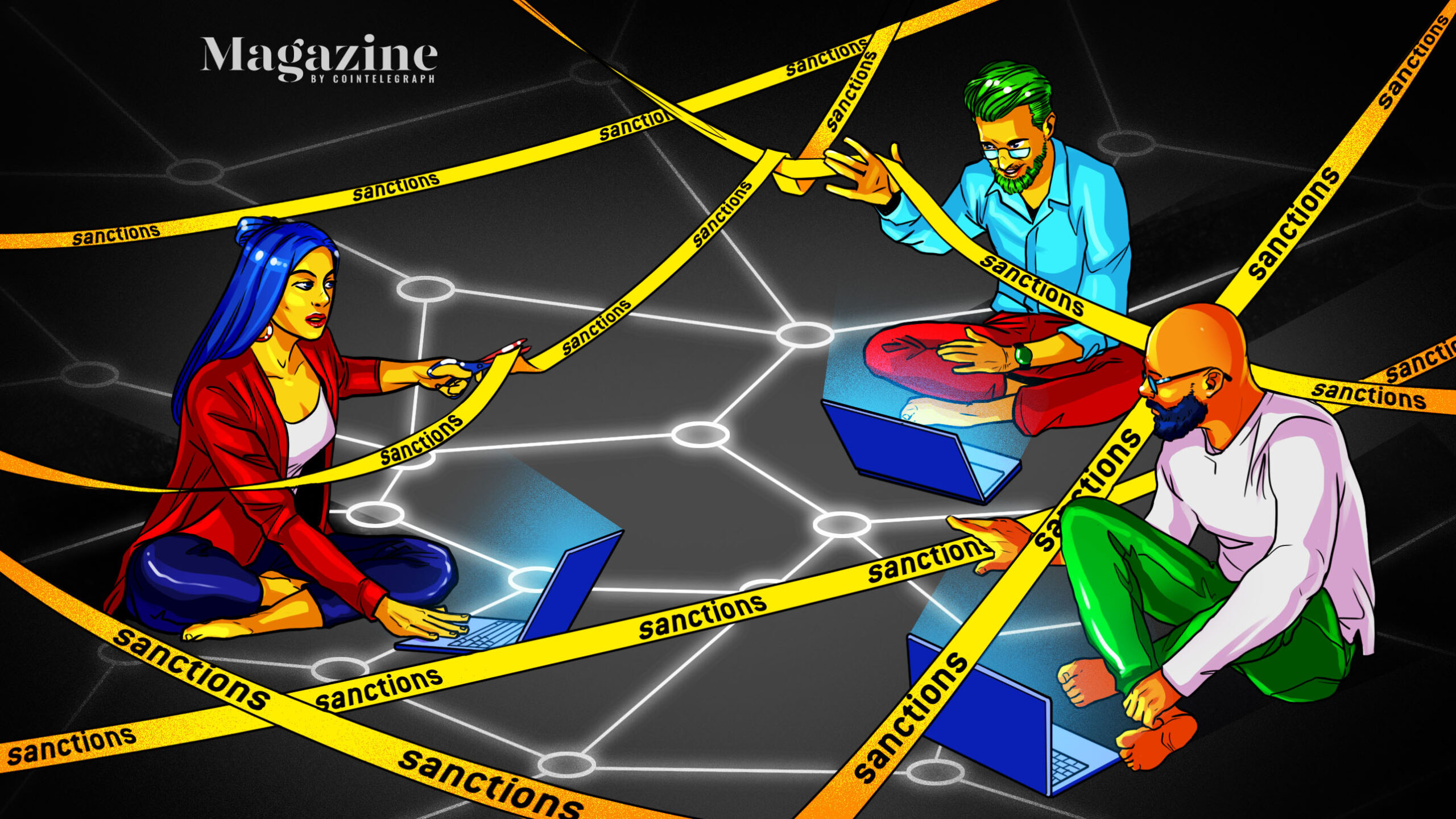

As crypto adoption grows, it appears solely inevitable that its decentralized finance (DeFi) networks will push up in opposition to extra nation-state prerogatives, together with financial sanctions. However isn’t there one thing inherently problematic about cracking down on a decentralized trade (DEX)? Does the trade actually have a headquarters handle? Is anybody even residence at residence? And will it even reply to somebody if it’s really…